EXHIBIT

99.4

ANS

Investments LLC

▪

50

Battery Place, Suite 7F, New York, NY 10280 ▪

▪

Tel:

(212) 945-2080 ▪ Fax: (508) 629-0074 ▪

▪

Email:

jmeer@verizon.net▪

September

10, 2008

VIA

ELECTRONIC MAIL, OVERNIGHT MAIL

AND

FACSIMILE TRANSMISSION

Magellan

Petroleum Corporation

10

Columbus Boulevard

Hartford,

CT 06106

Attention:

Mr. Edward B. Whittemore, Esq.

Corporate

Secretary

| Re: |

Access

to Stockholder List and Demand to Inspect Stockholder Records

|

|

Pursuant

to Section 220 of the Delaware General Corporation

Law

|

Ladies

and Gentlemen:

The

undersigned stockholder, ANS Investments LLC, a Delaware limited liability

company (the “Stockholder”), with a business address of 50 Battery Place, Suite

7F, New York, New York

10280-1517,

is the

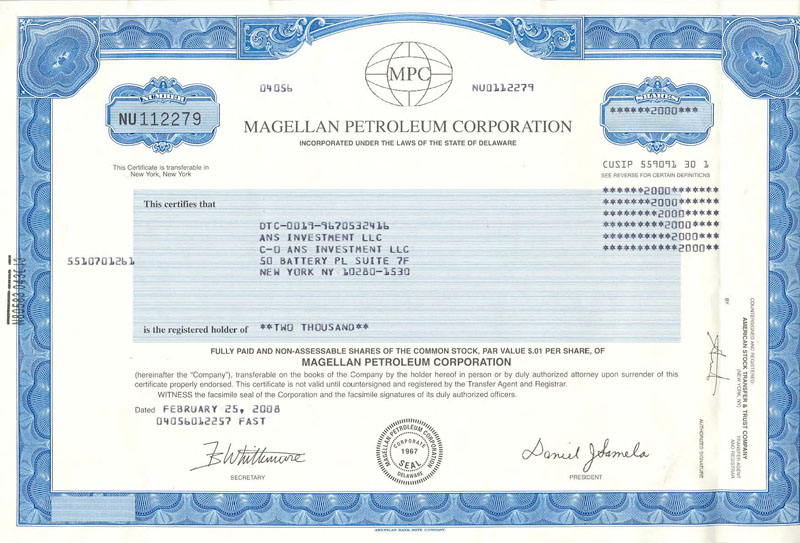

record owner of 2,000 shares (the “Record Shares”) of the Common Stock, par

value $0.01 per share ("Magellan Common Stock" or “Common Stock”), of Magellan

Petroleum Corporation, a Delaware corporation (“Magellan” or the “Company”), as

evidenced by Magellan stock certificate number NU0112279 dated February 25,

2008. In

addition, and including the Record Shares, the Stockholder is the beneficial

owner of 304,780 shares of the Magellan Common Stock (collectively, the

“Shares”). The name and address of the Stockholder as they appear on the

Company's stock ledger are: ANS Investments LLC, 50 Battery Place, Suite

7F, New

York, New York

10280-1530.

As

evidence of the Stockholder’s record ownership, attached hereto is a true and

correct copy of the stock certificate referenced above which was issued by

the

Company’s stock transfer agent and registrar, American Stock Transfer &

Trust Company, LLC.

Pursuant

to Section 220 of the Delaware General Corporation Law (the “DGCL”), the

Stockholder hereby demands (the “Demand”) an opportunity to inspect, and to make

copies and extracts from, the following records and documents of the Company

(the “Demand Materials”):

Magellan

Petroleum Corporation

September

10, 2008

Page

2

1. A

complete record or list of the Company’s stockholders arranged in descending

order by number of shares, certified by its transfer agent(s) and/or

registrar(s), setting forth the name and address of each stockholder and

the

number of shares of Common Stock registered in the name of each such stockholder

(i) as of the date hereof, and (ii) as of any record date for the 2008 Annual

Meeting of Stockholders of the Company or any postponement, rescheduling,

adjournment or continuation thereof, or any other meeting of stockholders

held

in lieu thereof the (“Annual Meeting”) (each record date under the preceding

sub-clauses is hereinafter referred to as a “Record Date”).

2. A

CD, DVD

or other electronic storage medium containing a list of the Company’s

stockholders setting forth the name and addresses of each stockholder and

number

of shares of Common Stock registered in the name of each such stockholder

as of

the date hereof and as of any Record Date, together with any computer processing

information that may be relevant or necessary for the Stockholder to make

use of

such electronic medium, and a hard copy printout of such electronic medium

for

verification purposes.

3. All

daily

transfer sheets showing changes in the lists of the Company’s stockholders

referred to in Item 1 above which are in or come into the possession of the

Company or its transfer agent, or which can reasonably be obtained, pursuant

to

Rule 14b-2 promulgated under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), from brokers, dealers, banks, clearing agencies, voting

trusts or nominees of any central certificate depository system, from the

date

of such lists to the date of the Annual Meeting or any other meeting of

stockholders held in lieu thereof.

4. All

information that is in, or that comes into the Company’s or its transfer agent’s

possession or control, or which can reasonably be obtained, pursuant to Rule

14b-2 under the Exchange Act, from brokers, dealers, banks, clearing agencies,

voting trusts or nominees of any central certificate depository system

concerning the number and identity of, and the number of shares held by,

the

actual beneficial owners of the Common Stock, including (a) the Securities

Position Listing and omnibus proxy issued by The Depository Trust Company

(“DTC”) for any Record Date; (b) all “Weekly Security Position Listing Daily

Closing Balances” reports issued by DTC (and authorization for The Altman Group,

Inc., the Stockholder’s agent, to receive such reports directly); and (c) all

lists (and computer media, processing data and printouts as described in

Item 2

above) containing the name, address and number of shares of Common Stock

attributable to any participant in any employee stock ownership, incentive,

profit sharing, savings, retirement, stock option, stock purchase, restricted

stock, dividend reinvestment or other comparable plan of the Company in which

the decision whether to vote shares of Common Stock held by such plan is

made,

directly or indirectly, individually or collectively, by the participants

in the

plan and the method(s) by which the Stockholder or its agents may communicate

with each such participant.

5. All

lists, tapes, electronic files and other information that are in, or that

come

into, the possession or control of the Company, or that can reasonably be

obtained, pursuant to Rules 14b-1 and 14b-2 under the Exchange Act, which

set

forth the names and addresses of, and the number of shares held by, the

beneficial owners of the Common Stock, including, but not limited to, any

list

of non-objecting or consenting beneficial owners (“NOBO’s” or “COBO’s”) in the

format of a printout and magnetic computer tape listing in descending order

balance. If such information is not in the Company’s possession, custody or

control, such information should be requested from Broadridge Financial

Solutions, Inc. (formerly ADP Proxy Services) - Investor Communications

Services.

Magellan

Petroleum Corporation

September

10, 2008

Page

3

6. A

“stop

transfer” list or “stop lists” relating to any shares of the Common Stock as of

the dates of the lists referred to in Item 1 above.

7. A

correct

and complete copy of the Bylaws of the Company, as amended to date, and any

and

all changes of any sort to the Bylaws of the Company hereafter made through

the

date of the Annual Meeting or any other meeting of stockholders held in lieu

thereof, including, without limitation, any amendment to the existing Bylaws,

any adoption of new Bylaws or deletions of any provisions of the existing

Bylaws.

8. Any

and

all omnibus proxies and correspondent participant listings with respect to

all

nominees and respondent banks which are currently in effect.

9. The

information and records specified in Items 1, 2, 4, 5, 6, and 8 above as

of any

Record Date for stockholder action set by the Company’s Board of Directors, by

operation of law or otherwise.

10. A

copy of

the report prepared by the Inspector of Elections showing the names of the

Company’s stockholders and how such stockholders voted with respects to any

matter presented for consideration by the stockholders at the Company’s 2007

Annual Meeting of Stockholders.

11. A

copy of

the minutes of the Company’s 2007 Annual Meeting of Stockholders.

The

Stockholder further requests that modifications, additions to or deletions

from

any and all information in the Demand Materials through the date of the Annual

Meeting be immediately furnished to the Stockholder or his agents as such

modifications, additions or deletions become available to the Company or

its

agents or representatives.

The

Stockholder expects the Company to either deliver copies of the requested

materials to him or his agents or representatives or make the materials

available during the Company’s usual business hours. The Stockholder will forego

the demand for inspection if the Company voluntarily furnishes to the

Stockholder or his agents or representatives all the information included

in the

Demand Materials.

Magellan

Petroleum Corporation

September

10, 2008

Page

4

The

Company is hereby authorized to deliver the information included in the Demand

Materials to The Altman Group, Inc., at 1200 Wall Street West, Lyndhurst,

New

Jersey 07071, Attention: Paul Schulman (Pschulman@altmangroup.com,

(201)

806-2206).

The

Stockholder will also bear the reasonable costs incurred by the Company

including those of its transfer agent(s) or registrar(s) in connection with

the

production of the Demand Materials.

The

Stockholder makes this notification and demand to inspect, copy and make

extracts of the Demand Materials in good faith and for the purpose of enabling

the Stockholder to communicate with the Company’s stockholders, in compliance

with applicable law, with respect to matters relating to their interests

as

stockholders, including, but not limited to, the Stockholder’s intention to

solicit proxies from the Company’s stockholders to be voted at the Annual

Meeting to have the Company’s stockholders (i) elect to the Company’s Board of

Directors one (1) nominee selected by the Stockholder; (ii) approve one or

more

other stockholder proposals; and (iii) repeal any and all amendments to the

Bylaws (whether effected by supplement to, deletion from or revision of the

Bylaws) that are unilaterally adopted by the Company’s Board of Directors since

April 18, 2007.

The

Stockholder hereby designates and authorizes The Altman Group, Inc., its

principals and employees, Blank Rome LLP, its partners, principals and

employees, and any other persons designated by the Stockholder, The Altman

Group, Inc., or Blank Rome LLP, acting together, singly or in any combination,

to conduct, as its agents, the inspection and copying of the Demand Materials

herein requested.

Please

advise Keith E. Gottfried, Esq., of Blank Rome LLP, via mail at Watergate

600

New Hampshire Avenue, Washington, DC 20037, by telephone at (202) 772-5887,

by

facsimile at (202) 572-1434 or by e-mail at Gottfried@blankrome.com, as promptly

as practicable as to the time and place that the items requested above will

be

made available in accordance with this Demand. Please also advise such counsel

immediately whether you voluntarily will supply the information requested

by

this Demand. In addition, if the Company believes that this Demand is incomplete

or otherwise deficient in any respect, please contact such counsel immediately

so that the Stockholder may promptly address any alleged

deficiencies.

If

you

refuse to permit the inspection and copying demanded herein, or fail to reply

to

this Demand, within five (5) business days from the date hereof, the Stockholder

will conclude that this Demand has been refused and will take appropriate

steps

to secure its rights to examine and copy the Demand Materials.

Please

also be advised that this Demand is not intended to constitute a request

under

Rule 14a-7 of the Securities Exchange Act of 1934, as amended. The Stockholder

intends to make its request pursuant to Rule 14a-7 by separate communication

to

the Company.

The

Stockholder reserves the right to withdraw or modify this Demand at any time,

and to make other demands of the Company whether pursuant to the DGCL, other

applicable law, or the Company’s certificate of incorporation or

bylaws.

Magellan

Petroleum Corporation

September

10, 2008

Page

5

Please

acknowledge receipt of this letter and the enclosures by signing and dated

the

enclosed copy of this letter and returning it to the Stockholder in the enclosed

envelope.

| Very truly yours, | ||

| ANS Investments LLC | ||

|

By:

|

/s/ Jonah M. Meer | |

| Jonah M. Meer | ||

| Chief Executive Officer | ||

POWER

OF ATTORNEY

KNOW

ALL MEN

that ANS

Investments LLC (the “Stockholder”) hereby constitutes and appoints The Altman

Group, Inc., its officers, employees, agents and other persons designed by

The

Altman Group, Inc. and Blank Rome LLP, its partners, employees, agents and

other

persons designated by Blank Rome LLP, acting singly, together, or in any

combination, its true and lawful attorneys-in-fact and agents for it in its

name, place and stead, giving and granting unto said attorneys and agents

full

power and authority to act on his behalf, as a stockholder of Magellan Petroleum

Corporation, a Delaware corporation (the “Company”), to seek the production, and

to engage in the inspection and copying, of records and documents of every

kind

and description, including, without limitation, the certificate of incorporation

and amendments thereto, minutes, by-laws and amendments thereto and any other

business records relating to the Company.

The

Stockholder reserves all rights on his part which said attorneys hereby are

authorized to do or perform. This Power of Attorney may be terminated by

the

Stockholder or said attorneys by written notice to the other.

|

|

ANS INVESTMENTS LLC | |

|

|

By:

|

/s/

Jonah M. Meer

|

| Jonah M. Meer | ||

| Chief Executive Officer | ||

|

Date:

September 10, 2008

|

||

DECLARATION

|

STATE

OF NEW YORK

|

)

|

|

|

)

|

ss:

|

|

|

COUNTY

OF NEW YORK

|

)

|

Jonah

M.

Meer, being duly sworn, deposes and says under oath that he has executed

the

stockholder demand on behalf of ANS Investments LLC to which this Declaration

is

attached and affirms under penalty of perjury under the laws of the State

of New

York that the facts and statements contained in such demand are true and

correct

in all material respects to his knowledge, information and belief.

|

/s/

Jonah M. Meer

|

|

Jonah

M. Meer

|

SWORN

TO AND SUBSCRIBED

before

me

this

10th

day of

September 2008.

| /s/ Maureen Tragoma |

|

Notary

Public, State of New York

|

No.

01TR4916069

Qualified

in Kings County

Commission

Expires February 17, 2010