Corporate presentation August 2018 Exhibit 99.1

Disclaimer

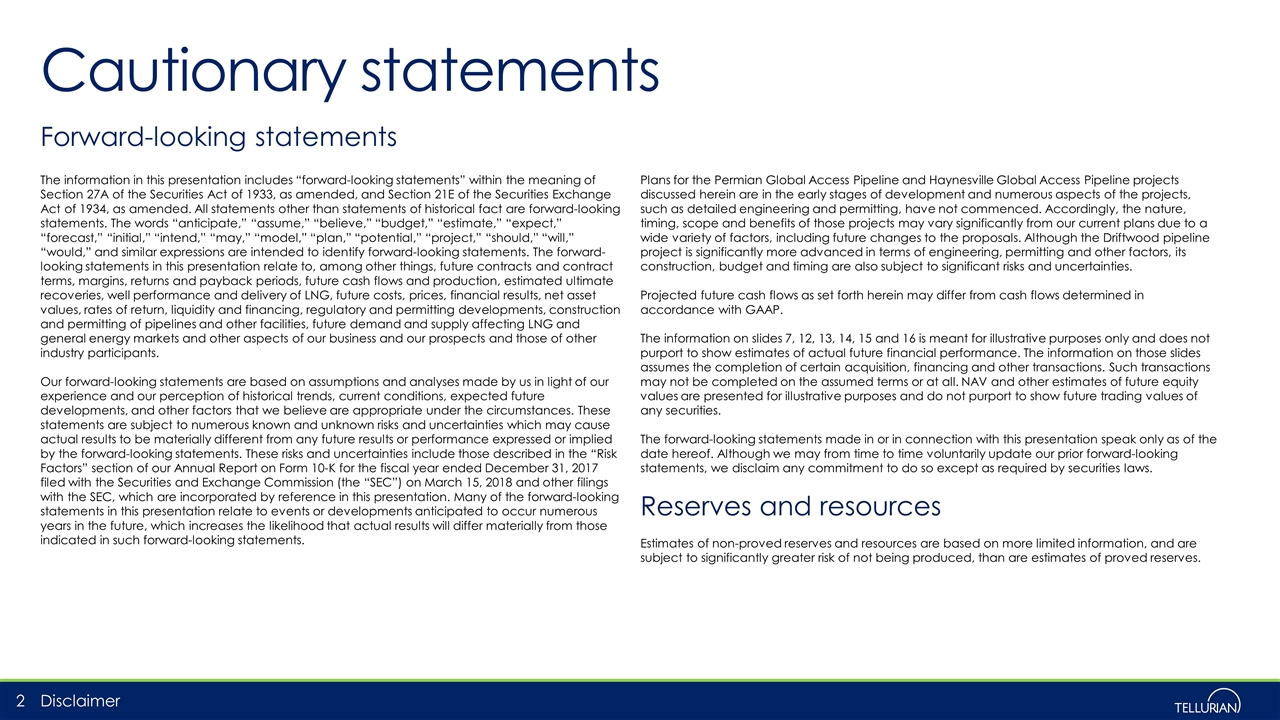

Global call on U.S. natural gas Fundamentals U.S. supply push… …and global demand pull Source: Wood Mackenzie, Tellurian Research. Notes:(1) Includes the Permian, Haynesville, Utica, Marcellus, Anadarko, Eagle Ford. (2) Based on a demand growth estimate of 4.5% post-2020. (3) Capacity required to meet demand growth post-2020. 51 71 20 46 75 Bcf/d Output from selected shale basins(1) mtpa Global LNG production capacity mtpa Takeaway infrastructure Required Under construction Other U.S. Supply infrastructure Required(3) 29 (2) 150 Under construction 221 Bcf/d

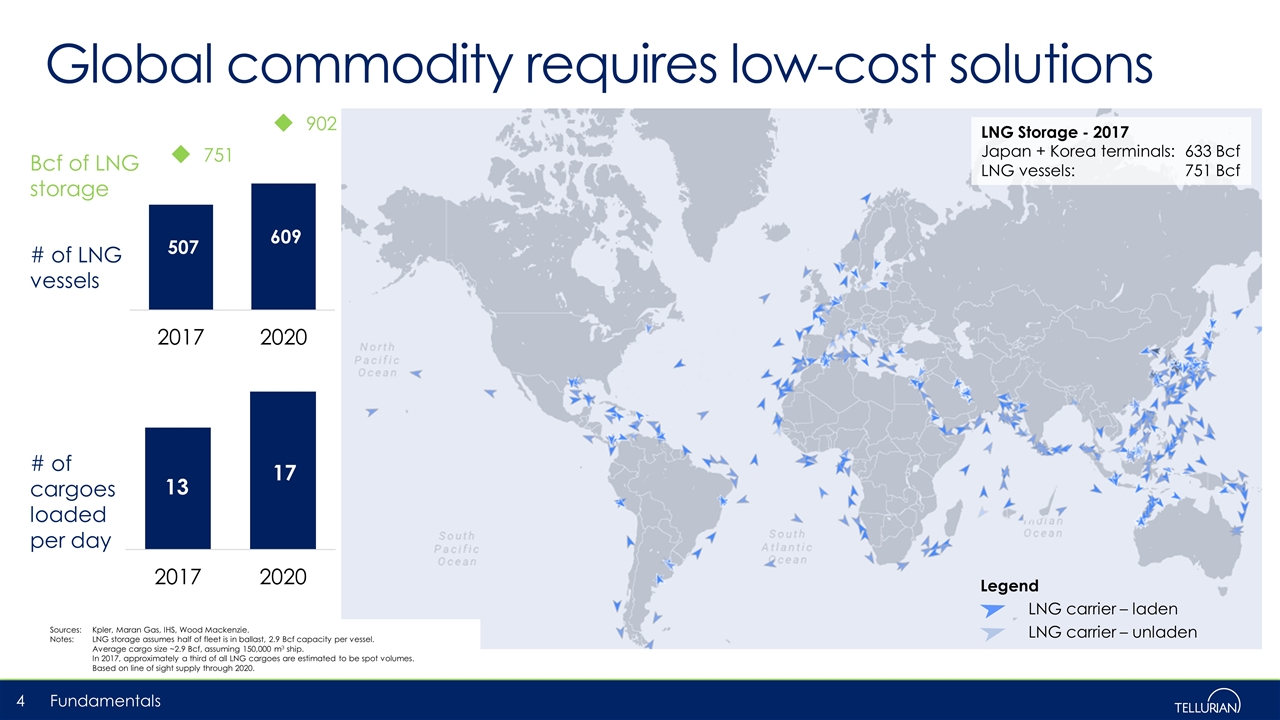

Sources:Kpler, Maran Gas, IHS, Wood Mackenzie. Notes: LNG storage assumes half of fleet is in ballast, 2.9 Bcf capacity per vessel. Average cargo size ~2.9 Bcf, assuming 150,000 m3 ship. In 2017, approximately a third of all LNG cargoes are estimated to be spot volumes. Based on line of sight supply through 2020. Global commodity requires low-cost solutions Fundamentals Bcf of LNG storage # of LNG vessels # of cargoes loaded per day Legend LNG carrier – laden LNG carrier – unladen LNG Storage - 2017 Japan + Korea terminals:633 Bcf LNG vessels:751 Bcf

Managing three risks Business model Basin Basis Construction Adequate natural gas supply Reliable access to pipelines Site selection and execution Successful projects require a sophisticated strategy to manage complex risks

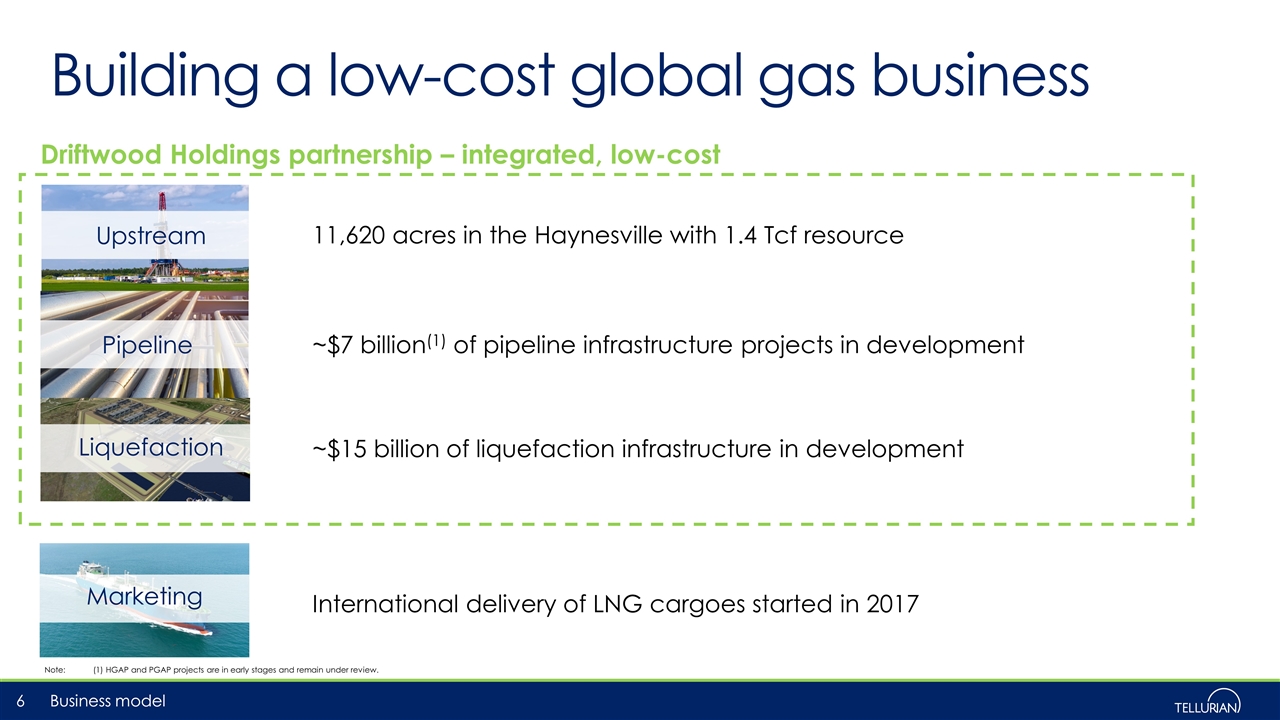

Building a low-cost global gas business 6 Pipeline Liquefaction Marketing Upstream 11,620 acres in the Haynesville with 1.4 Tcf resource ~$7 billion(1) of pipeline infrastructure projects in development ~$15 billion of liquefaction infrastructure in development International delivery of LNG cargoes started in 2017 Driftwood Holdings partnership – integrated, low-cost Note:(1) HGAP and PGAP projects are in early stages and remain under review. Business model Business model

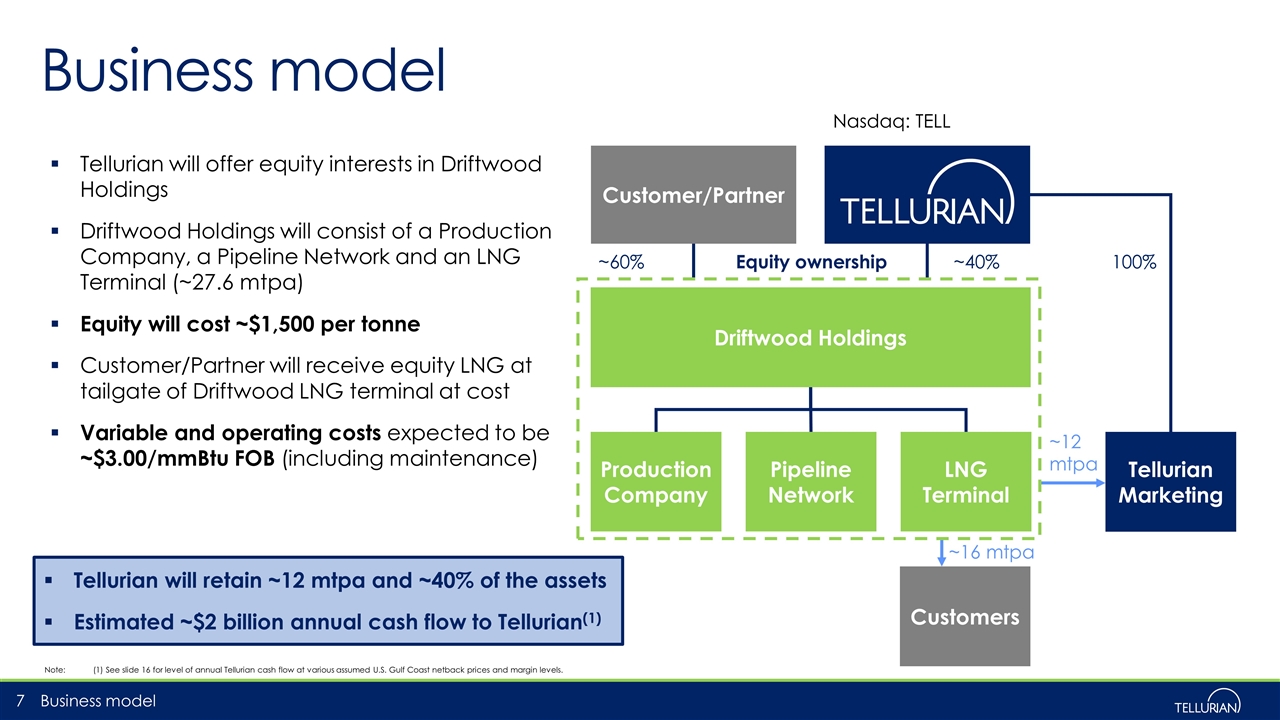

Tellurian will offer equity interests in Driftwood Holdings Driftwood Holdings will consist of a Production Company, a Pipeline Network and an LNG Terminal (~27.6 mtpa) Equity will cost ~$1,500 per tonne Customer/Partner will receive equity LNG at tailgate of Driftwood LNG terminal at cost Variable and operating costs expected to be ~$3.00/mmBtu FOB (including maintenance) Business model 7 Tellurian Marketing Pipeline Network Production Company Equity ownership ~40% ~16 mtpa ~12 mtpa Customer/Partner ~60% Customers 100% Business model Nasdaq: TELL LNG Terminal Tellurian will retain ~12 mtpa and ~40% of the assets Estimated ~$2 billion annual cash flow to Tellurian(1) Driftwood Holdings Note:(1) See slide 16 for level of annual Tellurian cash flow at various assumed U.S. Gulf Coast netback prices and margin levels.

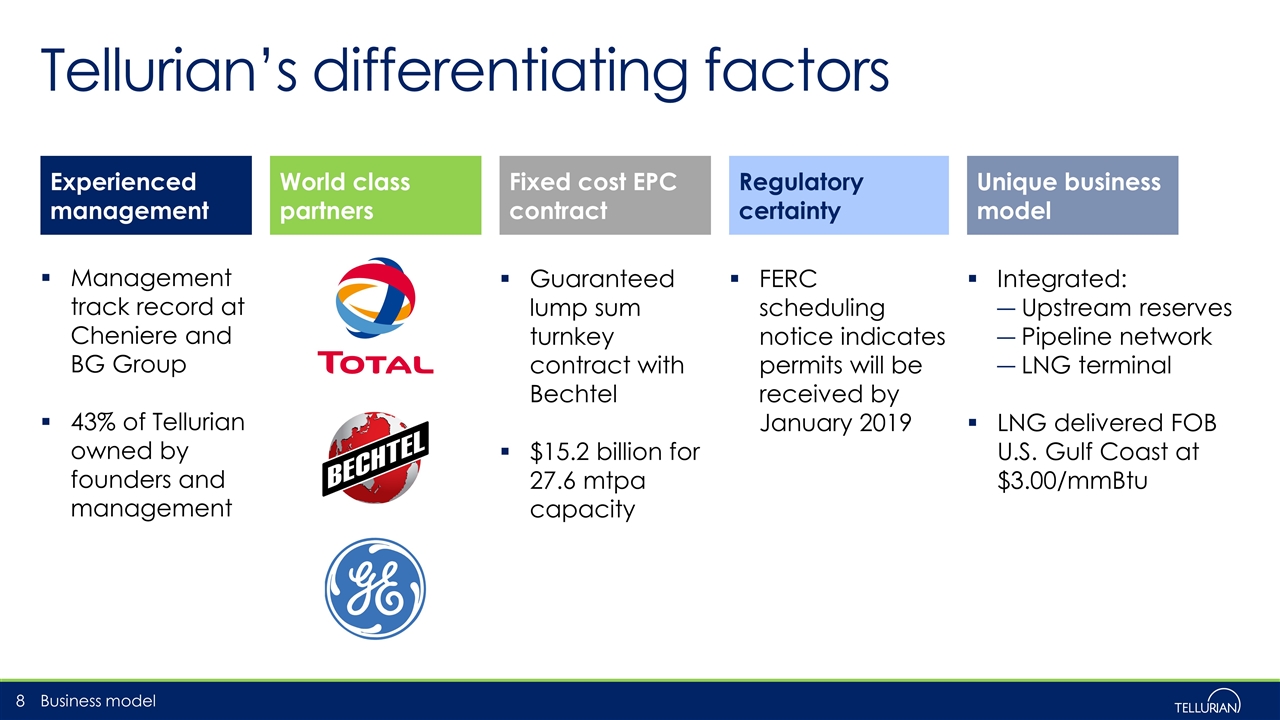

Tellurian’s differentiating factors Business model Management track record at Cheniere and BG Group 43% of Tellurian owned by founders and management Guaranteed lump sum turnkey contract with Bechtel $15.2 billion for 27.6 mtpa capacity FERC scheduling notice indicates permits will be received by January 2019 Integrated: Upstream reserves Pipeline network LNG terminal LNG delivered FOB U.S. Gulf Coast at $3.00/mmBtu World class partners Fixed cost EPC contract Regulatory certainty Experienced management Unique business model

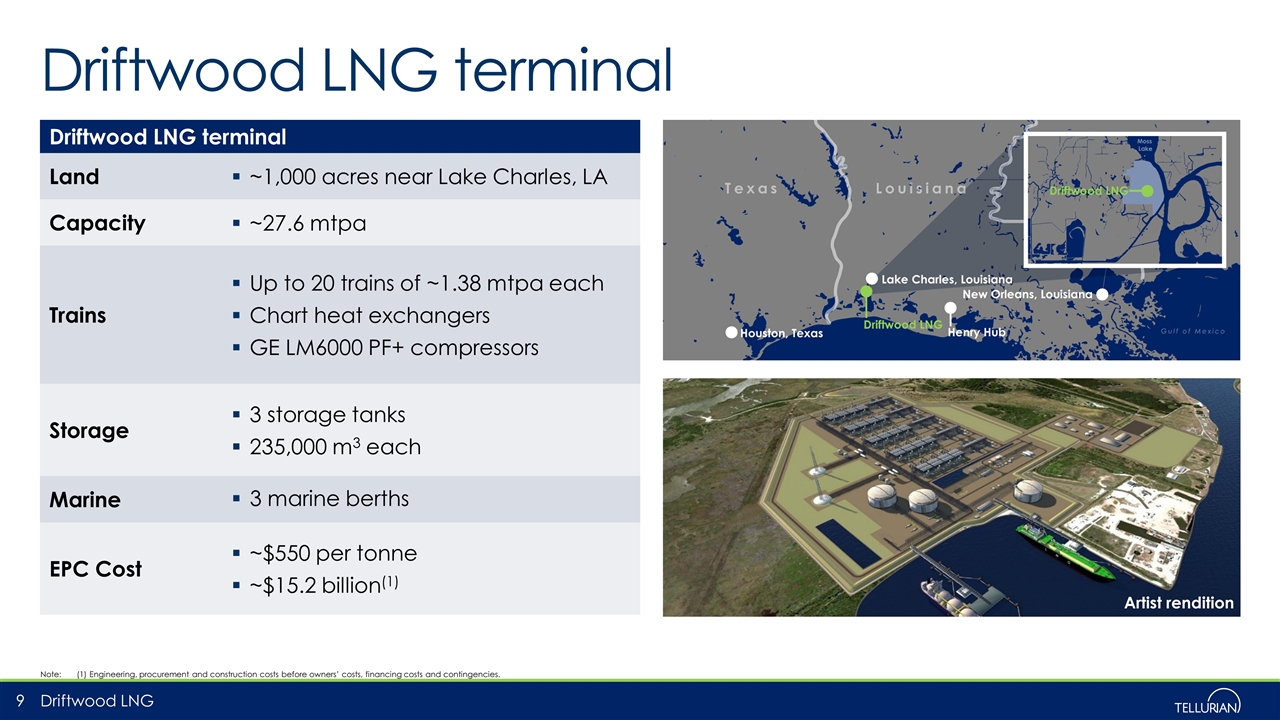

Driftwood LNG terminal Note:(1) Engineering, procurement and construction costs before owners’ costs, financing costs and contingencies. Driftwood LNG terminal Land ~1,000 acres near Lake Charles, LA Capacity ~27.6 mtpa Trains Up to 20 trains of ~1.38 mtpa each Chart heat exchangers GE LM6000 PF+ compressors Storage 3 storage tanks 235,000 m3 each Marine 3 marine berths EPC Cost ~$550 per tonne ~$15.2 billion(1) Artist rendition Driftwood LNG

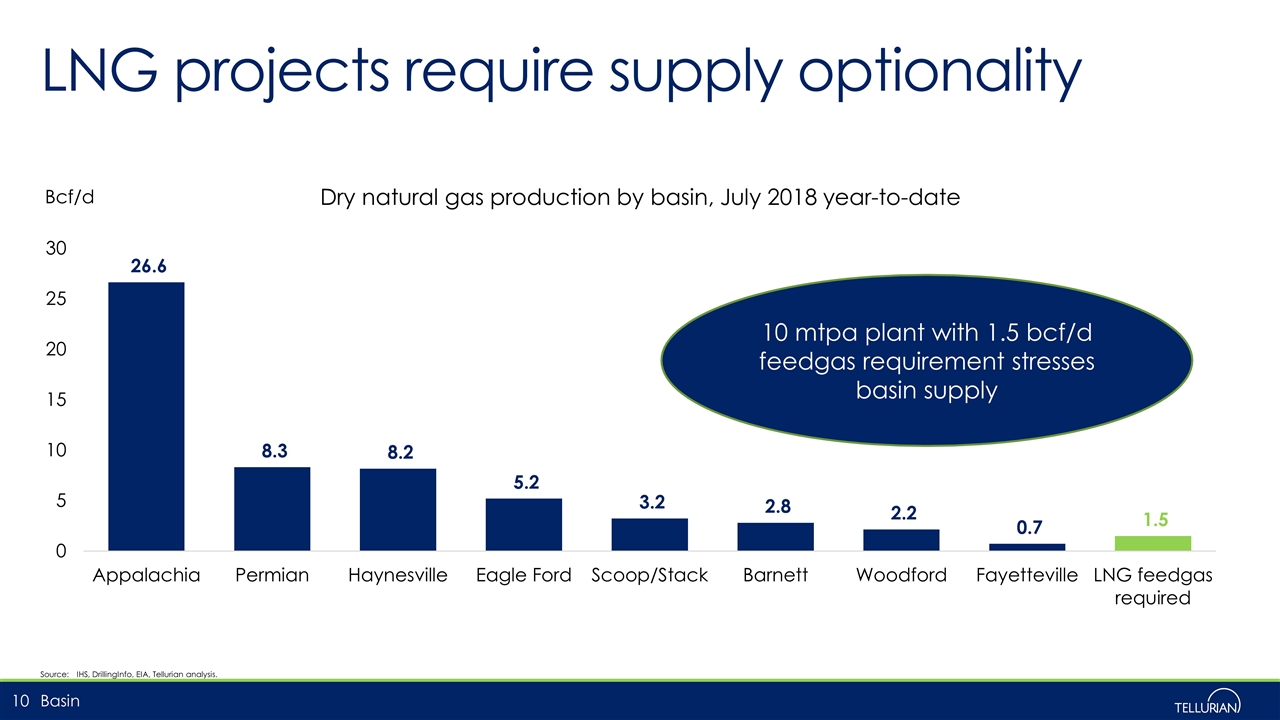

LNG projects require supply optionality Basin Source:IHS, DrillingInfo, EIA, Tellurian analysis. 10 mtpa plant with 1.5 bcf/d feedgas requirement stresses basin supply

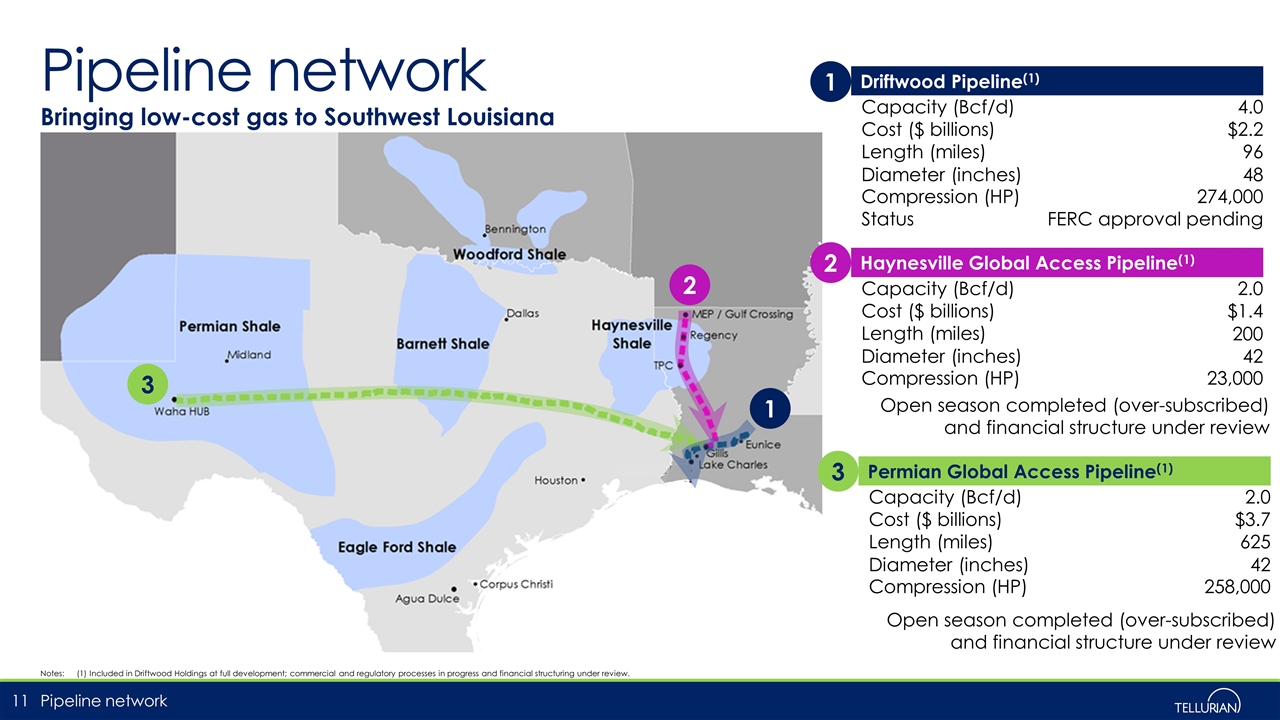

Pipeline network Notes: (1) Included in Driftwood Holdings at full development; commercial and regulatory processes in progress and financial structuring under review. Pipeline network Driftwood Pipeline(1) Capacity (Bcf/d) 4.0 Cost ($ billions) $2.2 Length (miles) 96 Diameter (inches) 48 Compression (HP) 274,000 Status FERC approval pending Haynesville Global Access Pipeline(1) Capacity (Bcf/d) 2.0 Cost ($ billions) $1.4 Length (miles) 200 Diameter (inches) 42 Compression (HP) 23,000 Permian Global Access Pipeline(1) Capacity (Bcf/d) 2.0 Cost ($ billions) $3.7 Length (miles) 625 Diameter (inches) 42 Compression (HP) 258,000 Bringing low-cost gas to Southwest Louisiana 1 2 3 1 2 3 Open season completed (over-subscribed) and financial structure under review Open season completed (over-subscribed) and financial structure under review

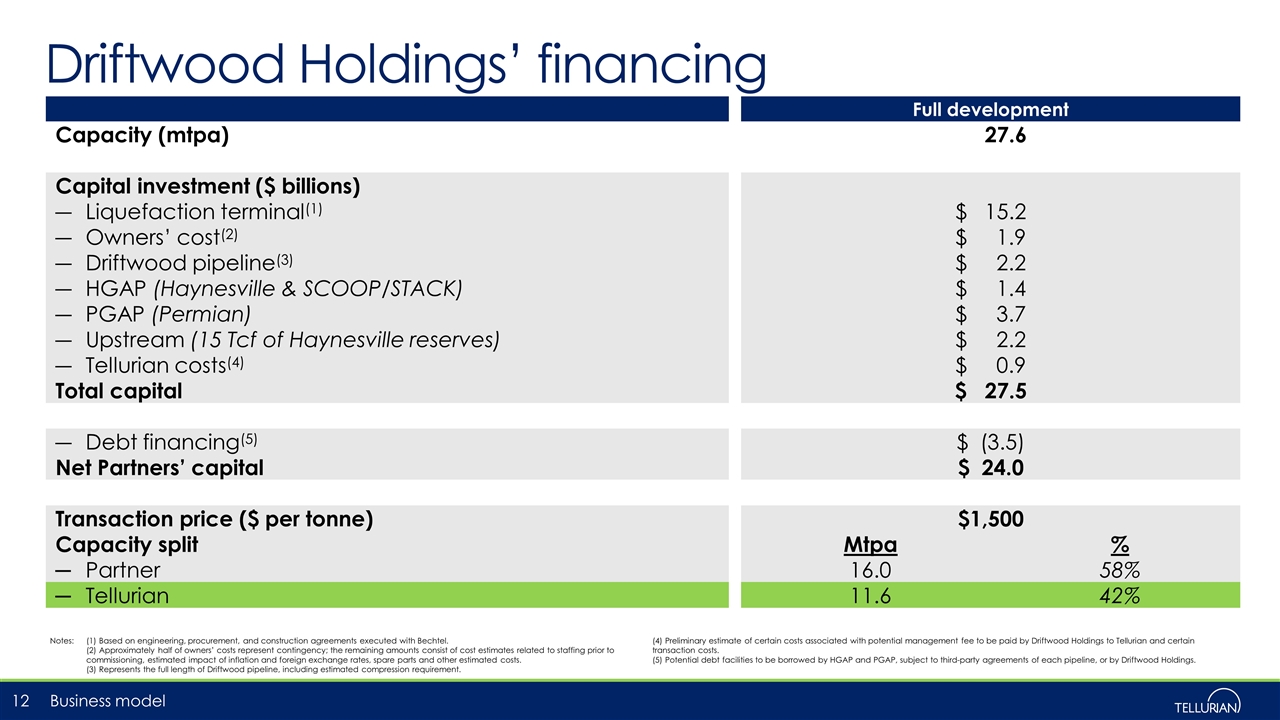

Driftwood Holdings’ financing Business model Notes:(1) Based on engineering, procurement, and construction agreements executed with Bechtel. (2) Approximately half of owners’ costs represent contingency; the remaining amounts consist of cost estimates related to staffing prior to commissioning, estimated impact of inflation and foreign exchange rates, spare parts and other estimated costs. (3) Represents the full length of Driftwood pipeline, including estimated compression requirement. (4) Preliminary estimate of certain costs associated with potential management fee to be paid by Driftwood Holdings to Tellurian and certain transaction costs. (5) Potential debt facilities to be borrowed by HGAP and PGAP, subject to third-party agreements of each pipeline, or by Driftwood Holdings. Full development Capacity (mtpa) 27.6 Capital investment ($ billions) Liquefaction terminal(1) $ 15.2 Owners’ cost(2) $ 1.9 Driftwood pipeline(3) $ 2.2 HGAP (Haynesville & SCOOP/STACK) $ 1.4 PGAP (Permian) $ 3.7 Upstream (15 Tcf of Haynesville reserves) $ 2.2 Tellurian costs(4) $ 0.9 Total capital $ 27.5 Debt financing(5) $ (3.5) Net Partners’ capital $ 24.0 Transaction price ($ per tonne) $1,500 Capacity split Mtpa % % Partner 16.0 58% 58% Tellurian 11.6 42% 42%

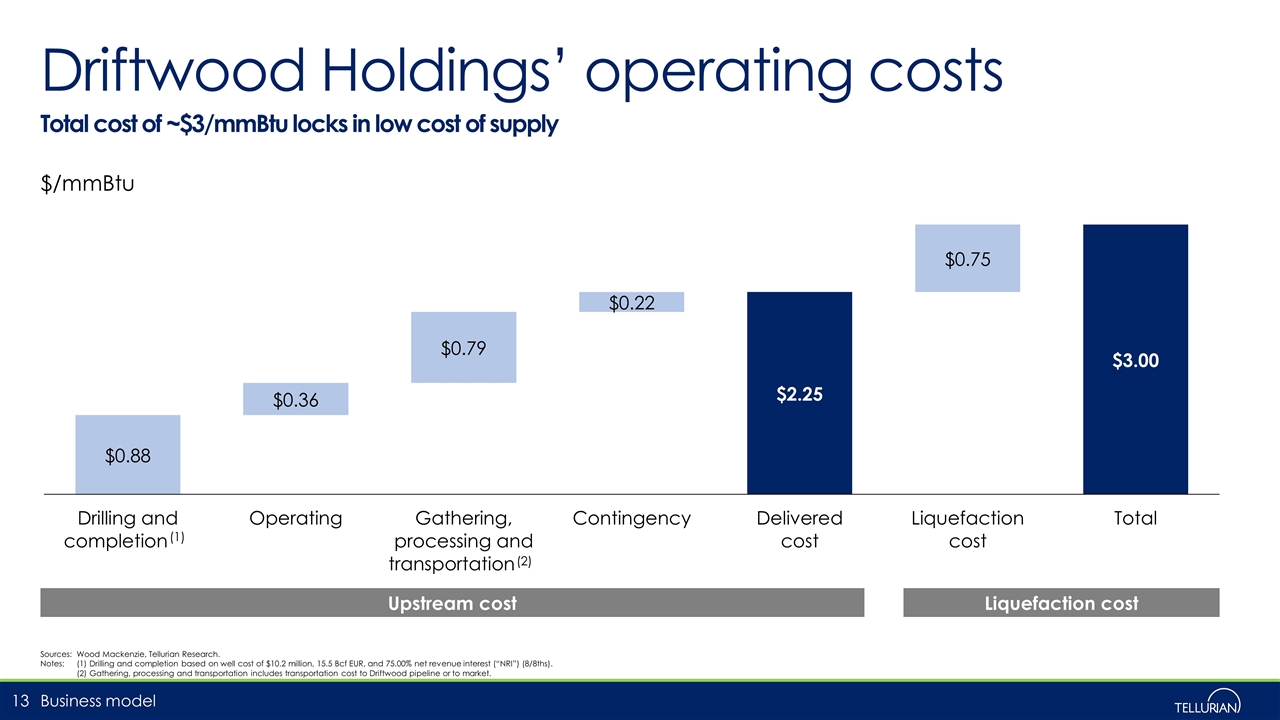

Driftwood Holdings’ operating costs Business model Total cost of ~$3/mmBtu locks in low cost of supply Sources: Wood Mackenzie, Tellurian Research. Notes: (1) Drilling and completion based on well cost of $10.2 million, 15.5 Bcf EUR, and 75.00% net revenue interest (“NRI”) (8/8ths). (2) Gathering, processing and transportation includes transportation cost to Driftwood pipeline or to market. Upstream cost $/mmBtu Liquefaction cost (1) (2)

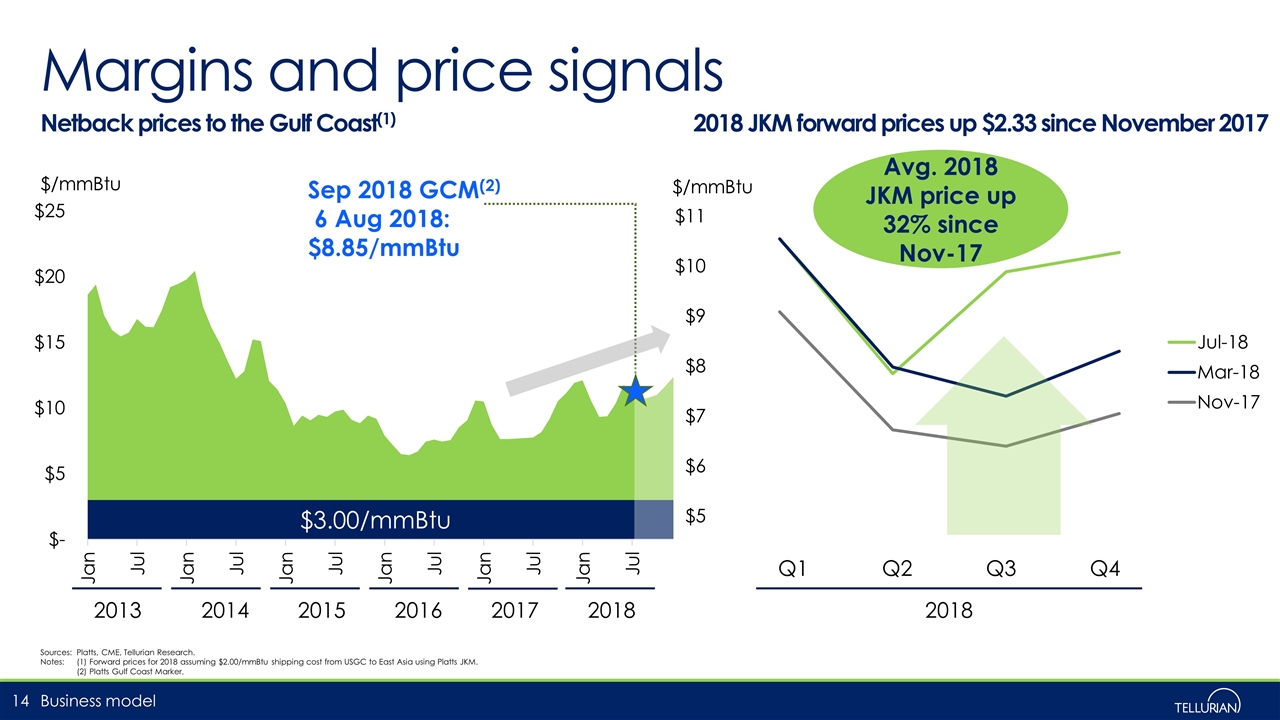

Margins and price signals Business model Netback prices to the Gulf Coast(1) Sources: Platts, CME, Tellurian Research. Notes: (1) Forward prices for 2018 assuming $2.00/mmBtu shipping cost from USGC to East Asia using Platts JKM. (2) Platts Gulf Coast Marker. 2018 JKM forward prices up $2.33 since November 2017 Avg. 2018 JKM price up 32% since Nov-17 Sep 2018 GCM(2) 6 Aug 2018: $8.85/mmBtu 2013 2014 2015 2016 2017 2018 Q1 Q2 Q3 Q4 2018 $/mmBtu $3.00/mmBtu

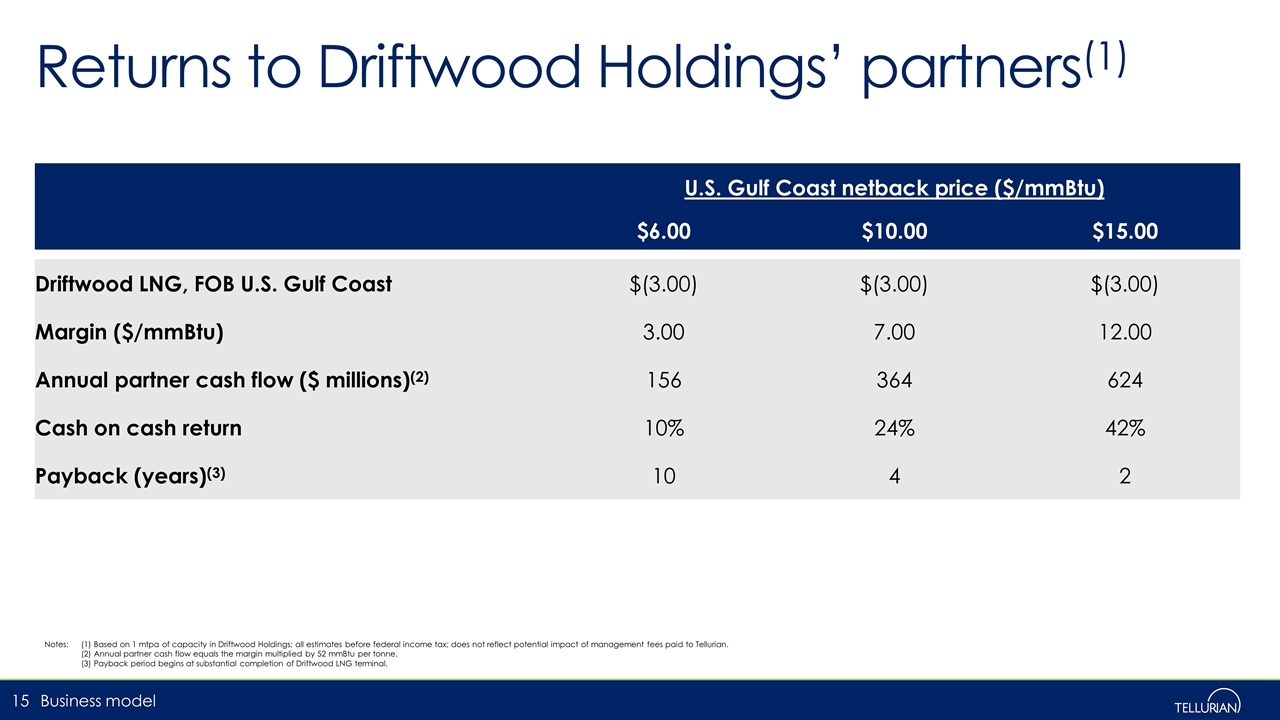

Returns to Driftwood Holdings’ partners(1) Business model U.S. Gulf Coast netback price ($/mmBtu) $6.00 $10.00 $15.00 Driftwood LNG, FOB U.S. Gulf Coast $(3.00) $(3.00) $(3.00) Margin ($/mmBtu) 3.00 7.00 12.00 Annual partner cash flow ($ millions)(2) 156 364 624 Cash on cash return 10% 24% 42% Payback (years)(3) 10 4 2 Notes:(1) Based on 1 mtpa of capacity in Driftwood Holdings; all estimates before federal income tax; does not reflect potential impact of management fees paid to Tellurian. (2) Annual partner cash flow equals the margin multiplied by 52 mmBtu per tonne. (3) Payback period begins at substantial completion of Driftwood LNG terminal.

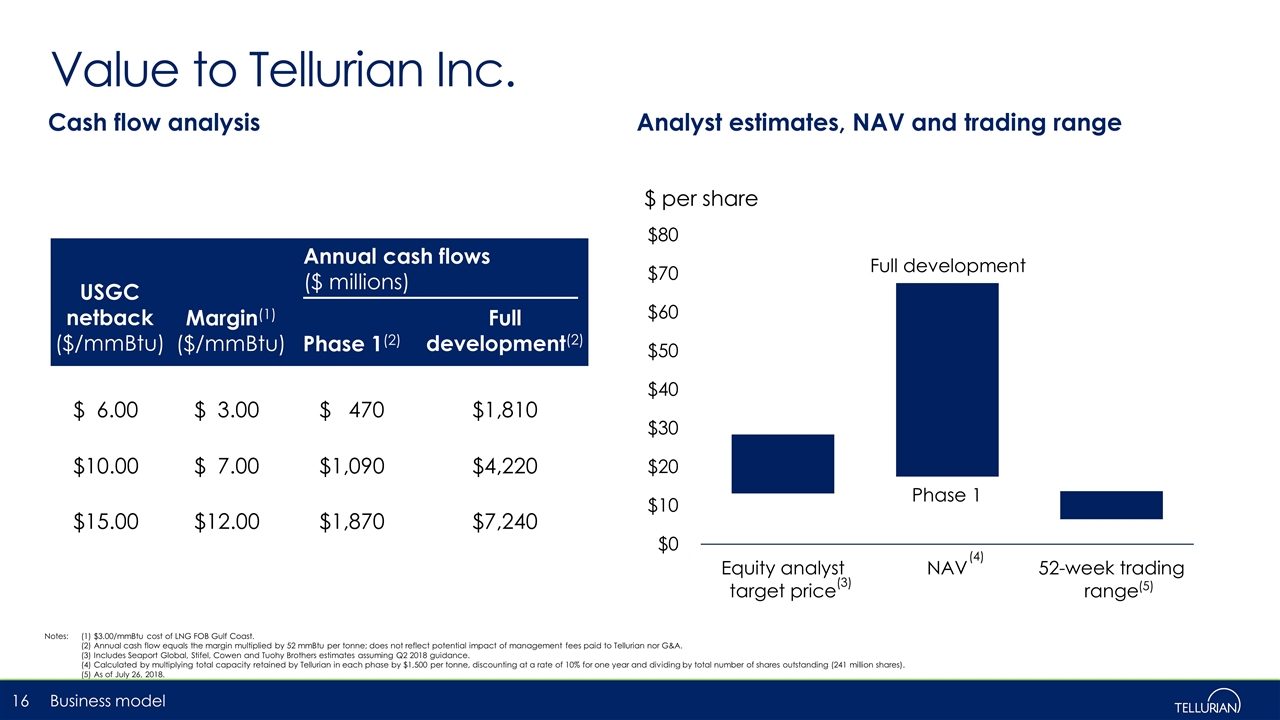

Value to Tellurian Inc. Business model Notes: (1) $3.00/mmBtu cost of LNG FOB Gulf Coast. (2) Annual cash flow equals the margin multiplied by 52 mmBtu per tonne; does not reflect potential impact of management fees paid to Tellurian nor G&A. (3) Includes Seaport Global, Stifel, Cowen and Tuohy Brothers estimates assuming Q2 2018 guidance. (4) Calculated by multiplying total capacity retained by Tellurian in each phase by $1,500 per tonne, discounting at a rate of 10% for one year and dividing by total number of shares outstanding (241 million shares). (5) As of July 26, 2018. USGC netback ($/mmBtu) Margin(1) ($/mmBtu) Phase 1(2) Full development(2) Annual cash flows ($ millions) $ 6.00 $10.00 $15.00 $ 3.00 $ 7.00 $12.00 $ 470 $1,090 $1,870 $1,810 $4,220 $7,240 Analyst estimates, NAV and trading range Cash flow analysis (5) (4) (3) Phase 1 Full development $ per share

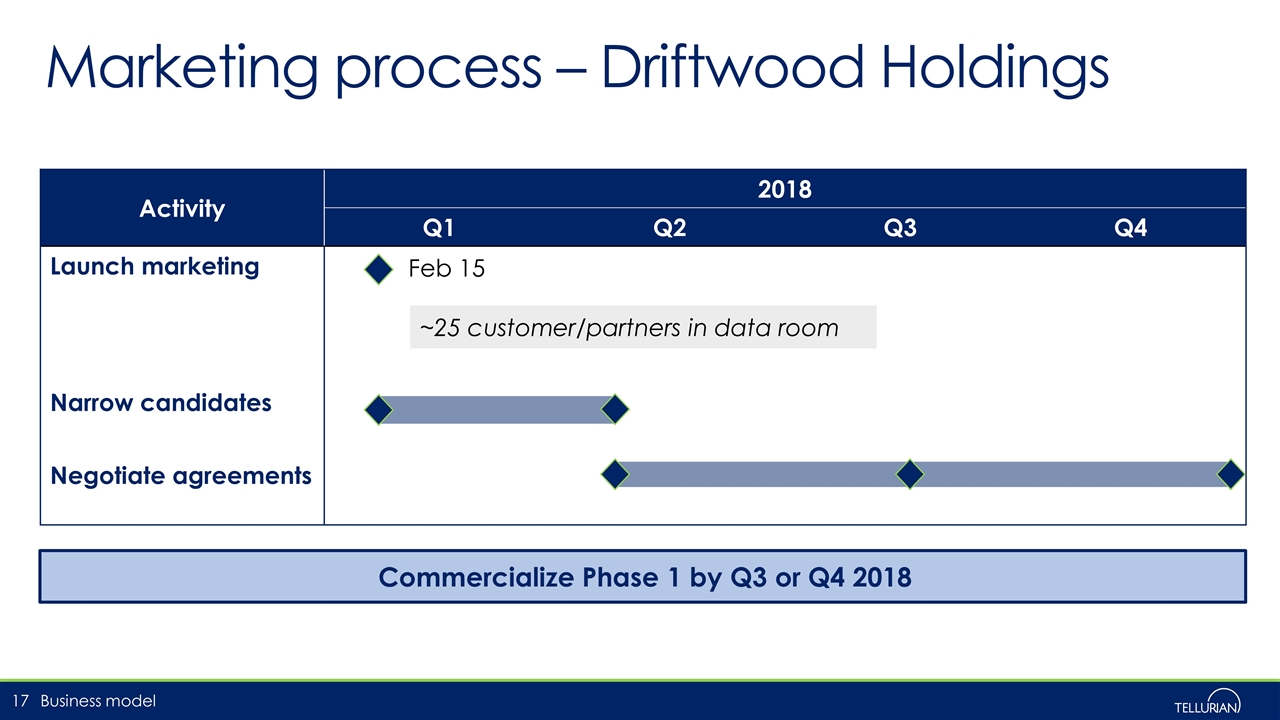

Marketing process – Driftwood Holdings Business model Activity 2018 Q1 Q2 Q3 Q4 Launch marketing Narrow candidates Negotiate agreements ~25 customer/partners in data room Feb 15 Commercialize Phase 1 by Q3 or Q4 2018

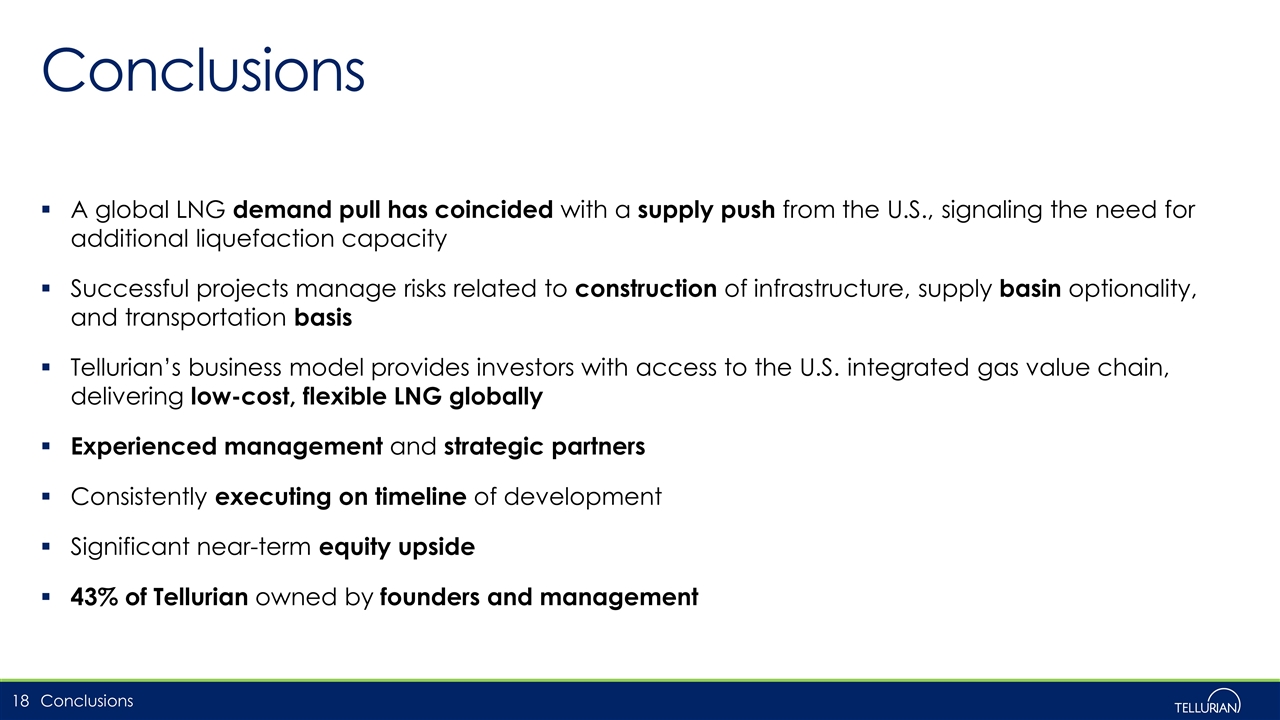

A global LNG demand pull has coincided with a supply push from the U.S., signaling the need for additional liquefaction capacity Successful projects manage risks related to construction of infrastructure, supply basin optionality, and transportation basis Tellurian’s business model provides investors with access to the U.S. integrated gas value chain, delivering low-cost, flexible LNG globally Experienced management and strategic partners Consistently executing on timeline of development Significant near-term equity upside 43% of Tellurian owned by founders and management Conclusions Conclusions

Contact us Amit Marwaha Director, Investor Relations & Finance +1 832 485 2004 amit.marwaha@tellurianinc.com Joi Lecznar SVP, Public Affairs & Communication +1 832 962 4044 joi.lecznar@tellurianinc.com @TellurianLNG Contacts

2017 Additional detail

Site characteristics determine long-run costs Additional detail Access to power and water Berth over 45’ depth with access to high seas Support from local communities Access to pipeline infrastructure Site size over 1,000 acres Insulated from surge, wind, and local populations

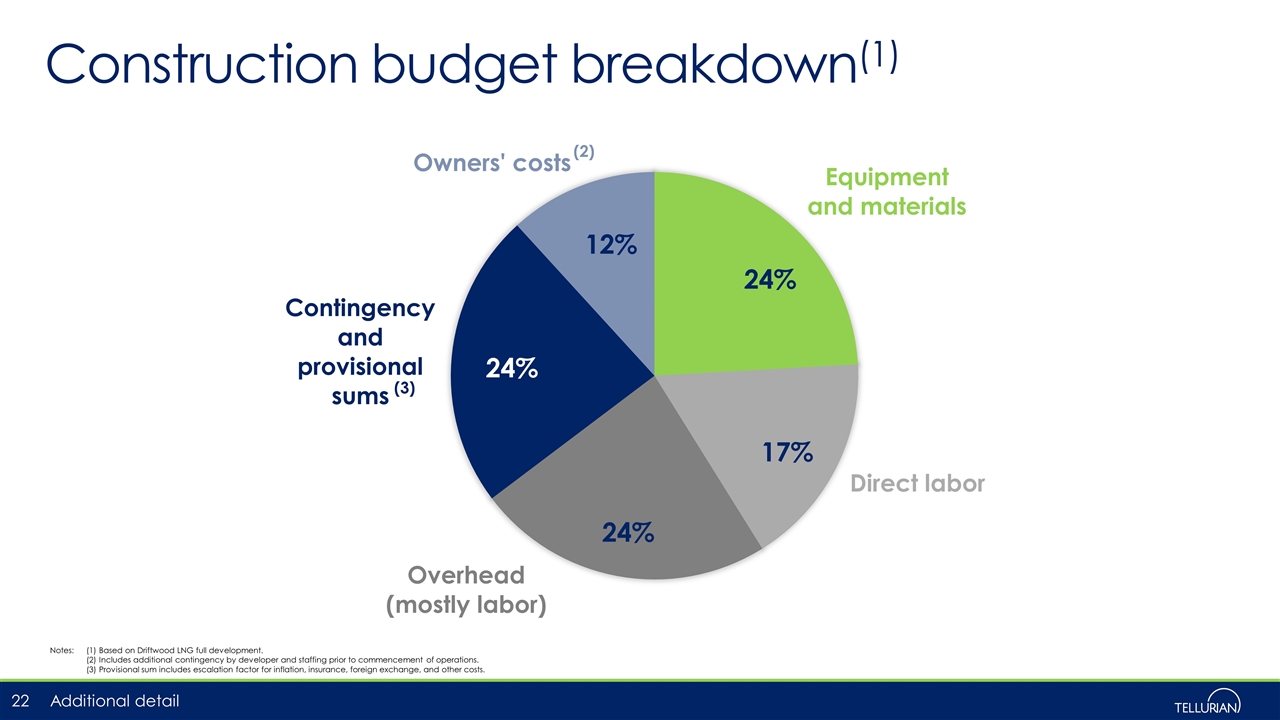

Construction budget breakdown(1) Additional detail Notes:(1) Based on Driftwood LNG full development. (2) Includes additional contingency by developer and staffing prior to commencement of operations. (3) Provisional sum includes escalation factor for inflation, insurance, foreign exchange, and other costs. 24% 24% 24% 12% 17% (3) (2)

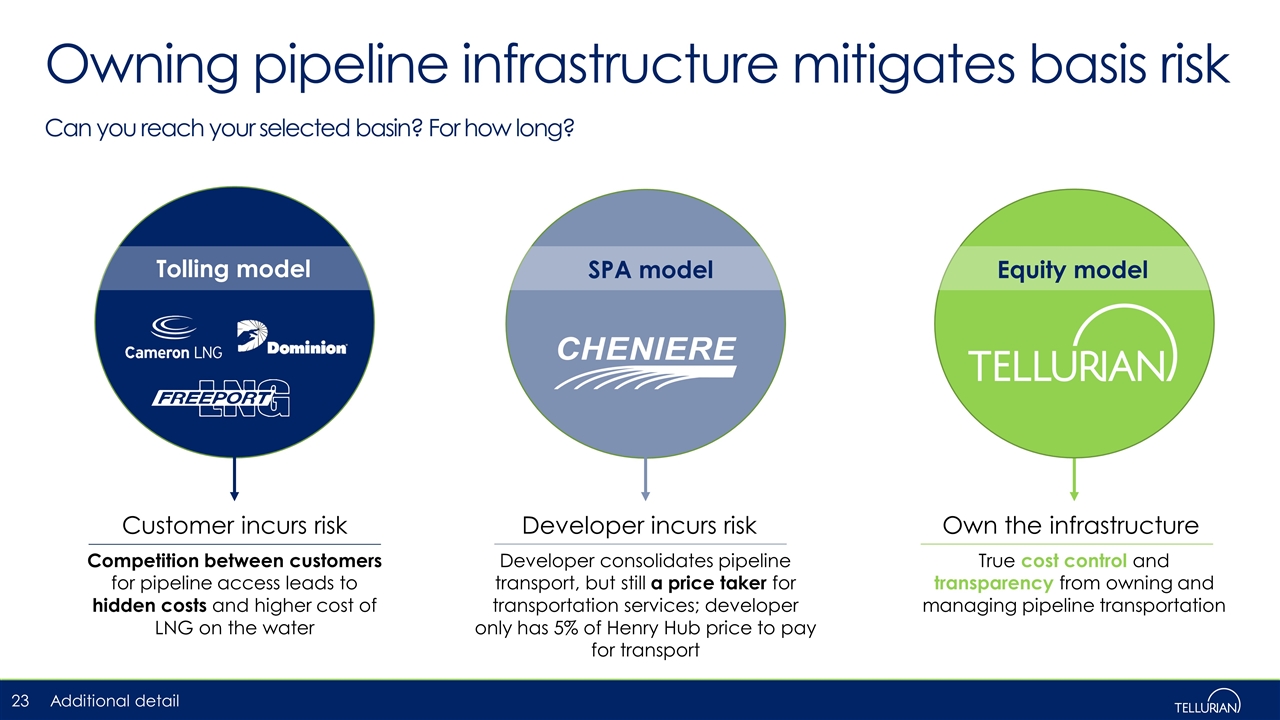

Owning pipeline infrastructure mitigates basis risk Additional detail Can you reach your selected basin? For how long? Tolling model SPA model Equity model Customer incurs risk Competition between customers for pipeline access leads to hidden costs and higher cost of LNG on the water Developer incurs risk Developer consolidates pipeline transport, but still a price taker for transportation services; developer only has 5% of Henry Hub price to pay for transport Own the infrastructure True cost control and transparency from owning and managing pipeline transportation

Low-cost LNG is built before the fence line Additional detail Pipeline access and control of infrastructure is key Adequacy and reliability of supply is critical All-in cost is predictable, but execution and scale matter Basin Basis Construction Illustrative cost inflation +$1-$2/mmBtu in costs from long-term cost escalation as legacy agreements roll off +$1-$2/mmBtu in long-term cost escalation from exhausting lowest-cost drilling locations in one basin +$200-$300 per tonne or $0.40-$0.60/mmBtu cost inflation due to poor execution

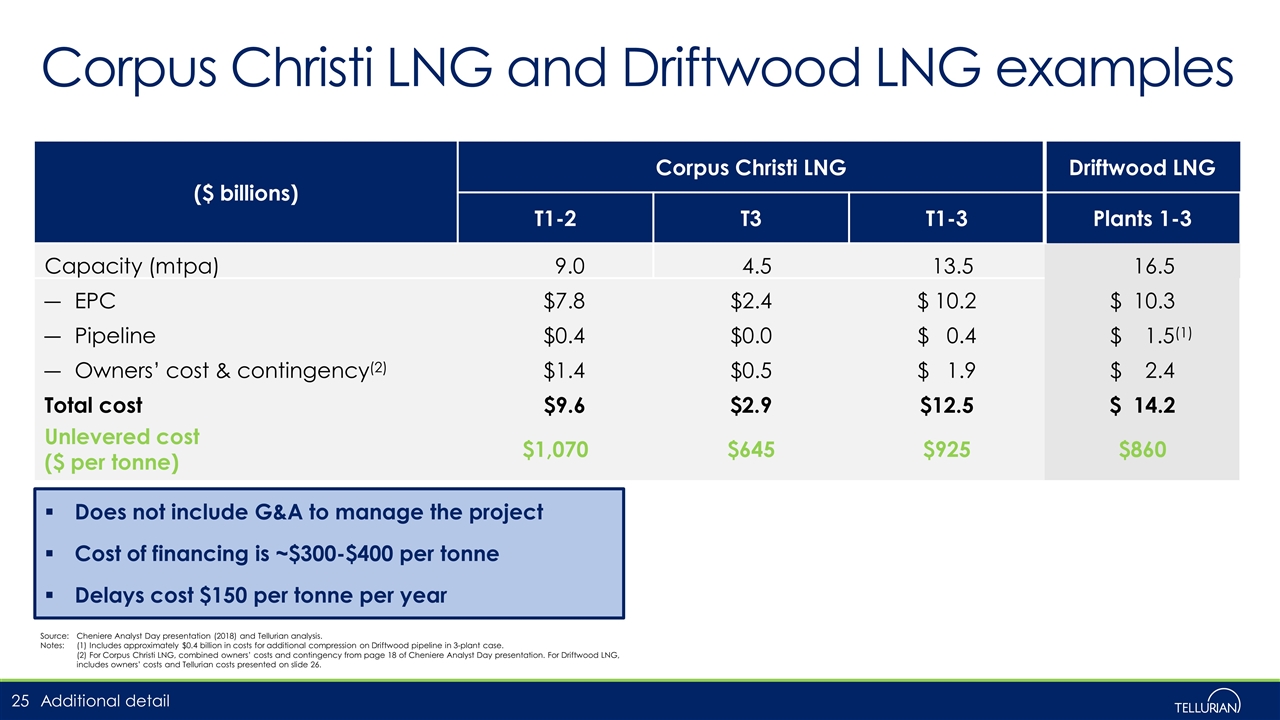

Corpus Christi LNG and Driftwood LNG examples Additional detail Source:Cheniere Analyst Day presentation (2018) and Tellurian analysis. Notes:(1) Includes approximately $0.4 billion in costs for additional compression on Driftwood pipeline in 3-plant case. (2) For Corpus Christi LNG, combined owners’ costs and contingency from page 18 of Cheniere Analyst Day presentation. For Driftwood LNG, includes owners’ costs and Tellurian costs presented on slide 26. ($ billions) Corpus Christi LNG Driftwood LNG T1-2 T3 T1-3 Plants 1-3 Capacity (mtpa) 9.0 4.5 13.5 16.5 EPC $7.8 $2.4 $ 10.2 $ 10.3 Pipeline $0.4 $0.0 $ 0.4 $ 1.5(1) Owners’ cost & contingency(2) $1.4 $0.5 $ 1.9 $ 2.4 Total cost $9.6 $2.9 $12.5 $ 14.2 Unlevered cost ($ per tonne) $1,070 $645 $925 $860 Does not include G&A to manage the project Cost of financing is ~$300-$400 per tonne Delays cost $150 per tonne per year

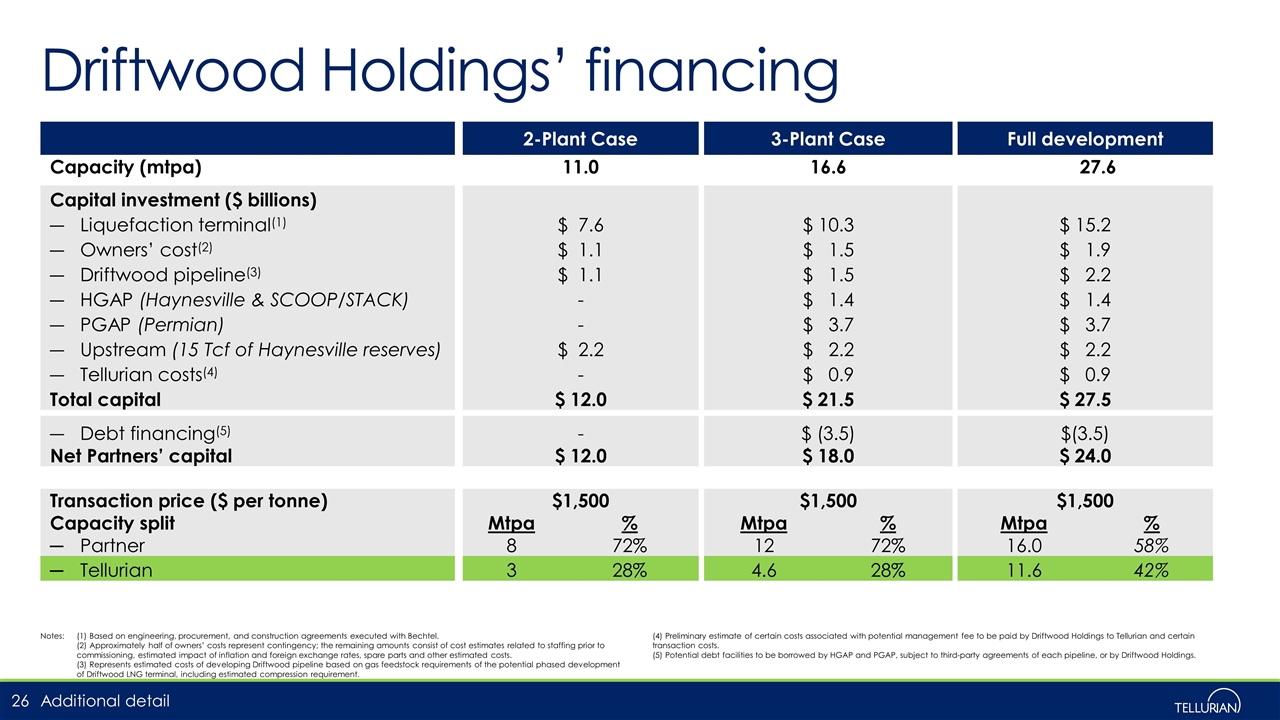

Driftwood Holdings’ financing Additional detail Notes:(1) Based on engineering, procurement, and construction agreements executed with Bechtel. (2) Approximately half of owners’ costs represent contingency; the remaining amounts consist of cost estimates related to staffing prior to commissioning, estimated impact of inflation and foreign exchange rates, spare parts and other estimated costs. (3) Represents estimated costs of developing Driftwood pipeline based on gas feedstock requirements of the potential phased development of Driftwood LNG terminal, including estimated compression requirement. (4) Preliminary estimate of certain costs associated with potential management fee to be paid by Driftwood Holdings to Tellurian and certain transaction costs. (5) Potential debt facilities to be borrowed by HGAP and PGAP, subject to third-party agreements of each pipeline, or by Driftwood Holdings. 2-Plant Case 3-Plant Case Full development Capacity (mtpa) 11.0 16.6 27.6 Capital investment ($ billions) Liquefaction terminal(1) $ 7.6 $ 10.3 $ 15.2 Owners’ cost(2) $ 1.1 $ 1.5 $ 1.9 Driftwood pipeline(3) $ 1.1 $ 1.5 $ 2.2 HGAP (Haynesville & SCOOP/STACK) - $ 1.4 $ 1.4 PGAP (Permian) - $ 3.7 $ 3.7 Upstream (15 Tcf of Haynesville reserves) $ 2.2 $ 2.2 $ 2.2 Tellurian costs(4) - $ 0.9 $ 0.9 Total capital $ 12.0 $ 21.5 $ 27.5 Debt financing(5) - $ (3.5) $(3.5) Net Partners’ capital $ 12.0 $ 18.0 $ 24.0 Transaction price ($ per tonne) $1,500 $1,500 $1,500 Capacity split Mtpa % Mtpa % Mtpa % Partner 8 72% 12 72% 16.0 58% Tellurian 3 28% 4.6 28% 11.6 42%

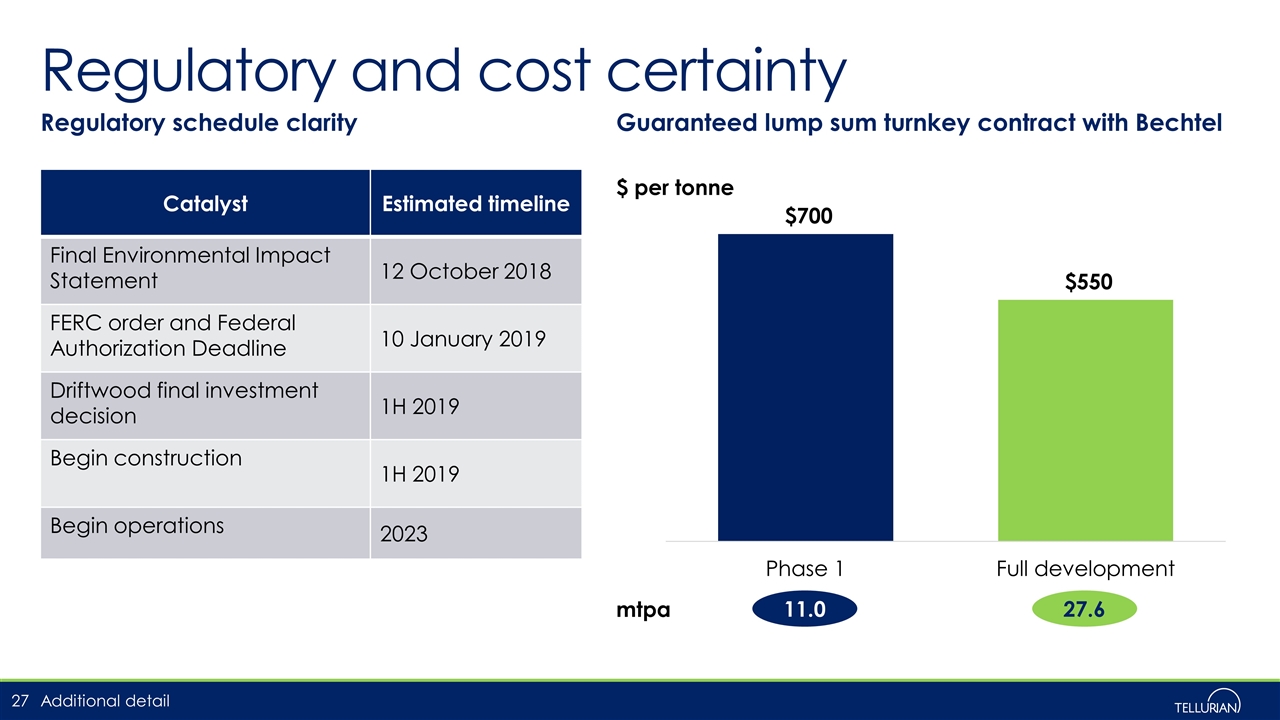

Regulatory and cost certainty Additional detail Regulatory schedule clarity Guaranteed lump sum turnkey contract with Bechtel Catalyst Estimated timeline Final Environmental Impact Statement 12 October 2018 FERC order and Federal Authorization Deadline 10 January 2019 Driftwood final investment decision 1H 2019 Begin construction 1H 2019 Begin operations 2023 11.0 27.6 $ per tonne mtpa

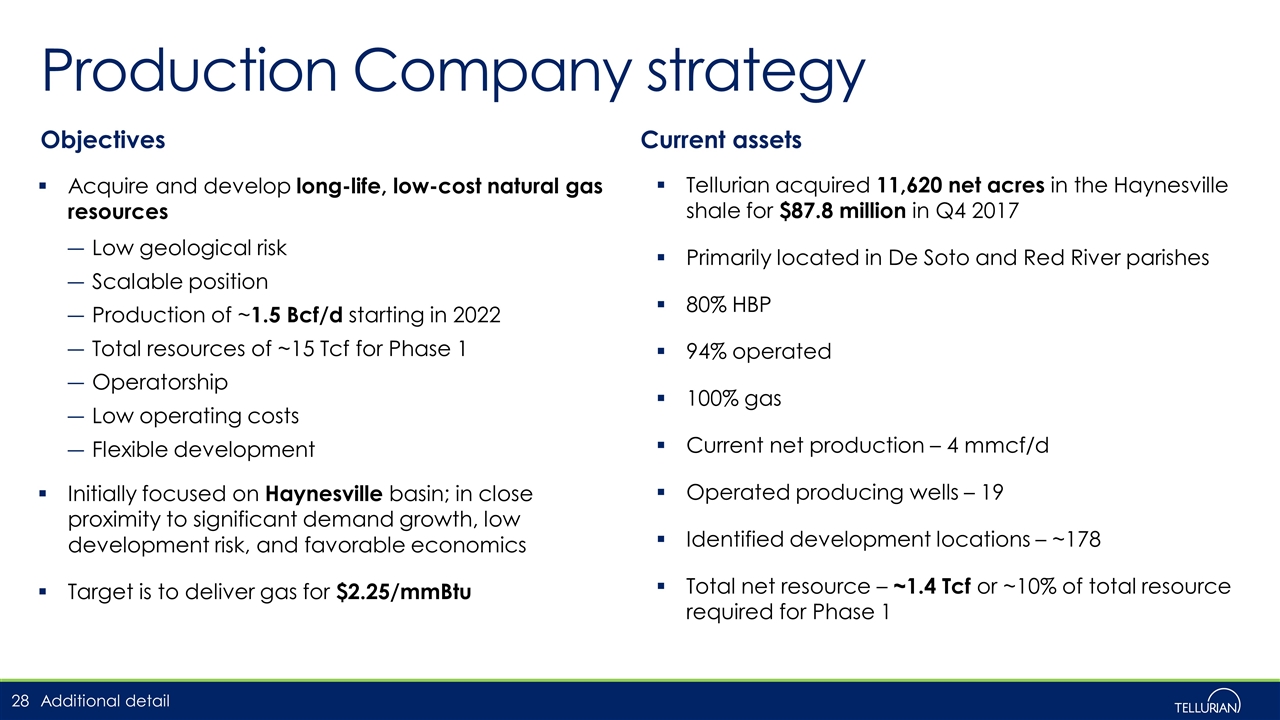

Production Company strategy Acquire and develop long-life, low-cost natural gas resources Low geological risk Scalable position Production of ~1.5 Bcf/d starting in 2022 Total resources of ~15 Tcf for Phase 1 Operatorship Low operating costs Flexible development Initially focused on Haynesville basin; in close proximity to significant demand growth, low development risk, and favorable economics Target is to deliver gas for $2.25/mmBtu Tellurian acquired 11,620 net acres in the Haynesville shale for $87.8 million in Q4 2017 Primarily located in De Soto and Red River parishes 80% HBP 94% operated 100% gas Current net production – 4 mmcf/d Operated producing wells – 19 Identified development locations – ~178 Total net resource – ~1.4 Tcf or ~10% of total resource required for Phase 1 Additional detail Objectives Current assets

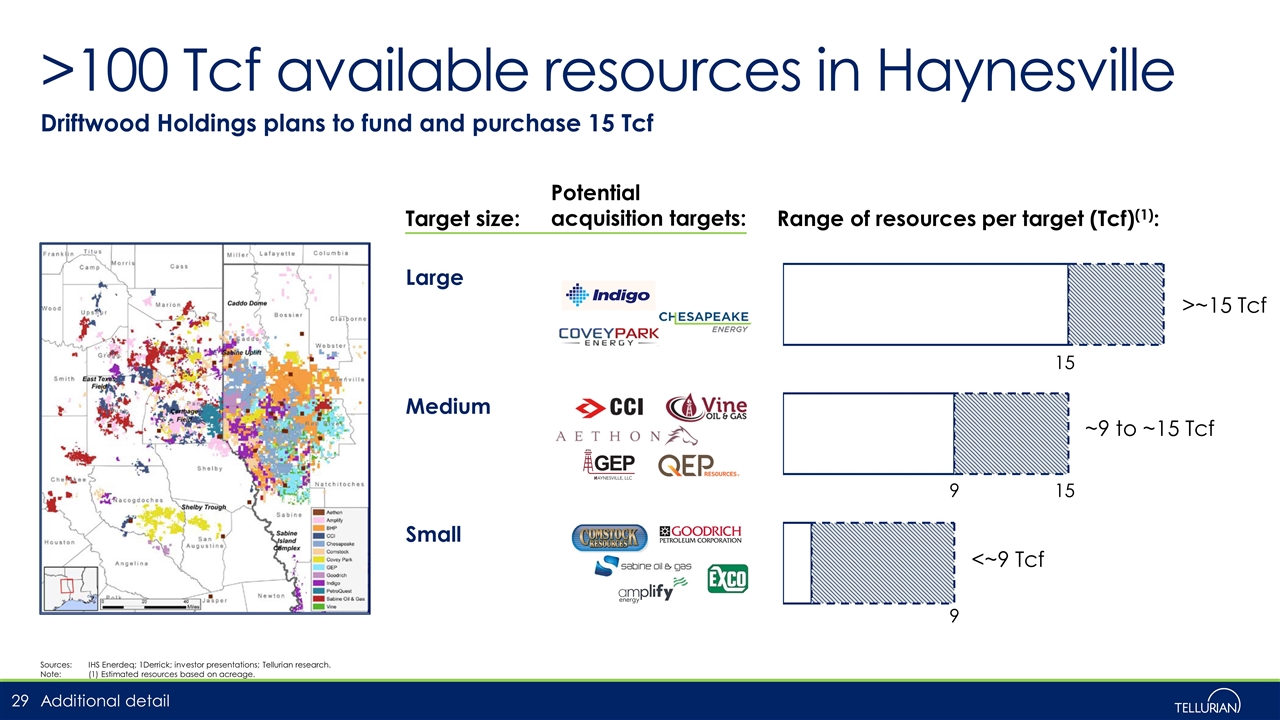

>100 Tcf available resources in Haynesville Additional detail Sources: IHS Enerdeq; 1Derrick; investor presentations; Tellurian research. Note: (1) Estimated resources based on acreage. Driftwood Holdings plans to fund and purchase 15 Tcf Potential acquisition targets: Range of resources per target (Tcf)(1): Target size: Large Medium Small 15 15 9 9

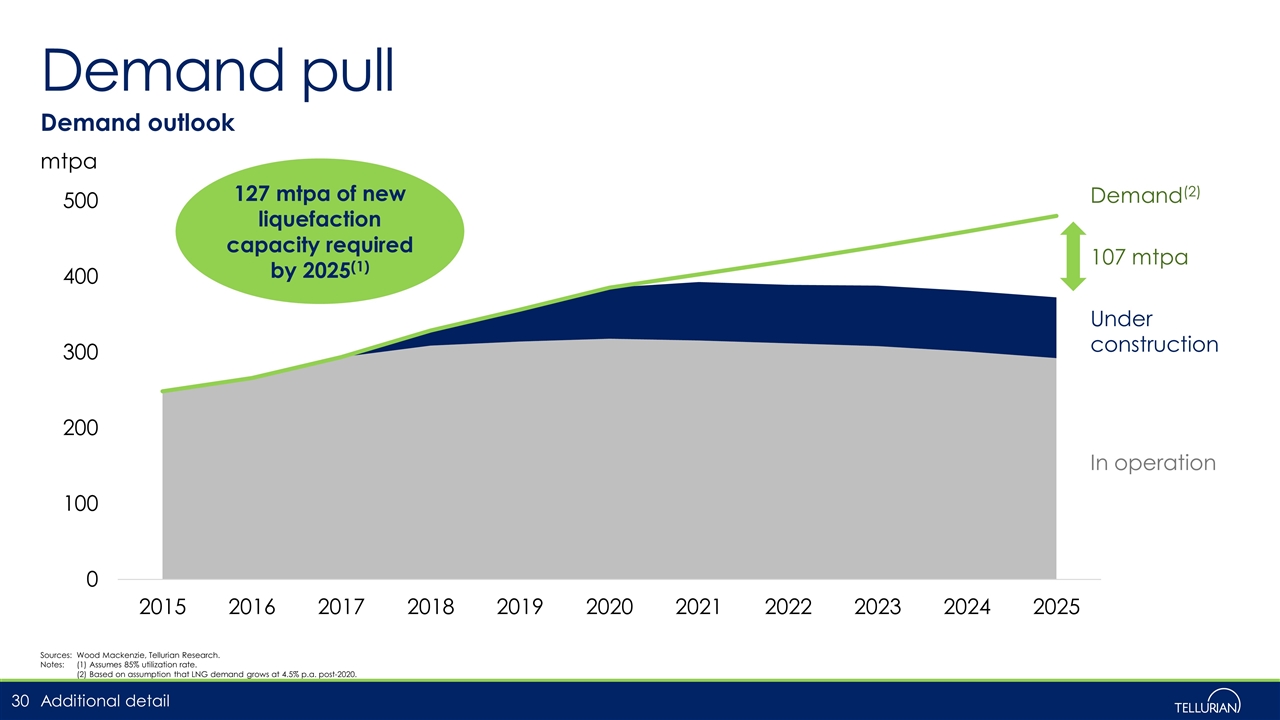

Demand pull Additional detail Demand outlook Sources: Wood Mackenzie, Tellurian Research. Notes:(1) Assumes 85% utilization rate. (2) Based on assumption that LNG demand grows at 4.5% p.a. post-2020. 127 mtpa of new liquefaction capacity required by 2025(1) mtpa Under construction In operation Demand(2) 107 mtpa

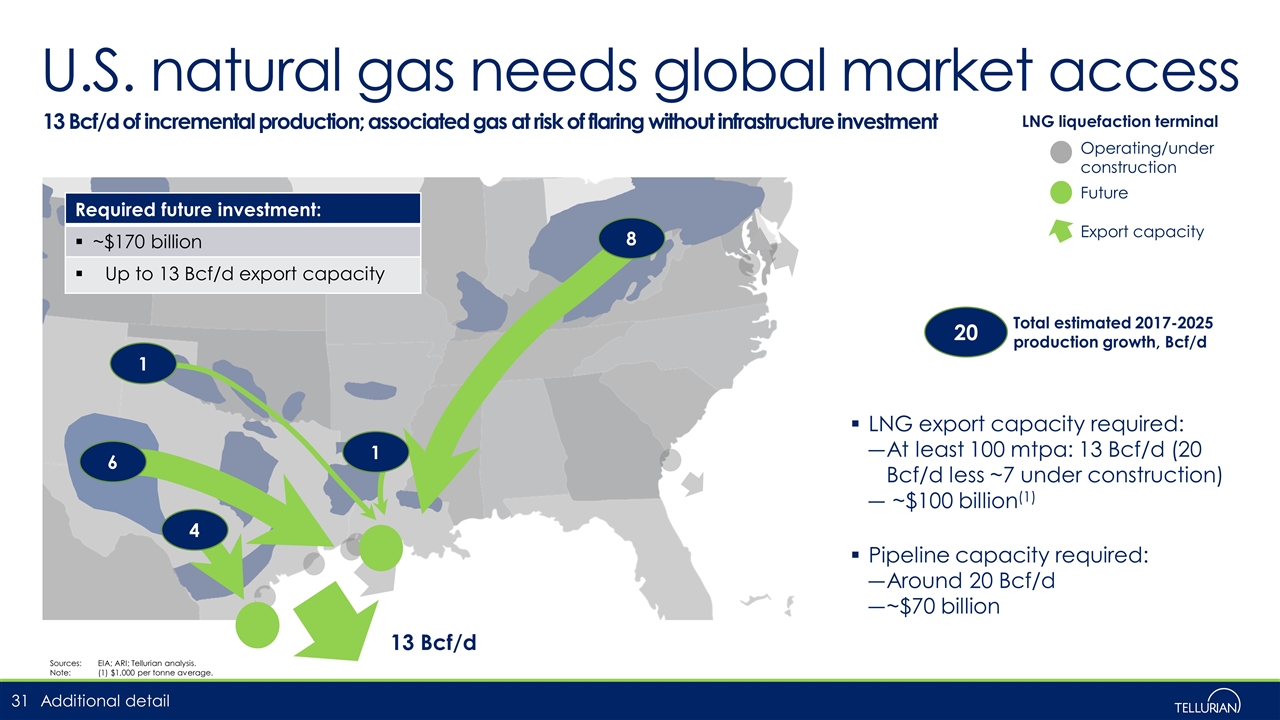

13 Bcf/d 6 1 8 1 4 U.S. natural gas needs global market access Additional detail 13 Bcf/d of incremental production; associated gas at risk of flaring without infrastructure investment Sources: EIA; ARI; Tellurian analysis. Note:(1) $1,000 per tonne average. LNG export capacity required: At least 100 mtpa: 13 Bcf/d (20 Bcf/d less ~7 under construction) ~$100 billion(1) Pipeline capacity required: Around 20 Bcf/d ~$70 billion LNG liquefaction terminal Operating/under construction Future Export capacity 20 Total estimated 2017-2025 production growth, Bcf/d Required future investment: ~$170 billion Up to 13 Bcf/d export capacity

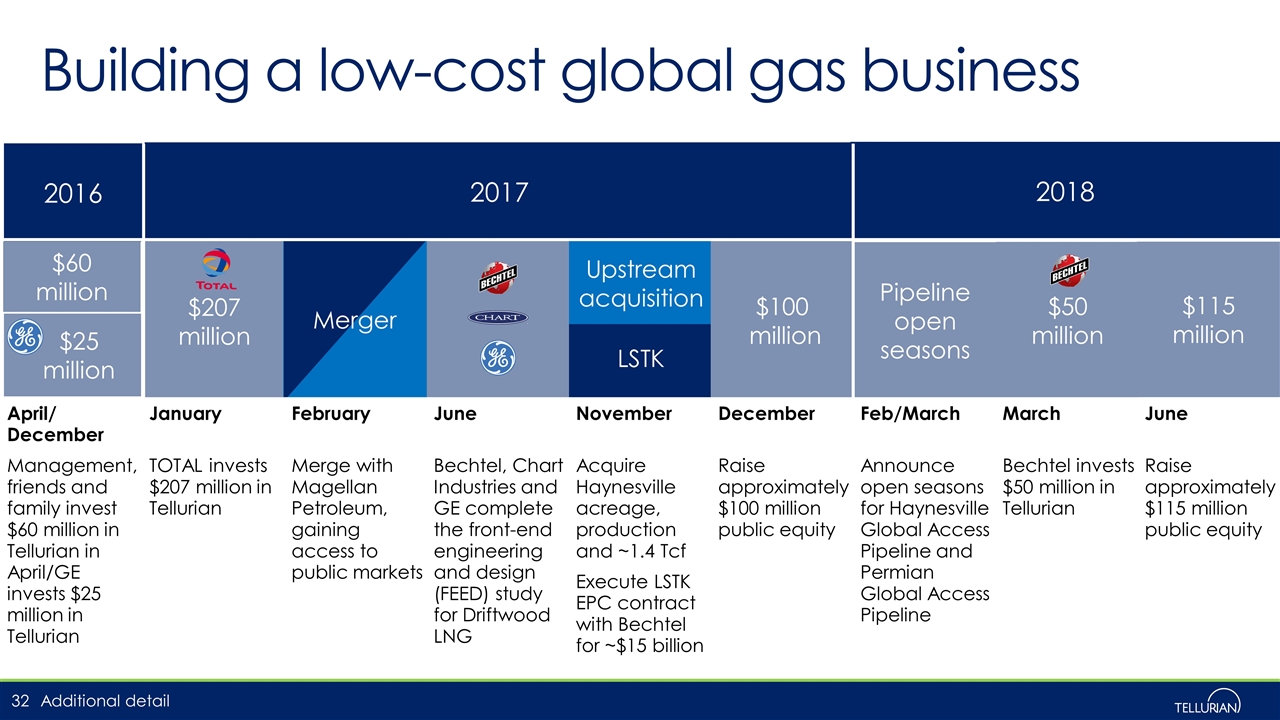

$25 million 2018 Pipeline open seasons $50 million $207 million Merger $100 million Upstream acquisition LSTK April/ December January February June November December Feb/March March June Management, friends and family invest $60 million in Tellurian in April/GE invests $25 million in Tellurian TOTAL invests $207 million in Tellurian Merge with Magellan Petroleum, gaining access to public markets Bechtel, Chart Industries and GE complete the front-end engineering and design (FEED) study for Driftwood LNG Acquire Haynesville acreage, production and ~1.4 Tcf Execute LSTK EPC contract with Bechtel for ~$15 billion Raise approximately $100 million public equity Announce open seasons for Haynesville Global Access Pipeline and Permian Global Access Pipeline Bechtel invests $50 million in Tellurian Raise approximately $115 million public equity 2017 2016 Building a low-cost global gas business $115 million $60 million Additional detail

Funding and ownership Sources (1) ($ million) Notes:(1) As of July 31, 2018. (2) Excludes 6.1 million preferred shares outstanding. Ownership(1)(2) (%) $576 million 241 million shares Additional detail

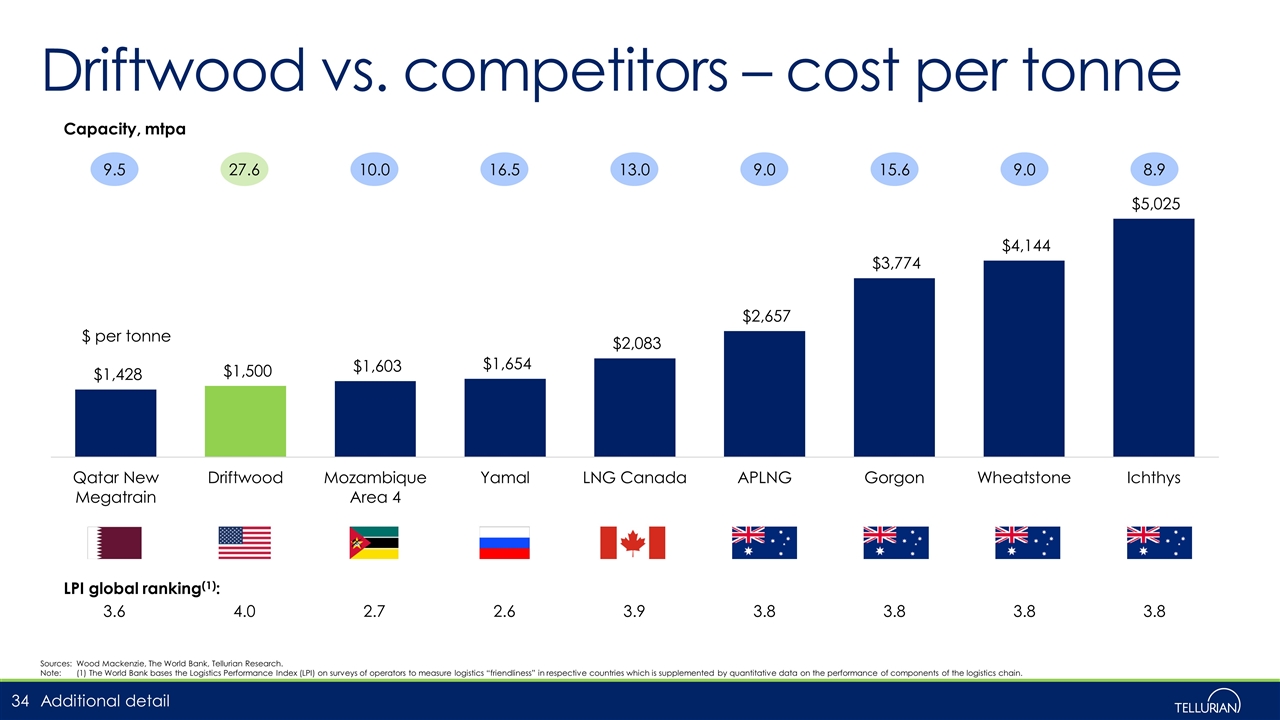

Driftwood vs. competitors – cost per tonne Sources:Wood Mackenzie, The World Bank, Tellurian Research. Note:(1) The World Bank bases the Logistics Performance Index (LPI) on surveys of operators to measure logistics “friendliness” in respective countries which is supplemented by quantitative data on the performance of components of the logistics chain. Capacity, mtpa 9.5 27.6 10.0 16.5 13.0 9.0 15.6 9.0 8.9 LPI global ranking(1): 3.6 4.0 2.7 2.6 3.9 3.8 3.8 3.8 3.8 Additional detail

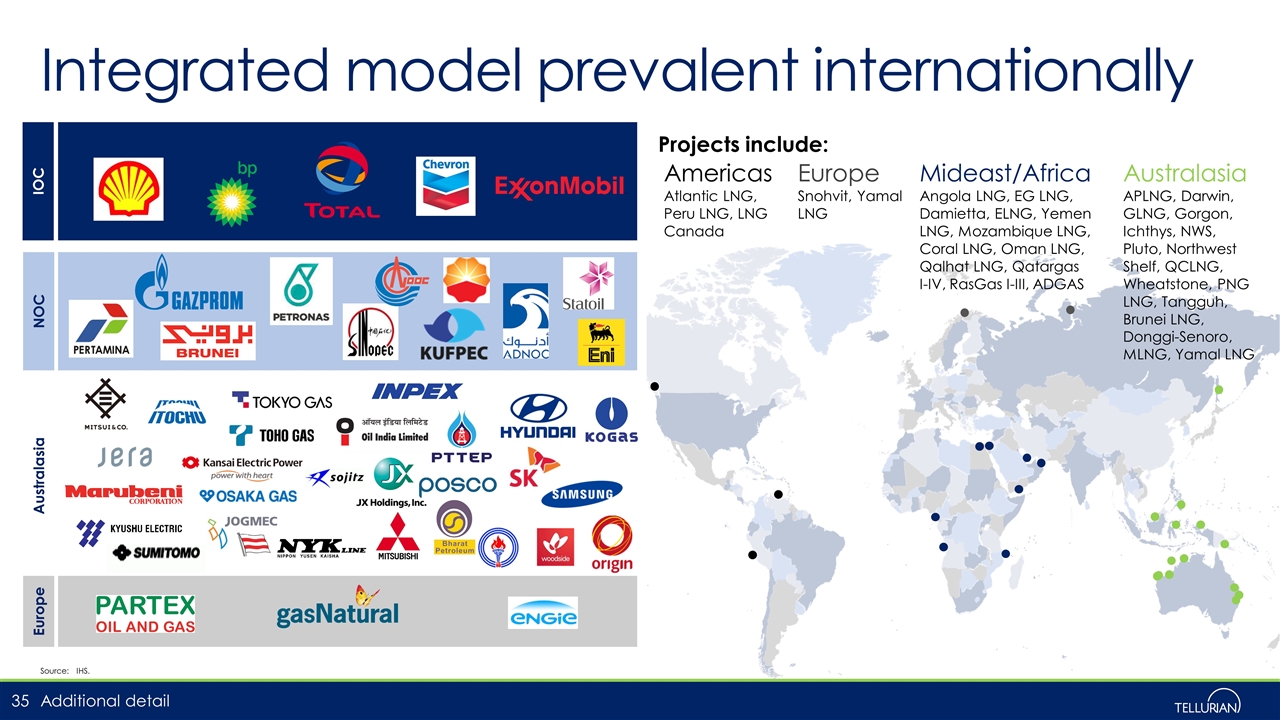

Integrated model prevalent internationally Source:IHS. Projects include: Australasia APLNG, Darwin, GLNG, Gorgon, Ichthys, NWS, Pluto, Northwest Shelf, QCLNG, Wheatstone, PNG LNG, Tangguh, Brunei LNG, Donggi-Senoro, MLNG, Yamal LNG Mideast/Africa Angola LNG, EG LNG, Damietta, ELNG, Yemen LNG, Mozambique LNG, Coral LNG, Oman LNG, Qalhat LNG, Qatargas I-IV, RasGas I-III, ADGAS Americas Atlantic LNG, Peru LNG, LNG Canada Europe Snohvit, Yamal LNG Europe Australasia NOC IOC Additional detail

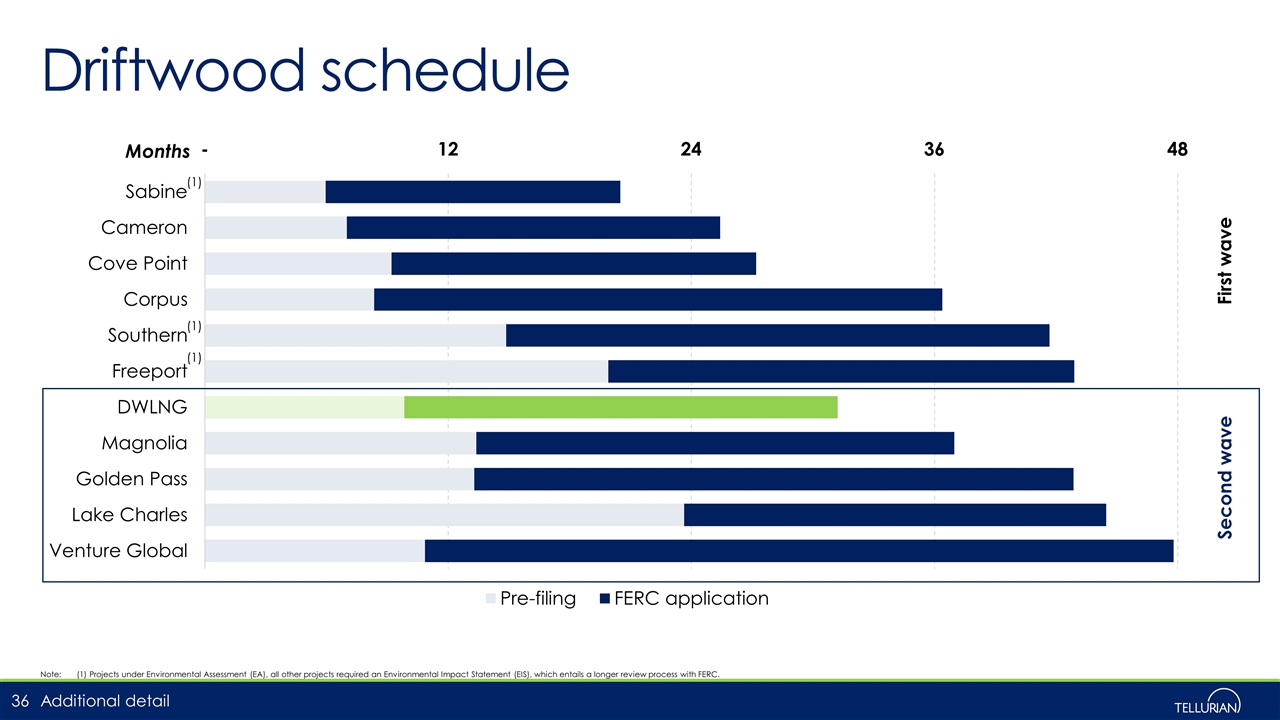

Driftwood schedule Additional detail Note:(1) Projects under Environmental Assessment (EA), all other projects required an Environmental Impact Statement (EIS), which entails a longer review process with FERC. Second wave First wave Months (1) (1) (1)

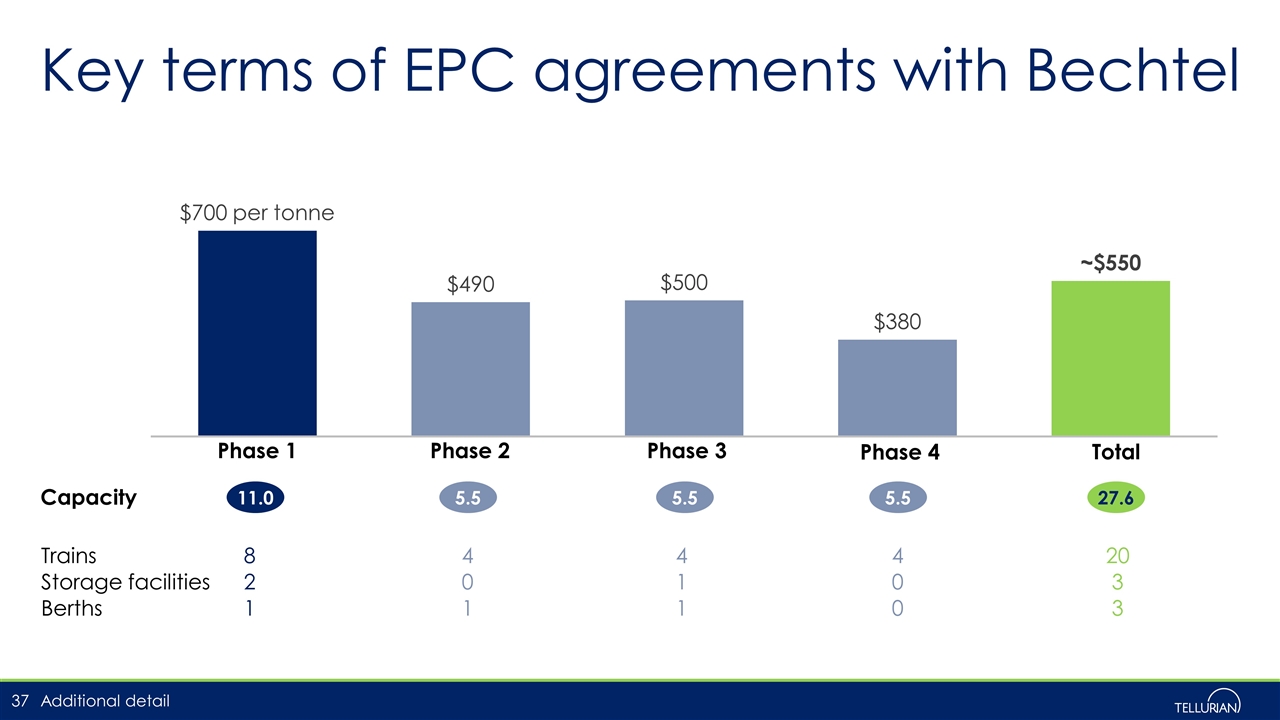

Key terms of EPC agreements with Bechtel Additional detail Trains 8 4 4 4 20 Storage facilities 2 0 1 0 3 Berths 1 1 1 0 3 Phase 1 Phase 2 Phase 3 Phase 4 Total 11.0 5.5 5.5 5.5 27.6 Capacity

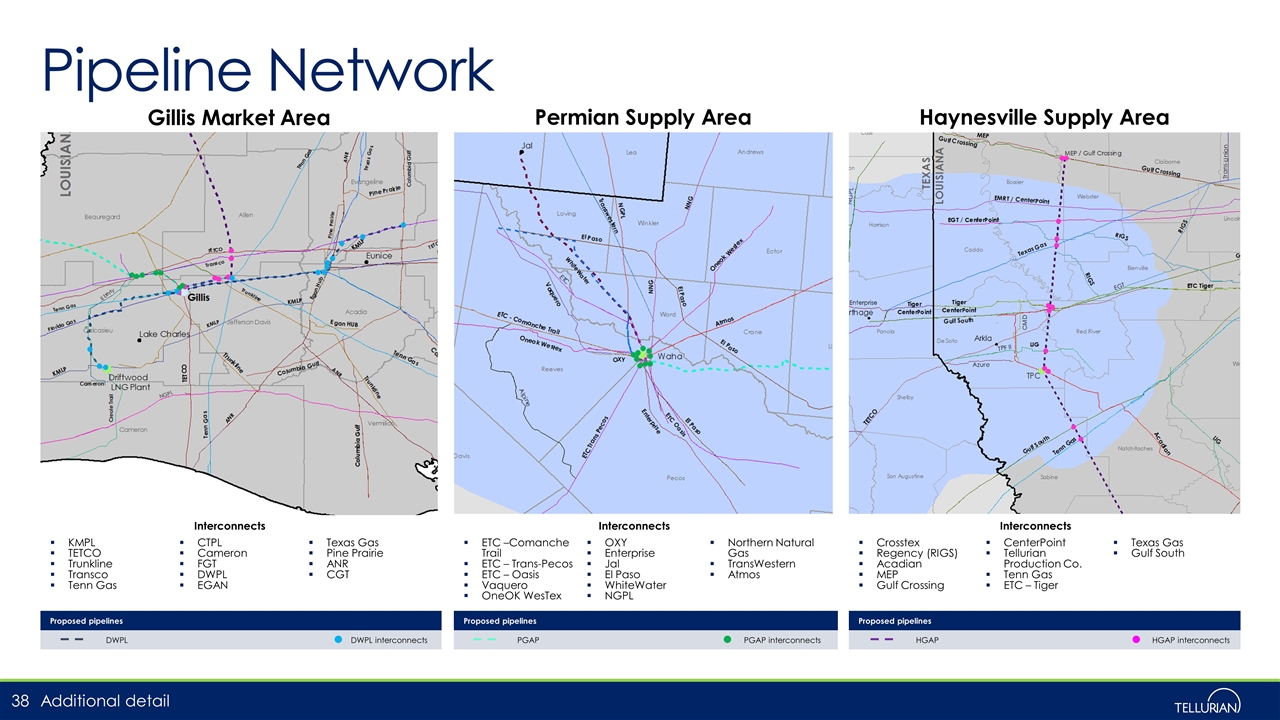

Pipeline Network Gillis Market Area KMPL TETCO Trunkline Transco Tenn Gas CTPL Cameron FGT DWPL EGAN Texas Gas Pine Prairie ANR CGT Interconnects Permian Supply Area ETC –Comanche Trail ETC – Trans-Pecos ETC – Oasis Vaquero OneOK WesTex OXY Enterprise Jal El Paso WhiteWater NGPL Northern Natural Gas TransWestern Atmos Interconnects Haynesville Supply Area Crosstex Regency (RIGS) Acadian MEP Gulf Crossing CenterPoint Tellurian Production Co. Tenn Gas ETC – Tiger Texas Gas Gulf South Interconnects Proposed pipelines DWPL DWPL interconnects Additional detail Proposed pipelines PGAP PGAP interconnects Proposed pipelines HGAP HGAP interconnects

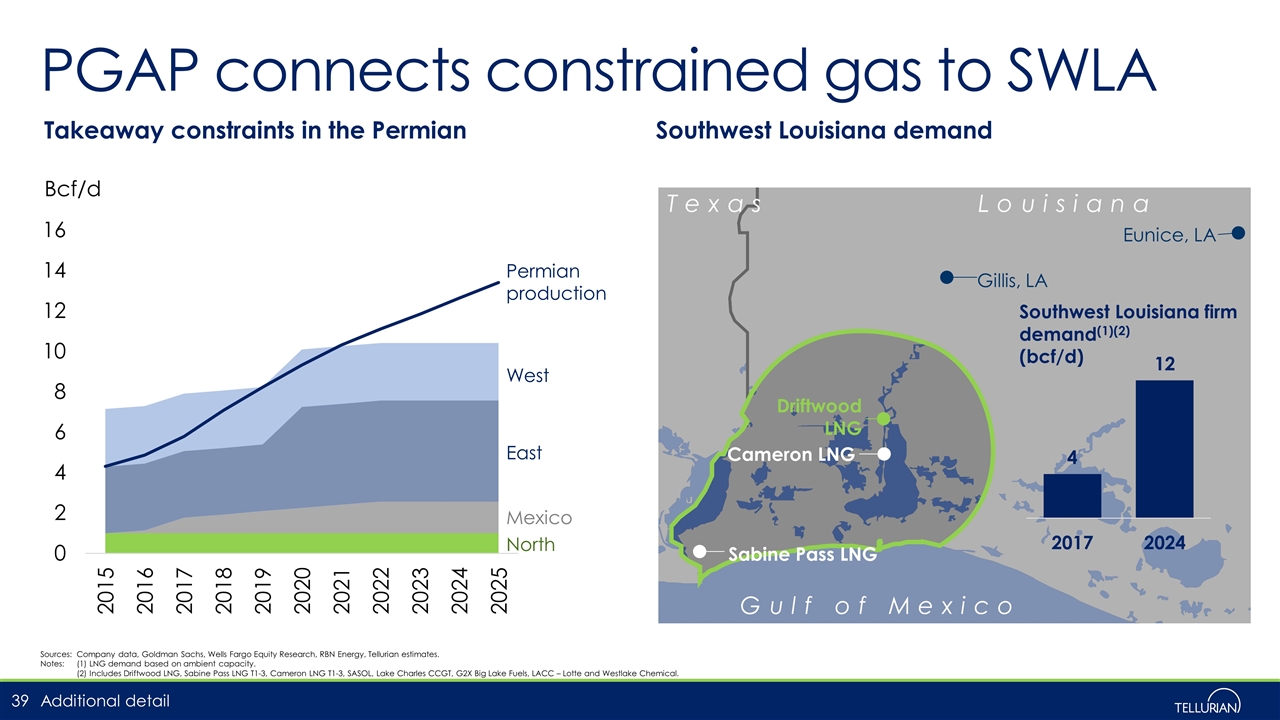

PGAP connects constrained gas to SWLA Additional detail Takeaway constraints in the Permian Southwest Louisiana demand Sources:Company data, Goldman Sachs, Wells Fargo Equity Research, RBN Energy, Tellurian estimates. Notes:(1) LNG demand based on ambient capacity. (2) Includes Driftwood LNG, Sabine Pass LNG T1-3, Cameron LNG T1-3, SASOL, Lake Charles CCGT, G2X Big Lake Fuels, LACC – Lotte and Westlake Chemical. Louisiana Texas Gulf of Mexico Gillis, LA Eunice, LA Driftwood LNG Cameron LNG Sabine Pass LNG Southwest Louisiana firm demand(1)(2) (bcf/d) North Mexico East West Permian production

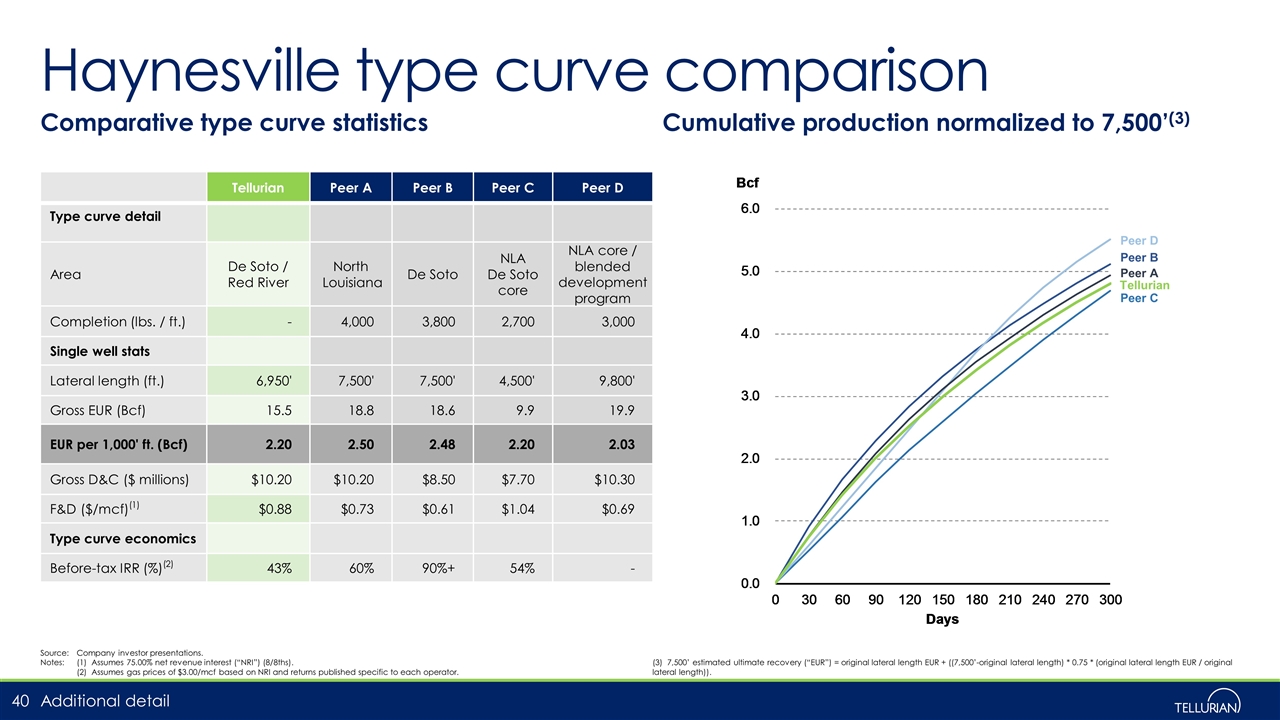

Haynesville type curve comparison Comparative type curve statistics Cumulative production normalized to 7,500’(3) Source:Company investor presentations. Notes:(1) Assumes 75.00% net revenue interest (“NRI”) (8/8ths). (2) Assumes gas prices of $3.00/mcf based on NRI and returns published specific to each operator. (3) 7,500’ estimated ultimate recovery (“EUR”) = original lateral length EUR + ((7,500’-original lateral length) * 0.75 * (original lateral length EUR / original lateral length)). Peer B Peer D Peer A Peer C Tellurian Tellurian Peer A Peer B Peer C Peer D Type curve detail Area De Soto / Red River North Louisiana De Soto NLA De Soto core NLA core / blended development program Completion (lbs. / ft.) - 4,000 3,800 2,700 3,000 Single well stats Lateral length (ft.) 6,950' 7,500' 7,500' 4,500' 9,800' Gross EUR (Bcf) 15.5 18.8 18.6 9.9 19.9 EUR per 1,000' ft. (Bcf) 2.20 2.50 2.48 2.20 2.03 Gross D&C ($ millions) $10.20 $10.20 $8.50 $7.70 $10.30 F&D ($/mcf)(1) $0.88 $0.73 $0.61 $1.04 $0.69 Type curve economics Before-tax IRR (%)(2) 43% 60% 90%+ 54% - Additional detail