| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) | |

| Filed by the Registrant ☒ | |

| Filed by a Party other than the Registrant ☐ | |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

| (Name of Registrant as Specified in its Charter) | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

| Payment of Filing Fee (Check all boxes that apply): | |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Tellurian Inc.

1201 Louisiana Street, Suite 3100

Houston, Texas 77002

(832) 320-9548

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To be held on Wednesday, June 5, 2024

To the Stockholders of Tellurian Inc.:

We will hold an annual meeting of the stockholders of Tellurian Inc. (“Tellurian” or the “Company”), a Delaware corporation, on Wednesday, June 5, 2024, at 8:30 a.m. local time at the Petroleum Club of Houston, located at 1201 Louisiana Street, 35th Floor, Houston, Texas 77002, for the following purposes:

| 1. | To elect the two nominees identified in the enclosed proxy statement as members of the board of directors of Tellurian (the “Board”), each to hold office for a three-year term expiring at the 2027 annual meeting of stockholders; |

| 2. | To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2024; |

| 3. | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in the enclosed proxy statement; and |

| 4. | To transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

Only holders of record of Tellurian common stock, par value $0.01 per share, or Tellurian Series C convertible preferred stock, par value $0.01 per share, at the close of business on April 22, 2024, the record date for the annual meeting, are entitled to notice of and to vote at the meeting or any adjournment or postponement of the meeting.

The Board recommends that you vote (1) “FOR” the election of each individual named as a director nominee in the enclosed proxy statement to the Company’s board of directors for a three-year term; (2) “FOR” the proposal to ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2024; and (3) “FOR” the proposal to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers.

To ensure your representation at the annual meeting, please complete and promptly mail your proxy card in the return envelope enclosed, or authorize the individuals named on your proxy card to vote your shares by calling the toll-free telephone number or by using the Internet as described in the instructions included with your proxy card or voting instruction card. This will not prevent you from voting in person but will help to secure a quorum for the annual meeting and avoid added solicitation costs. If your shares

are held in “street name” by your broker, bank or other nominee, only that holder can vote your shares, and the vote cannot be cast on Proposal 1 or 3 unless you provide instructions to your broker, bank or other nominee. You should follow the directions provided by your broker, bank or other nominee regarding how to instruct your nominee to vote your shares. Your proxy may be revoked at any time before it is voted. Please review the proxy statement accompanying this notice for more complete information regarding the annual meeting.

We intend to hold our annual meeting in person. If you are a stockholder of record, meaning your shares are registered directly in your name with Tellurian’s transfer agent, Broadridge Corporate Issuer Solutions, Inc., please bring government-issued photo identification for entrance into the annual meeting. If you are not a stockholder of record but hold your shares as the “beneficial owner” of such shares in “street name” (e.g., in a stock brokerage account or through a bank or other nominee), you must provide proof of beneficial ownership as of the record date, such as your most recent account statement reflecting stock ownership on the record date, April 22, 2024, a copy of the voting instruction card provided by your broker, bank or other nominee, or similar evidence of ownership, together with government-issued photo identification. In addition, (i) stockholders and others who might otherwise attend in person may instead listen to the meeting in real-time by calling toll free 1-877-853-5247 or direct 1-346-248-7799 (meeting identification number: 933 6681 4952) and (ii) those stockholders who have questions that they would like to have answered at the meeting may send those questions to our Corporate Secretary in advance of the meeting at the address set forth in “Information About the Meeting—Assistance.” International dial-in numbers for specific countries and regions are available at https://tellurianinc.zoom.us/u/acGH2OgIxM. Stockholders dialing in to listen to the meeting will not be able to vote their Tellurian shares during the call.

| By Order of the Board of Directors, | |

| |

| Meredith S. Mouer, General Counsel and Corporate Secretary | |

| April 25, 2024 |

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON WEDNESDAY, JUNE 5, 2024

Our notice of annual meeting of stockholders, proxy statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are available at http://www.proxyvote.com.

YOUR VOTE IS IMPORTANT.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE SUBMIT ALL PROXIES YOU RECEIVE. STOCKHOLDERS OF RECORD CAN SUBMIT THEIR PROXIES IN ANY ONE OF THREE WAYS:

| ● | BY TELEPHONE: CALL THE TOLL-FREE NUMBER ON YOUR PROXY CARD TO SUBMIT YOUR PROXY BY PHONE; |

| ● | VIA INTERNET: VISIT THE WEBSITE ON YOUR PROXY CARD TO SUBMIT YOUR PROXY VIA THE INTERNET; OR |

| ● | BY MAIL: MARK, SIGN, DATE, AND MAIL YOUR PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE. |

THE METHOD BY WHICH YOU DECIDE TO SUBMIT YOUR PROXY WILL NOT LIMIT YOUR RIGHT TO VOTE AT THE ANNUAL MEETING. IF YOU LATER DECIDE TO ATTEND THE ANNUAL MEETING IN PERSON, YOU MAY VOTE YOUR SHARES EVEN IF YOU HAVE PREVIOUSLY SUBMITTED A PROXY.

IF YOU HOLD YOUR SHARES THROUGH A BANK, BROKER OR OTHER NOMINEE, YOU MUST FOLLOW THE VOTING INSTRUCTIONS PROVIDED BY THE NOMINEE. IN ADDITION, YOU MUST OBTAIN A PROXY, EXECUTED IN YOUR FAVOR, FROM THE NOMINEE TO BE ABLE TO VOTE IN PERSON AT THE MEETING. YOU MAY BE ABLE TO SUBMIT YOUR VOTING INSTRUCTIONS VIA THE INTERNET OR BY TELEPHONE IN ACCORDANCE WITH THE INSTRUCTIONS THE NOMINEE PROVIDES.

TABLE OF CONTENTS

i

ii

Tellurian Inc.

1201 Louisiana Street, Suite 3100

Houston, Texas 77002

(832) 320-9548

PROXY STATEMENT

The Tellurian Inc. (“Tellurian” or the “Company”) board of directors (the “Board”) is soliciting the accompanying proxy for use in connection with the annual meeting of stockholders (including any adjournment or postponement thereof, the “Meeting”) to be held on Wednesday, June 5, 2024, at 8:30 a.m. local time at the Petroleum Club of Houston, located at 1201 Louisiana Street, 35th Floor, Houston, Texas 77002.

This proxy statement and the accompanying notice of annual meeting of stockholders, proxy card and Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are being mailed to stockholders on or about April 25, 2024.

INFORMATION ABOUT THE MEETING

Date, Time, and Place

The Meeting will take place at 8:30 a.m. local time, on Wednesday, June 5, 2024, at the Petroleum Club of Houston, located at 1201 Louisiana Street, 35th Floor, Houston, Texas 77002.

If you are a stockholder of record, meaning your shares are registered directly in your name with Tellurian’s transfer agent, Broadridge Corporate Issuer Solutions, Inc., please bring government-issued photo identification for entrance into the Meeting. If you are not a stockholder of record but hold your shares as the “beneficial owner” of such shares in “street name” (e.g., in a stock brokerage account or through a bank or other nominee), you must provide proof of beneficial ownership as of the record date, such as your most recent account statement reflecting stock ownership on the record date, April 22, 2024, a copy of the voting instruction card provided by your broker, bank or other nominee, or similar evidence of ownership, together with government-issued photo identification.

Purpose; Other Matters

At the Meeting, holders of Tellurian shares will be asked to consider and vote upon three proposals. The first proposal will be to elect two directors nominated by the Board, each for a term of three years. The second proposal will be to ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2024. The third proposal will be to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers (sometimes referred to as the “Say-on-Pay Proposal”).

Holders of Tellurian shares may also be asked to consider and vote upon such other matters as may properly come before the Meeting, or any adjournment or postponement of the Meeting. As of the mailing date of this proxy statement, the Board knows of no other matter to be presented at the Meeting. If, however, other matters are properly brought before the Meeting, or any adjournment or postponement of the Meeting,

1

the persons named in the proxy will vote the proxies in accordance with their best judgment with respect to those matters.

Recommendation of the Tellurian Board

The Board has carefully considered each of the matters to be considered at the Meeting. Based on its review, the Board recommends that you vote (i) “FOR” the election of the two directors nominated by the Board for three-year terms, (ii) “FOR” the proposal to ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2024, and (iii) “FOR” the Say-on-Pay Proposal.

Record Date, Outstanding Shares, and Voting Rights

Each holder of record of Tellurian common stock, par value $0.01 per share, or Tellurian Series C convertible preferred stock, par value $0.01 per share (the “Preferred Stock”), at the close of business on April 22, 2024, the record date, is entitled to notice of and to vote at the Meeting. Each such stockholder is entitled to cast one vote for each share of Tellurian common stock or Preferred Stock owned on each matter properly submitted to a vote of stockholders at the Meeting. As set forth in the Company’s Certificate of Designations of Series C Convertible Preferred Stock, the Preferred Stock votes with the Tellurian common stock on all matters presented to the stockholders for their action or consideration. As of the record date, there were 833,208,186 shares of Tellurian common stock and 6,123,782 shares of Preferred Stock issued and outstanding and entitled to vote at the Meeting. The holders of the Preferred Stock and the holders of Tellurian common stock are voting together as a single class on each of the proposals to be considered at the Meeting.

Quorum and Vote Required; “Broker Non-Votes” and Abstentions

Quorum Required

A quorum of Tellurian stockholders is necessary to hold the Meeting. In accordance with the Company’s bylaws, the holders of 33⅓% in voting power of the total number of shares issued and outstanding and entitled to be voted at the Meeting, present in person or by proxy, will constitute a quorum for the transaction of business. Stockholders are counted as present at the Meeting if they are present in person or have authorized a valid proxy. The presence of holders of at least 279,777,323 shares of Tellurian common stock and Preferred Stock in the aggregate will constitute a quorum. Under the General Corporation Law of the State of Delaware (the “DGCL”), abstentions and “broker non-votes” (described below) are counted as present and are, therefore, included for purposes of determining whether a quorum of shares is present at the Meeting. Shares of Tellurian common stock or Preferred Stock held by stockholders who are not present in person or by proxy will not be counted towards a quorum.

Vote Required

The election of each director nominee set forth in Proposal 1 and the approval of Proposals 2 and 3 will require the affirmative vote of the holders of a majority of the votes cast with respect to the relevant matter.

Differences Between Holding Shares as a Stockholder of Record and as a Beneficial Owner; Broker Non-Votes

If your shares are registered directly in your name with Tellurian’s transfer agent, Broadridge Corporate Issuer Solutions, Inc. (“Broadridge”), you are considered the “stockholder of record” of those

2

shares, and the notice of annual meeting of stockholders, proxy statement, proxy card and Annual Report on Form 10-K for the fiscal year ended December 31, 2023 have been sent directly to you by Tellurian. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of such shares held in “street name,” and the proxy materials have been forwarded to you by your broker, bank or other nominee. As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote your shares by using the voting instruction card included in the mailing or by following the instructions for submitting your voting instructions by telephone or on the Internet.

Broker non-votes occur when a nominee holding Tellurian shares for a beneficial owner returns a properly executed or otherwise submitted proxy but has not received voting instructions from the beneficial owner, and such nominee does not possess discretionary authority on one or more proposals with respect to such shares. Brokers are not allowed to exercise their voting discretion with respect to the approval of matters which are considered “non-routine” under applicable rules without specific instructions from the beneficial owner. Proposals 1 and 3 are considered non-routine, and Proposal 2 is considered routine. Accordingly, your broker will not be entitled to vote your shares on Proposal 1 or 3 unless you provide instructions on how to vote by filling out the voter instruction form sent to you by your broker with this proxy statement, but your broker will be entitled to vote your shares on Proposal 2 without such instructions.

Abstentions

An “abstention” represents a stockholder’s affirmative choice to decline to vote on a proposal. Stockholders may abstain with respect to any of the proposals described in this proxy statement by returning a properly executed or otherwise submitted proxy.

Effects of Broker Non-Votes and Abstentions

Pursuant to Delaware law and our bylaws, abstentions are not considered votes cast and, therefore, will not have an effect on the outcome of the vote on Proposal 1, 2, or 3.

Broker non-votes are not considered votes cast and, therefore, will have no effect on the outcome of the vote on Proposal 1 or 3. Because Proposal 2 is considered a routine matter and brokers will be entitled to vote your shares in their discretion if no voting instructions are timely received, there will be no broker non-votes with respect to that proposal.

Voting by Tellurian Directors and Executive Officers

As of the record date, the directors and executive officers of Tellurian beneficially owned and were entitled to vote 24,576,415 shares of Tellurian common stock, which represent approximately 2.9% of the voting power of the Tellurian capital stock, including the Preferred Stock. The directors and executive officers of Tellurian are expected to vote in favor of the election of each director nominee named in Proposal 1 and “FOR” Proposals 2 and 3.

Adjournment and Postponement

Adjournments and postponements of the Meeting may be made for the purpose of, among other things, soliciting additional proxies. The Meeting may be adjourned by the chairman of the Meeting or the vote of a majority of Tellurian shares present in person or represented by proxy at the Meeting, even if less than a quorum.

3

Voting of Proxies

Voting by Proxy Card

All Tellurian shares entitled to vote and represented by properly executed proxies received prior to the Meeting, and not revoked, will be voted at the Meeting in accordance with the instructions indicated on the proxy card accompanying this proxy statement. If no direction is given and the proxy is validly executed, the stock represented by the proxy will be voted in favor of the election of each director nominee named in Proposal 1, and “FOR” Proposals 2 and 3. The persons authorized under the proxies will vote upon any other business that may properly come before the Meeting according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. Tellurian does not anticipate that any other matters will be raised at the Meeting.

If you are a holder of record, there are two additional ways to submit your proxy:

Submit your proxy by telephone—call toll free 1-800-690-6903.

| ● | Submit your proxy 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Time on June 4, 2024. |

| ● | Please have your proxy card and the last four digits of your Social Security Number or Tax Identification Number available. Follow the instructions the voice provides you. |

Submit your proxy by the Internet—http://www.proxyvote.com.

| ● | Use the Internet to submit your proxy 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Time on June 4, 2024. |

| ● | Please have your proxy card and the last four digits of your Social Security Number or Tax Identification Number available. Follow the instructions to obtain your records and create an electronic ballot. |

Submitting your proxy by telephone or Internet authorizes the named proxies to vote your shares at the Meeting or any adjournment or postponement thereof in the same manner as if you had marked, signed and returned your proxy card. The law of Delaware, where Tellurian is incorporated, allows a proxy to be sent electronically, so long as it includes or is accompanied by information that lets the inspector of elections know that it has been authorized by the stockholder.

If your shares are held in street name, your broker, bank or other nominee may provide the option of submitting your voting instructions through the Internet or by telephone instead of by mail. Please check the voting instruction card provided by your broker, bank or other nominee to see which options are available and the procedures to be followed.

Voting by Attending the Meeting

Holders of record of Tellurian shares and their authorized proxies may also vote their shares in person at the Meeting. If you attend the Meeting, you may submit your vote in person, and any previous proxies submitted by you will be superseded by the vote that you cast at the Meeting.

4

Revocability of Proxies

You may revoke your proxy at any time before the vote is taken at the Meeting. If you are a holder of record, you may revoke your proxy by:

| 1. | giving written notice of revocation no later than the commencement of the Meeting to Tellurian’s Corporate Secretary: |

| ● | if before commencement of the Meeting on the date of the Meeting, by personal delivery to Tellurian’s Corporate Secretary at the Petroleum Club of Houston, located at 1201 Louisiana Street, 35th Floor, Houston, Texas 77002; and |

| ● | if delivered before the date of the Meeting, to Tellurian’s Corporate Secretary at Tellurian’s offices, 1201 Louisiana Street, Suite 3100, Houston, Texas 77002; |

| 2. | delivering no later than the commencement of the Meeting a properly executed, later-dated proxy; or |

| 3. | voting in person at the Meeting; however, simply attending the Meeting without voting will not revoke an earlier proxy. |

Voting by proxy will in no way limit your right to vote at the Meeting if you later decide to attend in person. If your stock is held in the name of a broker, bank or other nominee, you must obtain a proxy, executed in your favor, to be able to vote at the Meeting, and must follow instructions provided to you by your broker, bank or other nominee to revoke or change your vote.

Solicitation of Proxies; Expenses

The entire expense of preparing and mailing this proxy statement and any other soliciting material (including, without limitation, costs, if any, related to advertising, printing, fees of attorneys, financial advisors, and solicitors, public relations, transportation, and litigation) will be borne by Tellurian. In addition to the use of the mail, Tellurian or certain of its officers or other employees may solicit proxies by telephone and personal solicitation; however, no additional compensation will be paid to those officers or employees in connection with such solicitation. The Company has retained Morrow Sodali LLC, 333 Ludlow Street, 5th Floor – South Tower, Stamford, Connecticut 06902, for a fee of $20,500, plus out-of-pocket expenses, to assist in soliciting proxies in connection with the Meeting. In addition, the Company has retained Broadridge to assist in soliciting proxies in connection with the Meeting and to provide or coordinate specified telephone and Internet voting, mailing, handling, tabulation, and document hosting services. The estimated fees and expenses payable to Broadridge by the Company for these services are approximately $185,000, plus per item charges for each registered or beneficial stockholder vote, per document charges for the hosting services, and reimbursement of Broadridge’s mailing costs and expenses.

Banks, brokerage houses, and other custodians, nominees, and fiduciaries will be requested to forward solicitation material to the beneficial owners of Tellurian stock that such institutions hold of record, and the Company will reimburse such institutions for their reasonable out-of-pocket disbursements and expenses.

No Appraisal Rights

There are no appraisal rights pursuant to Section 262 of the DGCL with respect to any of the proposed corporate actions on which the stockholders are being asked to vote.

5

Assistance

If you need assistance in completing your proxy card, have questions regarding the Meeting, the proposals to be made at the Meeting or how to submit your proxy, or want additional copies of this proxy statement or the enclosed proxy card, please contact either of the following:

|

Tellurian Inc. 1201 Louisiana Street, Suite 3100 Houston, Texas 77002 Attention: Corporate Secretary Telephone: (832) 320-9548 Facsimile: (832) 962-4055 E-mail: CorpSec@tellurianinc.com |

Morrow Sodali LLC 333 Ludlow Street, 5th Floor – South Tower Stamford, Connecticut 06902 Telephone: (203) 658-9400 Toll Free: (800) 662-5200 Facsimile: (203) 658-9444 E-mail: tell.info@morrowsodali.com |

6

PROPOSAL 1—ELECTION OF DIRECTORS TO THE COMPANY’S BOARD

In accordance with the Company’s certificate of incorporation, two directors are to be elected at the Meeting to hold office for a term of three years, expiring at the 2027 annual meeting of stockholders. The Company’s certificate of incorporation provides for three classes of directors who are to be elected for terms of three years each and until their successors shall have been elected and shall have been duly qualified. Both of the nominees for election at the Meeting, Martin Houston and Jonathan Gross, are currently serving as directors of the Company. Each of Mr. Houston and Mr. Gross has consented to being named in this proxy statement as a nominee for election as a director and will serve as a director if elected.

Under the Company’s bylaws, a director will be elected if he or she receives the affirmative vote of the holders of a majority of the votes cast with respect to an election that is not a contested election. Abstentions and broker non-votes will not be considered votes cast for this purpose and, therefore, will not have an effect on the outcome of the election.

Background Information About the Nominees and Other Directors

The following sets forth certain information about (i) each of the Company’s nominees for election as a director at the Meeting to hold office for a term expiring at the 2027 annual meeting of stockholders and (ii) each director whose term of office continues beyond the Meeting. The information presented includes, with respect to each such person: (a) the year during which he or she first became a director of the Company; (b) his or her other positions with the Company, if any; (c) his or her business experience for at least the past five years; (d) any other director positions held currently or at any time during the past five years with any company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or subject to the requirements of Section 15(d) of the Exchange Act, or any company registered as an investment company under the Investment Company Act of 1940, as amended; (e) information regarding involvement in certain legal or administrative proceedings, if applicable; (f) his or her age as of the date of this proxy statement; and (g) the experience, qualifications, attributes, or skills that led to the conclusion that the person should serve as a director for the Company. There are no family relationships among any of Tellurian’s directors or executive officers.

Vote Required for Approval

The election of each director nominee pursuant to this Proposal 1 will require the affirmative vote of the holders of a majority of the votes cast with respect to the election, assuming that a quorum exists.

If you fail to vote or submit a proxy, fail to instruct your broker to vote, or vote to “abstain,” it will have no effect on the election of director nominees pursuant to this Proposal 1, assuming that a quorum exists.

Board Recommendation

The Board unanimously recommends that Tellurian stockholders vote to elect each of Martin Houston and Jonathan Gross to the Board for a three-year term.

7

Director Nominees to Hold Office for a Three-Year Term Expiring at the 2027 Annual Meeting of Stockholders

|

Name |

Other

Positions |

Age and Business Experience |

|

Martin J. Houston

|

Executive Chairman |

Mr. Houston (age 66) has served as a director of Tellurian since February 2017, as the Chairman of the Board since December 8, 2023 and as Executive Chairman since February 27, 2024. He co-founded Tellurian in 2016, served as Vice Chairman of the Board of Tellurian from February 2017 to December 8, 2023, and served as a director of Tellurian Investments Inc. (now known as Tellurian Investments LLC (“Tellurian Investments”)) from February 2016 to February 2017. He was also President of Tellurian Investments from February 2016 until August 2016. Immediately prior to Tellurian Investments, Mr. Houston served as Chairman of Parallax Enterprises LLC starting in December 2014. Having spent more than three decades at BG Group plc, a Financial Times Stock Exchange (FTSE) 10 international integrated oil and gas company, Mr. Houston retired in February 2014 as the BG Group plc’s Chief Operating Officer and an executive director, which positions he held beginning in November 2011 and 2009, respectively. He is a former director of the Society of International Gas Tanker and Terminal Operators (SIGTTO), and from 2008 to 2014 he was the vice president for the Americas of GIIGNL, the International Group of Liquefied Natural Gas Importers. From November 2014 to February 2018, Mr. Houston was the international chairman of the Houston-based investment bank Tudor Pickering Holt. From August 2017 to February 2018, he was a senior advisor to Gresham Advisory Partners Limited, an M&A advisory firm based in Sydney, Australia. From 2014 to 2019, he was a non-executive director of Bupa, an unlisted international healthcare insurer and provider, based in the United Kingdom. From October 2019 to December 2022, Mr. Houston served as chairman of the board of directors of EnQuest PLC, an independent petroleum production and development company with operations in the U.K., North Sea and Malaysia. Since October 2018, he has been a non-executive director of Bupa Arabia, a Saudi-listed healthcare insurer and provider. Since November 2023, Mr. Houston has been a non-executive director of Energean plc, a London Stock Exchange- and Tel Aviv Stock Exchange-listed independent exploration and production company focused on developing resources in the Mediterranean Sea. Mr. Houston is also a senior advisory partner and chairman of the global energy group of Moelis & Company (a global independent investment bank), sits on the National Petroleum Council of the United States, and is a nonexecutive director of CC Energy Development (a private oil and gas exploration and production company). Mr. Houston was the first recipient of the CWC LNG Executive of the Year award in 2011 and is a Fellow of the Geological Society of London. In addition, he is on the advisory board of the Center on Global Energy Policy at Columbia University’s School of International Public Affairs (SIPA) in New York and of Radia Inc. Mr. Houston received a bachelor’s degree in Geology from Newcastle University in |

8

|

Name |

Other

Positions |

Age and Business Experience |

|

England in 1979 and a master’s degree in Petroleum Geology from Imperial College in London in 1983.

Mr. Houston’s qualifications to serve as a director of Tellurian include his knowledge of and experience in the liquefied natural gas (“LNG”) industry. In addition to his industry experience, his qualifications include his leadership skills and long-standing senior management experience in the energy industry. | ||

|

Jonathan S. Gross

|

Chair of the Cybersecurity Committee and Member of the Audit Committee |

Mr. Gross (age 65) has served as a director of Tellurian since November 2020, and he is an oil and gas consultant. Since June 2009, his company, Jexco LLC, has provided upstream exploration geological, geophysical, and information technology (IT) services to clients with projects in domestic and international basins. Mr. Gross previously served in senior management roles at Energy Partners, Ltd., Kuwait Energy Company, and Cheniere Energy, Inc. (“Cheniere”). While at Cheniere from 1999 to 2008, he was responsible for its exploration program and international LNG sourcing. In addition, from 1999 to 2005, he was responsible for IT, including data management and cybersecurity. Mr. Gross began his career at Amoco Production Company in 1981. From April 2010 to July 2012, Mr. Gross served on the board of directors of Miller Energy Resources, Inc., a publicly traded oil and gas exploration and production company. From March 2014 to September 2018, Mr. Gross served on the board of directors of Cheniere Energy Partners LP Holdings, LLC, a publicly traded subsidiary of Cheniere, where he was a member of the Audit and Conflicts Committees. He received his B.A. in Geophysical Science from the University of Chicago in 1981. He is a member of the Society of Exploration Geophysicists, the Houston Geological Society, and the American Association of Petroleum Geologists, where he is a Certified Geologist. Mr. Gross is a certified director, having earned the NACD.DC credential from the National Association of Corporate Directors (NACD). He also holds the CERT Certificate in Cybersecurity Oversight from NACD and Carnegie Mellon University.

Mr. Gross’s qualifications to serve as a director of Tellurian include his knowledge of and experience in the energy industry, IT, cybersecurity, and his prior board and management experience. |

9

Directors Continuing in Office for a Term Expiring at the 2026 Annual Meeting of Stockholders

|

Name |

Other

Positions |

Age and Business Experience |

|

Jean P. Abiteboul

|

Member of each of the Audit Committee and Compensation Committee |

Mr. Abiteboul (age 72) has served as a director of Tellurian since November 2020, and he is the founder and since August 2017 has been the Chief Executive Officer of JA Energy Consulting. From November 2016 to November 2017, Mr. Abiteboul served as a consultant to Tellurian Services LLC, a subsidiary of Tellurian Investments. Previously, at Cheniere, he served as Senior Vice President – International (February 2006–November 2016), President of Cheniere Marketing Ltd., a wholly owned subsidiary of Cheniere (April 2010–November 2016), and Executive Director of Cheniere LNG Services S.A.R.L., a wholly owned subsidiary of Cheniere (February 2006–April 2010). From 1975 until February 2006, Mr. Abiteboul held different positions at Gaz de France, a publicly traded natural gas distribution company, including Secretary of the board of directors (2004–2006), International Executive Vice President (2003–2004), Executive Vice President – Gas Supply, Trading and Marketing (2002–2003), and Executive Vice President – Gas Supply (1998–2003). He also served on the board of directors of Tejas Power Corporation (United States) (1991–1997), Gas Metropolitan (Canada) (1994–2006), Sceptre Resources (Canada) (1991–1996), and other affiliated companies of Gaz de France in Europe. Since November 2020, he has served as the President of GIIGNL, the International Group of Liquefied Natural Gas Importers. Mr. Abiteboul graduated as an engineer from École Centrale de Lyon and obtained a diploma in Economics from Université de Lyon.

Mr. Abiteboul’s qualifications to serve as a director of Tellurian include his knowledge of and experience in the LNG industry and his leadership and management experience.

|

|

Diana Derycz-Kessler

|

Chair of the Compensation Committee and Member of the Environmental, Social, Governance (ESG) and Nominating Committee |

Ms. Derycz-Kessler (age 59) has served as a director of Tellurian since February 2017, and she served as a director of Tellurian Investments from December 2016 to February 2017. Ms. Derycz-Kessler is an investor with a background in law, business and finance. She has been an active principal of her investment advisory firm Bristol Capital Advisors, LLC since 2000. Her investments have included companies in the energy, biotechnology, technology, education, real estate and consumer products sectors. As part of these investments, she has assumed active operational roles, including a 17-year tenure as Chief Executive Officer of the media arts college of The Los Angeles Film School and manager of commercial property partnerships. In February 2019, Ms. Derycz-Kessler became a founding member and director of LK Advisors, Inc. (formerly PiMac Advisors Inc.) a mortgage lending advisory company. Since October 2019, Ms. Derycz-Kessler has been a member of the board of managers of Bristol Luxury Group LLC and Sugarfina Corporation (formerly Sugarfina Holdings LLC), the parent companies to Sugarfina USA LLC, a luxury candy retailer. Ms. Derycz-Kessler’s early career began as a lawyer in the international oil and gas sector, working |

10

|

Name |

Other

Positions |

Age and Business Experience |

|

at the law firm of Curtis, Mallet-Prevost, Colt & Mosle LLP in New York. Subsequently, she joined Occidental Petroleum Corporation, overseeing legal for its Latin American exploration and production operations. From 2016 to 2018, Ms. Derycz-Kessler was a partner in UNESCO’s TeachHer program, a private–public sector partnership bridging the global gender gap in education. Ms. Derycz-Kessler holds a law degree from Harvard Law School and a master’s degree from Stanford University in Latin American Studies. She obtained her undergraduate “double” degree in History and Latin American Studies from the University of California, Los Angeles (UCLA).

Ms. Derycz-Kessler’s qualifications to serve as a director of Tellurian include her knowledge of and experience in the energy industry and her leadership and management experience.

| ||

|

Dillon J. Ferguson

|

Chair of the Environmental, Social, Governance (ESG) and Nominating Committee and Member of each of the Compensation Committee and Cybersecurity Committee |

Mr. Ferguson (age 76) has served as a director of Tellurian since February 2017, and he served as a director of Tellurian Investments from December 2016 to February 2017. Mr. Ferguson is a partner at Pillsbury Winthrop Shaw Pittman LLP in its energy and litigation practices. Mr. Ferguson focuses his practice on oil and gas law, with an emphasis on both transaction and litigation matters. His clients are composed of companies and individuals who are engaged in oil and gas activities, including exploration, production, processing, transportation, marketing and consumption. Mr. Ferguson has been a partner at Pillsbury Winthrop Shaw Pittman LLP since May 2016. He was a partner at Andrews Kurth LLP from 2001 to May 2016. Mr. Ferguson earned his B.B.A. from The University of Texas at Austin in 1970 and his J.D. from South Texas College of Law in 1973.

Mr. Ferguson’s qualifications to serve as a director of Tellurian include his experience practicing law and counseling energy companies involved in a wide array of transaction and litigation matters. |

11

Directors Continuing in Office for a Term Expiring at the 2025 Annual Meeting of Stockholders

|

Name |

Other

Positions |

Age and Business Experience | |

|

Don A. Turkleson

|

Chair of the Audit Committee and Member of the Cybersecurity Committee |

Mr. Turkleson (age 69) has served as a director of Tellurian since March 2017, and he served as a director and board chair of NextPoint Financial Inc. from January 2023 to October 2023. He served as Chief Financial Officer of Cheniere from December 1997 to March 2009 and of Cheniere Energy Partners GP, LLC, the general partner of Cheniere Energy Partners, L.P., an indirect subsidiary of Cheniere, from November 2006 to March 2009. He was a member of the board of directors of Cheniere Energy Partners GP, LLC from November 2006 to September 2012. From December 2013 until February 2017, Mr. Turkleson served on the board of directors and as chair of the audit committee and a member of the conflicts committee of Cheniere Energy Partners LP Holdings, LLC. From February 2018 to May 2020, Mr. Turkleson served on the board of directors and as chairman of the finance and audit committees of ACCEL Energy Canada Limited, a privately held company constructing and operating facilities for the delivery of energy, ultra-clean fuels and specialty products. From November 2013 until July 2015, he served on the board of directors and the audit committee and the conflicts committee of the general partner of QEP Midstream Partners, L.P., a midstream publicly traded master limited partnership. In addition, he served on the board of directors and as the chairman of the audit committee of Miller Energy Resources, Inc., a publicly traded energy exploration, production and drilling company, from January 2011 to April 2014. Mr. Turkleson is a Certified Public Accountant and received a B.S. in Accounting from Louisiana State University. He has been a Board Governance Fellow with the National Association of Corporate Directors (NACD) and has achieved NACD Directorship Certification.

Mr. Turkleson’s qualifications to serve as a director of Tellurian include his background and experience in the energy industry and his background as a Certified Public Accountant. | |

12

Executive Officers

As of April 19, 2024, our executive officers were as follows:

|

Name |

Title |

Age |

| Martin J. Houston | Executive Chairman | 66 |

| Daniel A. Belhumeur | President | 45 |

| Samik Mukherjee | President, Tellurian Investments | 53 |

| Simon G. Oxley | Chief Financial Officer | 46 |

| Khaled A. Sharafeldin | Chief Accounting Officer | 61 |

See “Proposal 1—Election of Directors to the Company’s Board-Directors Continuing in Office for a Term Expiring at the 2027 Annual Meeting of Stockholders” for biographical information concerning Mr. Houston.

Daniel A. Belhumeur has served as the President of Tellurian since December 8, 2023. Mr. Belhumeur served as General Counsel of Tellurian from the completion of the merger (the “Merger”) in February 2017 between Tellurian Investments and a subsidiary of Magellan Petroleum Corporation (now known as Tellurian Inc.) to December 8, 2023 and as Chief Compliance Officer of Tellurian from March 2017 to December 8, 2023, and he served as General Counsel of Tellurian Investments from October 2016 until the completion of the Merger. Previously, at Cheniere, Mr. Belhumeur served as Vice President, Tax and General Tax Counsel (January 2011–October 2016), Tax Director (January 2010–December 2010), and Domestic Tax Counsel (2007–2010). Mr. Belhumeur began his career in public accounting after he received his bachelor’s degree and master’s degree in Accounting from Texas A&M University. He then obtained his law degree from the University of Kansas School of Law and his LL.M. from the Georgetown University Law Center.

Samik Mukherjee has served as President, Tellurian Investments since March 14, 2024. Mr. Mukherjee joined the Company in May 2022 as Executive Vice President and President, Driftwood Assets, including pipelines, LNG production and export terminal. He has over 30 years of energy industry experience, most recently serving as Executive Vice President and Chief Operating Officer of McDermott International, Ltd. (July 2018–May 2022), where he was responsible for global operations, assets management, commercial, digital and energy transition. During his time at McDermott, Mr. Mukherjee was responsible for the project execution of five LNG projects with over 60 million tonnes per annum (mtpa) of LNG liquefaction capacity. He holds a master’s degree in business administration from the Rotterdam School of Management (RSM) at Erasmus University in the Netherlands and a bachelor’s degree in chemical engineering from the Indian Institute of Technology (IIT) Kanpur, India. Mr. Mukherjee completed the Harvard Business School Executive Program on Aligning and Executing Strategy.

Simon G. Oxley has served as the Chief Financial Officer of Tellurian since June 1, 2023. From May 2016 to May 2023, Mr. Oxley served as Managing Director and Co-Head of Oil & Gas Investment Banking for Europe, the Middle East, and Africa (EMEA) at Barclays Investment Bank, where he led a number of LNG-related transactions due to his extensive knowledge of the LNG business. From September 2009 to May 2023, he held positions of increasing responsibility with Barclays Investment Bank, where he was involved with numerous energy client transactions across exploration and production, refining and petrochemical, retail stations and pipelines as well as gas and LNG. From 2001 to 2009, Mr. Oxley was an investment banker at Citigroup Global Markets Inc. Mr. Oxley holds a Bachelor of Engineering in Chemical Engineering from The University of Edinburgh and a Master of Science in Corporate and International Finance from Durham University Business School.

13

Khaled A. Sharafeldin has served as the Chief Accounting Officer of Tellurian since the completion of the Merger in February 2017, and he served as the interim Chief Financial Officer of Tellurian from March 3, 2023 to June 1, 2023 and as the Chief Accounting Officer of Tellurian Investments from January 2017 until the completion of the Merger. From April 2012 to January 2017, Mr. Sharafeldin served as Vice President – Internal Audit at Cheniere. Previously, at Pride International, he served as Director – Quality Management (2010–2011) and Director of Internal Audit (2005–2010). In addition, he served as Director of Internal Audit at BJ Services Company (2003–2005), served in several financial management roles at Schlumberger Limited (1996–2003), and was employed by the public accounting firm Price Waterhouse LLP in Houston, Texas (1991–1996). Mr. Sharafeldin received his Bachelor of Commerce from Cairo University in Egypt. He is also a Certified Public Accountant in the State of California.

Corporate Governance

Director Independence

Tellurian common stock is listed on NYSE American LLC (the “NYSE American”) under the trading symbol “TELL.” The NYSE American LLC Company Guide requires that a majority of the Company’s directors be “independent directors,” as defined by NYSE American corporate governance listing standards. Generally, a director does not qualify as an independent director if the director has, or in the past three years has had, certain material relationships or affiliations with the Company or its external or internal auditors, or is an employee of the Company.

The Board is currently composed of six directors: Martin Houston, Jean Abiteboul, Diana Derycz-Kessler, Dillon Ferguson, Jonathan Gross, and Don Turkleson. The Board has determined that each of Ms. Derycz-Kessler and Messrs. Abiteboul, Ferguson, Gross, and Turkleson is “independent” for purposes of the NYSE American corporate governance listing standards.

Board Leadership Structure

Mr. Houston is the Executive Chairman and Mr. Belhumeur is the President. The Board believes that having different individuals serving in the separate roles of Executive Chairman and President is in the best interest of stockholders in the Company’s current circumstances because it reflects the Executive Chairman’s oversight of Board functions, strategic and commercial development, and financing activities, and the President’s responsibility for overseeing the other key business functions.

Board Role in Risk Oversight

The Board has an active role, as a whole and at the committee level, in overseeing management of the Company’s risks. The Board or an appropriate committee regularly receives reports from members of senior management and its outside advisors on areas of material risk to the Company, including operational, financial, legal, regulatory, environmental, and strategic and reputational risks. The full Board or an appropriate committee receives these reports from the appropriate executive or advisor, as the case may be, so that it may understand and oversee the strategies used to identify, manage, and mitigate risks. The Audit Committee oversees management of financial, legal, and regulatory risks, including with respect to related party transactions. The Compensation Committee oversees the management of risks relating to the Company’s incentive compensation plans, policies, practices and arrangements by considering information and reports with respect to whether such plans, policies, practices and arrangements encourage unnecessary or excessive risk taking, and presenting concerns to the full Board. The Environmental, Social, Governance (ESG) and Nominating Committee manages risks associated with the independence of the Board as well as

14

risks associated with sustainability. The Cybersecurity Committee oversees management of policies and practices to monitor and mitigate cybersecurity risks.

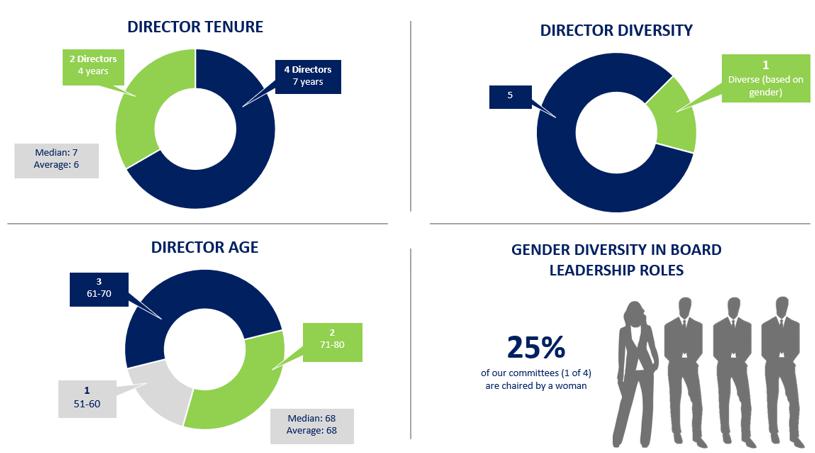

Board Evaluations

Each year, the members of the Board and each Board committee conduct a confidential oral assessment of their performance with members of our legal department. As part of the evaluation process, the Board reviews its overall composition, leadership structure, diversity, individual skill sets, format for meetings, and relationship with management to ensure that it serves the best interests of stockholders and positions the Company for future success. The results of the oral assessments are then summarized and communicated back to the Chairman of the Board and the Chair of each of the committees of the Board. After the evaluations, the Board and management work to improve upon any issues or focus points disclosed during the evaluation process. We believe that conducting these evaluations through a discussion with our Board members leads to more meaningful results that are more likely to result in changes when compared to conducting evaluations through a written process or completion of a questionnaire. As part of the evaluation process, each committee reviews its charter annually.

Age Limit for Directors

The Board believes that experience as a director is a valuable asset and, therefore, no term limits will be imposed on directors. However, beginning in March 2022, as reflected in the Company’s revised corporate governance guidelines, non-employee directors of the Company are not permitted to stand for re-election after reaching age 75 unless the Board waives this requirement in a particular case.

Summary of Director Qualifications and Experience

We believe effective oversight comes from a Board that represents a diverse range of experience and perspectives that provides the collective qualifications, attributes, skills and experience necessary for sound governance. The Environmental, Social, Governance (ESG) and Nominating Committee establishes and regularly reviews with the Board the qualifications, attributes, skills and experience that it believes are desirable to be represented on the Board to ensure that they align with the Company’s long-term strategy. The most important of these are described below, and the number of directors possessing those skills and experience is indicated.

|

LNG Experience in the LNG industry |

|

|

Corporate Governance Experience in public company corporate governance-related issues and best practices |

| |

|

Finance/Accounting/Risk Management Financial and risk management expertise, including experience as a chief financial officer or certified public accountant |

|

|

Legal Experience and/or formal education as an attorney |

| |

|

Regulatory/Government Experience in interacting with regulators and policymakers and/or working within government agencies |

|

|

Environmental Experience with oversight of environmental policy, regulation and/or business operation matters |

| |

|

Technology/Cybersecurity Experience with technology innovations and/or with oversight of cybersecurity programs |

|

|

Leadership Development/Succession Planning Experience in talent management, leadership development and succession planning to ensure a pipeline of leadership for an organization |

| |

|

Energy Experience in the energy industry, including exploration and production, wholesale energy marketing and energy trading |

|

|

Strategic Planning Experience in strategic planning and growth and value creation |

|

15

Standing Board Committees

The Board has four standing committees: the Audit Committee, the Compensation Committee, the Environmental, Social, Governance (ESG) and Nominating Committee, and the Cybersecurity Committee. The composition, functions, and responsibilities of the committees are discussed below.

Audit Committee

The Audit Committee is composed of Mr. Abiteboul, Mr. Gross, and Mr. Turkleson (Chair). The functions of the Audit Committee are set forth in its written charter, as amended on December 19, 2023 (the “Audit Committee Charter”). The Audit Committee Charter is posted on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Governance documents.” The Board has determined that each member of the committee is independent under applicable NYSE American listing standards and Securities and Exchange Commission (“SEC”) rules and that each of Messrs. Gross and Turkleson qualifies as an “audit committee financial expert” as defined in SEC rules.

Under the Audit Committee Charter, the Audit Committee is responsible for assisting the Board in fulfilling its oversight responsibilities with respect to (i) the Company’s accounting and financial reporting processes and the integrity of the Company’s financial statements; (ii) the effectiveness of the Company’s internal accounting and financial controls, disclosure controls and procedures, and internal control over financial reporting, as well as the performance of the Company’s internal audit function; (iii) the audits of the Company’s financial statements and the appointment, engagement, compensation, termination (if necessary), qualifications, independence, and performance of the Company’s independent registered public accounting firm; and (iv) the Company’s compliance with legal and regulatory requirements and ethics programs. The Audit Committee has the sole authority to select, engage (including approval of the fees and terms of engagement), oversee, and terminate, as appropriate, the Company’s independent registered public accounting firm.

In connection with the Audit Committee’s oversight of legal and regulatory compliance, the Audit Committee has until last year received regular, quarterly updates on cybersecurity matters from the

16

Company’s Chief Information Security Officer. Since the formation of the Cybersecurity Committee on March 23, 2023, that committee has been and will be primarily responsible for oversight of the Company’s cybersecurity policies and practices. On an annual basis, Tellurian conducts third-party external, internal and social penetration testing using industry-leading vendors, including Protiviti, Mandiant, and Accenture. In addition, Tellurian conducts monthly phishing exercises with, and cybersecurity email campaigns for, all personnel, and provides such personnel with annual compliance and cybersecurity training. The Company has not had a known material information security breach since the Merger.

Compensation Committee

The Compensation Committee is composed of Mr. Abiteboul, Ms. Derycz-Kessler (Chair), and Mr. Ferguson. The functions of the Compensation Committee are set forth in its written charter, as amended on December 19, 2023 (the “Compensation Committee Charter”). The Compensation Committee Charter is posted on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Governance documents.”

The Board has determined that each member of the Compensation Committee qualifies as (i) an independent director under applicable NYSE American listing standards, (ii) a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act and (iii) to the extent required for awards intended to constitute “qualified performance-based compensation” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), an “outside director” for purposes of Section 162(m) of the Code.

Under the Compensation Committee Charter, the primary duties and responsibilities of the Compensation Committee are to assist the Board in fulfilling its responsibilities with respect to the Company’s compensation plans, policies, programs, and practices, including (i) determining, and/or recommending to the Board for its determination, the compensation of the Company’s chief executive officer and all other executive officers of the Company; and (ii) reviewing and approving, and/or recommending to the Board for its approval, equity and other incentive compensation plans, policies, and programs for the Company’s directors, officers, employees, or consultants, and overseeing and administering such plans, policies, and programs in accordance with their terms. From time to time, the Compensation Committee consults with the Executive Chairman regarding executive and director compensation matters and with other members of senior management regarding executive compensation matters.

Environmental, Social, Governance (ESG) and Nominating Committee

The Environmental, Social, Governance (ESG) and Nominating Committee (the “ESG and Nominating Committee”) is composed of Ms. Derycz-Kessler and Mr. Ferguson (Chair). The functions of the ESG and Nominating Committee are set forth in its written charter, as amended on December 19, 2023 (the “ESG and Nominating Committee Charter”). The ESG and Nominating Committee Charter is posted on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Governance documents.” The Board has determined that each member of the committee is independent under applicable NYSE American listing standards.

Under the ESG and Nominating Committee Charter, the ESG and Nominating Committee is responsible for assisting the Board in fulfilling its oversight responsibilities with respect to (i) identifying individuals qualified to serve as directors; (ii) recommending to the Board candidates for nomination for election to the Board at the annual meeting of stockholders or to fill Board vacancies; (iii) developing and recommending to the Board a set of corporate governance guidelines and reviewing on a regular basis the overall corporate governance of the Company; and (iv) monitoring and reviewing, and as necessary

17

recommending Board action with respect to, sustainability matters, including environmental, social and governance (“ESG”) issues.

Cybersecurity Committee

Formed on March 23, 2023, the Cybersecurity Committee is composed of Mr. Ferguson, Mr. Gross (Chair) and Mr. Turkleson. The functions of the Cybersecurity Committee are set forth in its written charter, as amended on December 19, 2023 (the “Cybersecurity Committee Charter”). The Cybersecurity Committee Charter is posted on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Governance documents.” The Board has determined that each member of the committee is independent under applicable NYSE American listing standards. Mr. Gross has earned a certification for completing the National Association of Corporate Directors (NACD) Cyber-Risk Oversight Program.

Under the Cybersecurity Committee Charter, the Cybersecurity Committee is responsible for assisting the Board in fulfilling its oversight responsibilities with respect to (i) cybersecurity risks and (ii) policies and practices to monitor and mitigate cybersecurity risks.

Corporate Responsibility and ESG Practices

Oversight of the Company’s ESG efforts resides with the Board and its committees. In particular, the ESG and Nominating Committee is responsible for monitoring and reviewing, and as necessary recommending Board action with respect to, sustainability matters, including ESG issues. The ESG and Nominating Committee regularly receives ESG-related reports from management.

We also coordinate environmental and social activities through a non-Board committee with representatives from the organization, including executives from our operations and regulatory, health and safety, community relations, human resources and governance functions. We consider ESG-related risks and opportunities on an ongoing basis, disclose meaningful and appropriate ESG-related information with regard to our current and planned operations, and encourage dialogue on ESG topics with our stakeholders. We continue to make improvements to our risk evaluation and mitigation programs with respect to ESG and climate-related risks. With respect to environmental issues in particular, we monitor developments in greenhouse gas emissions, air quality, water management, biodiversity, incident management, climate-related matters, and emerging regulations, and incorporate them into our risk management process when appropriate.

Health, Safety and Environment

Our health, safety and environment policy reflects our commitments to our employees and the communities in which we operate. We strive to protect the health and safety of our employees and to prevent injury, ill health or damage to the environment. During 2023, Tellurian had no lost-time incidents, as determined in accordance with the recordkeeping and reporting requirements of the Occupational Safety and Health Administration (OSHA).

Our current operations focus on natural gas development and production. The environmental protection practices we follow when conducting these operations include:

| ● | routing gas to production facilities to minimize flaring and/or emissions following well completions; |

18

| ● | performing periodic leak detection and repair surveys utilizing optical gas imaging to allow early detection and repairs to minimize emissions; |

| ● | deploying technology on new producing facilities that allows for continuous, autonomous methane emissions monitoring to facilitate timely methane emissions management; and |

| ● | installing electric-driven valves and controllers on newly constructed facilities, eliminating emission sources. |

In the first quarter of 2022, we issued a limited notice to proceed to Bechtel Energy Inc., formerly known as Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”), under our lump sum, turnkey engineering, procurement and construction (“EPC”) contract to begin construction at the Driftwood terminal. Bechtel’s activities have included site demolition and clearing, civil site preparation, piling and pouring of critical foundations. In 2024, Bechtel will continue certain civil and piling work.

Tellurian participates in active leadership engagement in health, safety, security and environment (“HSSE”) matters at the LNG site by conducting joint safety walkdowns and monthly HSSE committee meetings to review risks, lessons learned, trends, and behavioral-based safety data with Bechtel.

In June 2022, we awarded Baker Hughes a contract to install its electric-powered Integrated Compressor Line (ICL) technology and turbomachinery equipment for pipelines related to the Driftwood Project. The compressors will have hermetically sealed casing, ensuring no emissions and requiring minimal downtime due to magnetic bearings for oil-free, efficient operations, minimized maintenance, and improved reliability.

Social

Human Capital Management

We position ourselves as an employer of choice by offering industry competitive compensation, including an industry-leading benefits package to provide for our employees’ health and welfare and retirement needs. Our benefits include health insurance at no cost, a company match on 401(k) retirement savings, and paid maternity and paternity leave. In addition, we have the following policies to foster an ethical, respectful and inclusive workplace environment:

| ● | our Code of Business Conduct and Ethics provides a comprehensive resource governing ethical concerns, employee privacy and workplace matters, legal compliance, and other matters; |

| ● | our Equal Employment Opportunity Policy commits us to fairly treating all employees and candidates, without regard to characteristics having no bearing on job performance; and |

| ● | our Harassment Policy addresses many forms of unwanted attention, including sexual harassment. |

At Tellurian, we believe that a diverse and inclusive culture supports our ability to create a consistent global employee experience to attract and retain talent, drive innovation and enable the long-term success of our business. As of December 31, 2023, (i) approximately 24% of Tellurian’s U.S. workforce was a member of a minority group and (ii) approximately 35% of our worldwide employees were women.

19

Community Investment

As part of its stakeholder engagement program, Tellurian is committed to being a good neighbor and strengthening its relationships with communities by working together on projects that improve the quality of life for all residents. The following are a few highlights of the 2023 investments we made in our southwest Louisiana community. Tellurian made a $1 million pledge to the LNG Center of Excellence at McNeese State University in Lake Charles, Louisiana. The Center will help prepare the next generation of workers for jobs in the LNG industry. Tellurian funded the Leadership, Enrichment, and Development (“LEAD”) program, providing two area high schools with funding for projects to impact their communities positively. Recent issues addressed by the LEAD program include hunger, mentorship, senior citizens, and autism. Each year, Tellurian serves as the title sponsor for “Wheels of Hope,” a charity bike race for St. Nicholas Center. This Lake Charles-based not-for-profit organization provides services and behavioral education to children with autism and their families in the region. The 2023 Tellurian team had over 40 riders and volunteers from its Houston and Louisiana offices and raised over $16,000 for the cause.

In December 2021, we announced that we partnered with the National Forest Foundation on a five-year, $25 million plan for reforestation and other projects across the United States. As part of this partnership, three million trees had been planted on U.S. Forest Service lands as of the end of 2023.

We have also made donations to various programs and research initiatives. For example, we donated to support a multi-phase, life-cycle research initiative at the University of Texas at Austin focusing on supply chain and environmental trade-offs related to specific energy sources used to generate and store electricity, including natural gas, wind, solar and batteries.

Governance

We believe that our efforts for effective corporate governance are illustrated by the following practices:

| ● | All of our Board committees are composed of independent directors. |

| ● | The functioning of our Board and Board committees is assessed annually. |

| ● | Non-employee directors of the Company are not permitted to stand for re-election after reaching age 75 unless the Board waives this requirement in a particular case. |

| ● | Our stock ownership guidelines align the interests of our directors and officers with the interests of our stockholders. |

| ● | Our key corporate governance and compliance policies are reviewed annually. |

Code of Conduct and Business Ethics

The Company has adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) that summarizes Tellurian’s compliance and ethical standards and the expectations it has for its officers, directors, and employees. Under the Code of Conduct, all directors, officers, and employees must follow ethical business practices in all business relationships, both within and outside of the Company.

The Code of Conduct is available on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Governance documents.” Tellurian intends to

20

provide disclosure regarding waivers of or amendments to the Code of Conduct by posting such waivers or amendments to the website in the manner provided by applicable law.

Risk Oversight of Compensation Programs and Policies

Consistent with the compensation-related risk assessment made by Pearl Meyer & Partners, LLC (“Pearl Meyer”), we have determined that any risks arising from our compensation programs and policies are not reasonably likely to have a material adverse effect on the Company. Our compensation programs and policies mitigate risk by combining performance-based, long-term compensation elements with payouts that are highly correlated to the achievement of our strategic business objectives or stock price performance. The combination of performance measures for Incentive Compensation Program (ICP) awards and for certain other long-term compensation encourages executives to maintain both a short and a long-term view with respect to Company performance. We maintain an insider trading policy that prohibits directors, officers and employees of the Company from hedging or engaging in derivative transactions involving shares of Tellurian stock and have adopted share ownership guidelines and a compensation clawback policy, both of which discourage excessive risk-taking. The ESG and Nominating Committee regularly reviews and makes recommendations to the Board regarding the overall corporate governance of the Company.

On March 23, 2023, upon the recommendation of the ESG and Nominating Committee, the insider trading policy was amended to prohibit directors, officers and employees from pledging Company securities, and there are no exceptions to the amended policy’s prohibition on pledging Company securities.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was, during the fiscal year ended December 31, 2023, an officer or employee of the Company, and no such member has ever served as an officer of the Company. During the fiscal year ended December 31, 2023, none of our executive officers served as a director or member of the compensation committee (or other committee serving an equivalent function) of any other entity whose executive officers served on our Compensation Committee or the Board.

Communications with Directors

Any stockholder wishing to communicate with the Board or any individual director may do so by contacting the Corporate Secretary at the address, telephone number, facsimile number, or e-mail address listed below:

Tellurian Inc.

1201 Louisiana Street, Suite 3100

Houston, Texas 77002

Attention: Corporate Secretary

Telephone: (832) 320-9548

Facsimile: (832) 962-4055

Website: http://www.tellurianinc.com

E-mail: CorpSec@tellurianinc.com

All communications will be forwarded to the Board or the relevant Board member. The Corporate Secretary has been authorized by the Board to screen frivolous or unlawful communications or commercial advertisements.

21

Stockholders also may communicate with management by contacting the Corporate Secretary using the above contact information.

Director Attendance at Annual Meetings

The Company does not have a policy regarding attendance of directors at annual meetings of stockholders. All of the Company’s current directors attended the Company’s last annual meeting of stockholders held on June 7, 2023.

Board Nomination Process

The ESG and Nominating Committee identifies director nominees based on recommendations from management, directors, stockholders, and other sources. In identifying and evaluating director nominees, the ESG and Nominating Committee takes into account, among other things, individual director performance (including for incumbent directors, their Board and committee meeting attendance and performance and length of Board service), qualifications, expertise, integrity, independence under NYSE American or other applicable listing standards, depth and diversity of experience (including service as a director or executive with other entities engaged in the Company’s business), willingness to serve actively and collaboratively, leadership and other skills, and the ability to exercise sound judgment. The Board does not currently employ an executive search firm, or pay a fee to any other third party, to identify qualified candidates for director positions.

The Board and ESG and Nominating Committee will consider any director candidates recommended to the Board by stockholders on the same basis as candidates submitted by others. Stockholders who wish to recommend a prospective director nominee for consideration by the Board should notify the Corporate Secretary in writing at the Company’s offices at 1201 Louisiana Street, Suite 3100, Houston, Texas 77002. The Corporate Secretary will forward all such stockholder recommendations to the Board for its consideration. Any such recommendation should provide whatever supporting material the stockholder considers appropriate but should include at a minimum such background and biographical material as will enable the ESG and Nominating Committee to make an initial determination as to whether the nominee satisfies the Board membership criteria set forth above. No stockholder recommendation of a prospective Tellurian director was received by the Board in 2023.

Audit Committee Report

In connection with the preparation and filing of the audited financial statements of Tellurian, for the fiscal year ended December 31, 2023 (the “audited financial statements”), the Audit Committee performed the following functions:

| ● | The Audit Committee reviewed and discussed the audited financial statements with senior management and Deloitte & Touche LLP (“Deloitte”), the Company’s independent registered public accounting firm. The review included a discussion of the quality, not just the acceptability, of the Company’s accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the forward-looking statements. |

| ● | The Audit Committee also discussed with Deloitte the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. |

| ● | The Audit Committee received the written disclosures and the letter from Deloitte required by applicable requirements of the PCAOB regarding Deloitte’s communications with the Audit |

22

Committee concerning independence, and discussed with Deloitte its independence from the Company and considered the compatibility of the auditors’ non-audit services to the Company, if any, with the auditors’ independence.

Based upon the functions performed, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K filed with the SEC on February 23, 2024.

Respectfully submitted by the Audit Committee of the Board of Directors,

| Don A. Turkleson (Chair) | |

| Jean P. Abiteboul | |

| Jonathan S. Gross |

Board and Committee Meetings Held During 2023

As noted in the table below, during 2023, 23 meetings of the Board, eight meetings of the Audit Committee, three meetings of the Cybersecurity Committee, 11 meetings of the Compensation Committee, and four meetings of the ESG and Nominating Committee were held. During 2023, all of the directors then in office attended at least 75% of the total number of meetings of the Board and committees of the Board on which the directors served. The following table also indicates the members of the Board and each committee of the Board.

|

Name |

Board |

Committees | |||

|

Audit |

Cybersecurity |

Compensation |

ESG

and | ||

| Martin J. Houston | Executive Chairman | ||||

| Charif Souki (1) | Former Executive Chairman | ||||

| Jean P. Abiteboul (2) | Member | Member | Member | ||

| Diana Derycz-Kessler | Member | Chair | Member | ||

| Dillon J. Ferguson (3) | Member | Member | Member | Chair | |

| Jonathan S. Gross | Member | Member | Chair | ||

| Brooke A. Peterson (4) | Member | ||||

| Don A. Turkleson (3) | Member | Chair | Member | Former Member | |

| Number of meetings in 2023 | 23 | 8 | 3 | 11 | 4 |

| (1) | Mr. Souki resigned as a director of the Company effective as of December 19, 2023. |

| (2) | On January 30, 2023, Mr. Abiteboul was appointed to the Audit Committee. |

| (3) | On March 23, 2023, Mr. Ferguson replaced Mr. Turkleson on the Compensation Committee. |

| (4) | On March 21, 2024, Mr. Peterson resigned as a director of the Company. |

Non-Employee Director Compensation

Our non-employee director compensation program is intended to attract and retain highly qualified individuals to serve on our Board and provide leadership on strategic initiatives that are critical to growing our business and increasing stockholder value. The Compensation Committee, which is responsible for recommending non-employee director compensation to the Board, reviews the competitiveness of our non-

23

employee director compensation program on an annual basis. In connection with its reviews, the Compensation Committee considers peer company director compensation data compiled by Pearl Meyer. Based on the Compensation Committee’s review of non-employee director compensation data in June 2023, the Compensation Committee determined that the Company’s non-employee director compensation program would continue to consist solely of a $275,000 annual Board retainer. In addition, to conserve shares available for issuance under the Company’s equity incentive plans, the Compensation Committee determined to pay the retainer solely in cash on a quarterly basis, and to thereby eliminate the ability of non-employee directors to receive all or a portion of their Board retainer in restricted stock, effective immediately following the Company’s 2023 annual meeting of stockholders.

2023 Director Compensation Table

The table below summarizes the compensation paid to each of the directors listed therein. The compensation disclosure for Mr. Souki, who resigned as a director of the Company effective as of December 19, 2023, has been included in the Summary Compensation Table and related tables later in this proxy statement.

|

Name |

Fees

Earned or |

All

Other |

Total |

| Martin J. Houston | $ 275,000 | $ 685,000 (2) | $ 960,000 |

| Jean P. Abiteboul | $ 137,500 | $ — | $ 137,500 |

| Diana Derycz-Kessler | $ 178,750 | $ — | $ 178,750 |

| Dillon J. Ferguson | $ 192,500 | $ — | $ 192,500 |

| Jonathan S. Gross | $ 171,875 | $ — | $ 171,875 |

| Brooke A. Peterson (3) | $ 137,500 | $ — | $ 137,500 |

| Don A. Turkleson | $ 137,500 | $ — | $ 137,500 |

| James D. Bennett (4) | $ — | $ — | $ — |

| Claire R. Harvey (4) | $ — | $ — | $ — |