|

|

Re:

|

Stockholder

Notice of Intention to Nominate a Person for Election to the Board of

Directors,

and to Bring Other Matters of Business before the

Stockholders,

|

| of Magellan Petroleum Corporation | ||

| Sincerely, | |||

| ANS Investments LLC | |||

|

|

By:

|

/s/ Jonah M. Meer | |

|

Jonah

M. Meer

Chief

Executive Officer

|

|||

|

Name

and Address of the

Record

Owner

|

Name

and Address of the

Beneficial

Owner

|

Nature

of Beneficial

Ownership

(if applicable)

|

Number

of Shares of Magellan

Common

Stock Held

|

Percent

of Class (1)

|

|

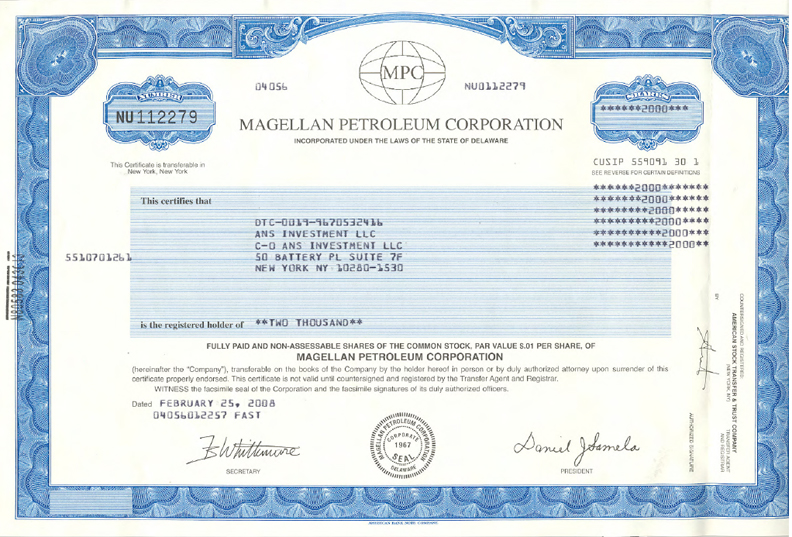

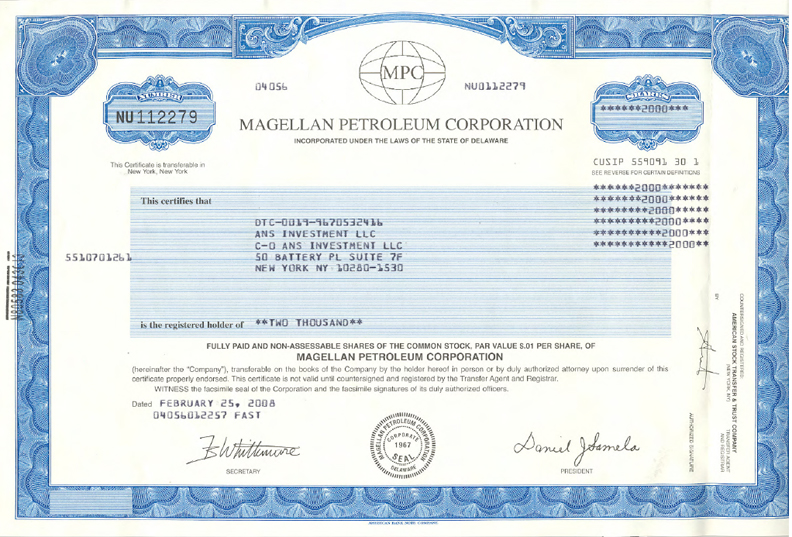

ANS

Investments LLC

50

Battery Place, Suite 7F

New

York, NY 10280-1530

|

ANS

Investments LLC

50

Battery Place, Suite 7F

New

York, NY 10280-1530

|

N/A

|

2,000

|

Less

than

1%

|

|

Cede

& Co., as the nominee of

The

Depository Trust Company

c/o

The Depository Trust Company

55

Water Street

New

York, NY 10041

|

ANS

Investments LLC

50

Battery Place, Suite 7F

New

York, NY 10280-1530

|

Shares

held in “street name” for the benefit of ANS Investments

LLC

|

572,485

|

1.4%

|

|

Total

Shares

|

574,485

|

1.4%

|

|

(1)

|

The

percentages used herein are calculated based upon the 41,500,325 shares of

Magellan Common Stock issued and outstanding as of November 10, 2008 as

reported by the Company in its Quarterly Report on Form 10-Q for the

quarterly period ended September 30,

2008.

|

|

Purchases

and sales by the Stockholder (ANS Investments LLC):

|

|||

|

Date

of Transaction

|

Sale

or Purchase

|

Number.

of Securities Purchased / Sold

|

Price

(Per

Share)

|

|

02/15/08

|

Purchase

|

2,000

|

$ 1.0895

|

|

08/15/08

|

Purchase

|

2,500

|

$ 1.38

|

|

08/18/08

|

Purchase

|

565

|

$ 1.34

|

|

08/18/08

|

Purchase

|

1,200

|

$ 1.38

|

|

08/18/08

|

Purchase

|

2,200

|

$ 1.38

|

|

08/18/08

|

Purchase

|

2,600

|

$ 1.38

|

|

08/19/08

|

Purchase

|

200

|

$ 1.37

|

|

08/19/08

|

Purchase

|

1,500

|

$ 1.39

|

|

08/19/08

|

Purchase

|

3,100

|

$ 1.38

|

|

08/20/08

|

Purchase

|

3,500

|

$ 1.39

|

|

08/20/08

|

Purchase

|

885

|

$ 1.38

|

|

08/21/08

|

Purchase

|

3,000

|

$ 1.38

|

|

08/21/08

|

Purchase

|

4,000

|

$ 1.4099

|

|

08/25/08

|

Purchase

|

5,000

|

$ 1.42

|

|

08/25/08

|

Purchase

|

7,279

|

$ 1.41

|

|

08/25/08

|

Purchase

|

11,000

|

$ 1.42

|

|

08/25/08

|

Purchase

|

9,000

|

$ 1.42

|

|

08/26/08

|

Purchase

|

2,500

|

$ 1.4599

|

|

08/26/08

|

Purchase

|

5,000

|

$ 1.46

|

|

08/26/08

|

Sale

|

(2,500)

|

$ 1.4601

|

|

08/26/08

|

Purchase

|

2,500

|

$ 1.46

|

|

08/26/08

|

Purchase

|

3,000

|

$ 1.4599

|

|

08/26/08

|

Purchase

|

4,600

|

$ 1.46

|

|

08/27/08

|

Purchase

|

2,500

|

$ 1.50

|

|

08/27/08

|

Purchase

|

2,000

|

$ 1.47

|

|

08/27/08

|

Purchase

|

4,700

|

$ 1.47

|

|

08/27/08

|

Purchase

|

1,400

|

$ 1.50

|

|

08/27/08

|

Purchase

|

1,600

|

$ 1.4999

|

|

08/27/08

|

Purchase

|

3,300

|

$ 1.47

|

|

08/28/08

|

Purchase

|

300

|

$ 1.52

|

|

08/28/08

|

Purchase

|

1,700

|

$ 1.5199

|

|

08/28/08

|

Purchase

|

5,000

|

$ 1.54

|

|

Purchases

and sales by the Stockholder (ANS Investments LLC):

|

|||

|

Date

of Transaction

|

Sale

or Purchase

|

Number.

of Securities Purchased / Sold

|

Price

(Per

Share)

|

|

08/29/08

|

Purchase

|

1,000

|

$ 1.5199

|

|

08/29/08

|

Purchase

|

2,500

|

$ 1.4799

|

|

09/02/08

|

Purchase

|

1,100

|

$ 1.5000

|

|

09/02/08

|

Purchase

|

6,900

|

$ 1.4999

|

|

09/02/08

|

Purchase

|

10,000

|

$ 1.50

|

|

09/02/08

|

Purchase

|

400

|

$ 1.50

|

|

09/02/08

|

Purchase

|

6,600

|

$ 1.4999

|

|

09/02/08

|

Purchase

|

5,000

|

$ 1.50

|

|

09/02/08

|

Purchase

|

10,000

|

$ 1.50

|

|

09/03/08

|

Purchase

|

2,500

|

$ 1.48

|

|

09/03/08

|

Purchase

|

2,500

|

$ 1.4999

|

|

09/03/08

|

Purchase

|

3,700

|

$ 1.4799

|

|

09/03/08

|

Purchase

|

4,500

|

$ 1.4999

|

|

09/03/08

|

Purchase

|

5,000

|

$ 1.3999

|

|

09/03/08

|

Purchase

|

5,000

|

$ 1.3999

|

|

09/03/08

|

Purchase

|

5,000

|

$ 1.4999

|

|

09/04/08

|

Purchase

|

4,500

|

$ 1.27

|

|

09/04/08

|

Purchase

|

2,000

|

$ 1.39

|

|

09/04/08

|

Purchase

|

10,000

|

$ 1.27

|

|

09/04/08

|

Purchase

|

12,500

|

$ 1.25

|

|

09/04/08

|

Purchase

|

2,500

|

$ 1.2599

|

|

09/04/08

|

Purchase

|

2,000

|

$ 1.2499

|

|

09/04/08

|

Purchase

|

900

|

$ 1.26

|

|

09/04/08

|

Purchase

|

1,000

|

$ 1.34

|

|

09/05/08

|

Purchase

|

8,000

|

$ 1.26

|

|

09/05/08

|

Purchase

|

5,000

|

$ 1.23

|

|

09/05/08

|

Purchase

|

400

|

$ 1.21

|

|

09/08/08

|

Purchase

|

15,000

|

$ 1.30

|

|

09/08/08

|

Purchase

|

5,000

|

$ 1.3399

|

|

09/08/08

|

Purchase

|

1,500

|

$ 1.31

|

|

09/08/08

|

Purchase

|

100

|

$ 1.31

|

|

09/09/08

|

Purchase

|

951

|

$ 1.20

|

|

09/09/08

|

Purchase

|

5,000

|

$ 1.24

|

|

09/09/08

|

Purchase

|

6,000

|

$ 1.24

|

|

09/09/08

|

Purchase

|

7,500

|

$ 1.25

|

|

09/09/08

|

Purchase

|

6,100

|

$ 1.27

|

|

09/09/08

|

Purchase

|

1,100

|

$ 1.2973

|

|

09/09/08

|

Purchase

|

8,900

|

$ 1.30

|

|

9/9/2008

|

Purchase

|

10,000

|

$ 1.23

|

|

9/9/2008

|

Purchase

|

10,000

|

$ 1.23

|

|

Purchases

and sales by the Stockholder (ANS Investments LLC):

|

|||

|

Date

of Transaction

|

Sale

or Purchase

|

Number.

of Securities Purchased / Sold

|

Price

(Per

Share)

|

|

9/9/2008

|

Purchase

|

5,000

|

$ 1.21

|

|

9/9/2008

|

Purchase

|

5,000

|

$ 1.22

|

|

09/11/08

|

Purchase

|

20,000

|

$ 1.15

|

|

09/11/08

|

Purchase

|

10,000

|

$ 1.10

|

|

09/11/08

|

Purchase

|

10,000

|

$ 1.15

|

|

09/11/08

|

Purchase

|

5,000

|

$ 1.1499

|

|

09/11/08

|

Purchase

|

5,000

|

$ 1.1499

|

|

09/11/08

|

Purchase

|

5,000

|

$ 1.12

|

|

09/11/08

|

Purchase

|

2,700

|

$ 1.1499

|

|

09/11/08

|

Purchase

|

1,500

|

$ 1.1499

|

|

09/11/08

|

Purchase

|

800

|

$ 1.15

|

|

09/15/08

|

Purchase

|

5,000

|

$ 1.1299

|

|

09/15/08

|

Purchase

|

700

|

$ 1.10

|

|

09/16/08

|

Purchase

|

6,100

|

$ 1.05

|

|

09/16/08

|

Purchase

|

5,000

|

$ 1.09

|

|

09/16/08

|

Purchase

|

4,700

|

$ 1.07

|

|

09/16/08

|

Purchase

|

3,250

|

$ 1.03

|

|

09/16/08

|

Purchase

|

2,300

|

$ 1.07

|

|

09/16/08

|

Purchase

|

55

|

$ 1.0699

|

|

09/17/08

|

Purchase

|

7,400

|

$ 1.07

|

|

09/17/08

|

Purchase

|

5,000

|

$ 1.0699

|

|

09/17/08

|

Purchase

|

2,500

|

$ 1.0999

|

|

09/17/08

|

Purchase

|

2,500

|

$ 1.0799

|

|

09/17/08

|

Purchase

|

2,300

|

$ 1.0999

|

|

09/17/08

|

Purchase

|

2,100

|

$ 1.07

|

|

09/17/08

|

Purchase

|

200

|

$ 1.10

|

|

09/18/08

|

Purchase

|

4,800

|

$ 1.08

|

|

09/18/08

|

Purchase

|

2,700

|

$ 1.05

|

|

09/19/08

|

Purchase

|

14,000

|

$ 1.05

|

|

09/19/08

|

Purchase

|

13,500

|

$ 1.07

|

|

09/19/08

|

Purchase

|

9,400

|

$ 1.06

|

|

09/19/08

|

Purchase

|

9,300

|

$ 1.07

|

|

09/19/08

|

Purchase

|

7,200

|

$ 1.07

|

|

09/19/08

|

Purchase

|

6,700

|

$ 1.05

|

|

09/24/08

|

Purchase

|

10,000

|

$ 1.08

|

|

09/24/08

|

Purchase

|

8,000

|

$ 1.07

|

|

09/24/08

|

Purchase

|

5,000

|

$ 1.09

|

|

09/29/08

|

Purchase

|

10,000

|

$ 1.03

|

|

09/29/08

|

Purchase

|

5,000

|

$ 1.03

|

|

09/29/08

|

Purchase

|

2,100

|

$ 1.03

|

|

Purchases

and sales by the Stockholder (ANS Investments LLC):

|

|||

|

Date

of Transaction

|

Sale

or Purchase

|

Number.

of Securities Purchased / Sold

|

Price

(Per

Share)

|

|

10/02/08

|

Purchase

|

10,000

|

$

0.8999

|

|

10/02/08

|

Purchase

|

10,000

|

$ 0.89

|

|

10/02/08

|

Purchase

|

7,500

|

$ 0.94

|

|

10/02/08

|

Purchase

|

5,000

|

$ 0.98

|

|

10/02/08

|

Purchase

|

5,000

|

$ 0.93

|

|

10/02/08

|

Purchase

|

5,000

|

$ 0.91

|

|

10/02/08

|

Purchase

|

400

|

$ 0.85

|

|

10/08/08

|

Purchase

|

10,000

|

$ 0.89

|

|

Purchases

and sales by the Nominee (Jonah M. Meer):

|

|||

|

Date

of Transaction

|

Sale

or Purchase

|

Number

of Securities Purchased / Sold

|

Price

(Per

Share)

|

|

09/12/07

|

Purchase

|

1,000

|

$ 1.1099

|

|

10/15/07

|

Purchase

|

1,000

|

$

1.11

|

|

11/28/07

|

Purchase

|

3,000

|

$ 0.9000

|

|

11/30/07

|

Purchase

|

900

|

$ 1.0000

|

|

11/30/07

|

Purchase

|

1,000

|

$

1.00

|

|

11/30/07

|

Purchase

|

1,000

|

$ 1.0000

|

|

11/30/07

|

Purchase

|

3,000

|

$ 0.9900

|

|

11/30/07

|

Purchase

|

4,600

|

$ 0.9900

|

|

11/30/07

|

Purchase

|

10,000

|

$ 1.0200

|

|

12/05/07

|

Purchase

|

900

|

$ 1.0600

|

|

12/05/07

|

Purchase

|

1,000

|

$ 1.0600

|

|

12/05/07

|

Purchase

|

1,100

|

$ 1.06

|

|

12/05/07

|

Purchase

|

1,600

|

$ 1.06

|

|

12/05/07

|

Purchase

|

4,000

|

$ 1.07

|

|

12/05/07

|

Purchase

|

5,000

|

$ 1.0700

|

|

12/05/07

|

Purchase

|

12,900

|

$ 1.07

|

|

12/19/07

|

Purchase

|

2,800

|

$ 1.02

|

|

12/19/07

|

Purchase

|

7,200

|

$ 1.0000

|

|

12/19/07

|

Purchase

|

100

|

$ 1.00

|

|

12/19/07

|

Purchase

|

200

|

$ 0.99

|

|

12/19/07

|

Purchase

|

200

|

$ 0.99

|

|

12/19/07

|

Purchase

|

200

|

$ 1.00

|

|

12/19/07

|

Purchase

|

200

|

$ 0.99

|

|

12/19/07

|

Purchase

|

300

|

$ 0.99

|

|

Purchases

and sales by the Nominee (Jonah M. Meer):

|

|||

|

Date

of Transaction

|

Sale

or Purchase

|

Number

of Securities Purchased / Sold

|

Price

(Per

Share)

|

|

12/19/07

|

Purchase

|

300

|

$ 0.99

|

|

12/19/07

|

Purchase

|

500

|

$ 0.99

|

|

12/19/07

|

Purchase

|

500

|

$ 0.99

|

|

12/20/07

|

Purchase

|

10,000

|

$ 1.01

|

|

12/21/07

|

Purchase

|

3,000

|

$ 0.9900

|

|

12/31/07

|

Purchase

|

1,000

|

$

0.9899

|

|

12/31/07

|

Purchase

|

1,000

|

$

0.9899

|

|

12/31/07

|

Purchase

|

500

|

$ 0.98

|

|

12/31/07

|

Purchase

|

1,000

|

$ 0.99

|

|

12/31/07

|

Purchase

|

1,000

|

$ 0.99

|

|

01/09/08

|

Purchase

|

2,500

|

$ 0.95

|

|

(i)

|

to

serving as a nominee for election as a director to the Company Board at

the Stockholder Meeting;

|

|

(ii)

|

to

being named as a nominee in any notice provided by the Stockholder of its

intention to nominate the undersigned for election as a director to the

Company Board at the Stockholder

Meeting;

|

|

(iii)

|

to

being named as a nominee in any proxy statement filed by the Stockholder

in connection with its solicitation of proxies or written consents for

election of the undersigned at the Stockholder Meeting;

and

|

|

(iv)

|

to

serve as a director of the Company if elected at the Stockholder

Meeting.

|