UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM |

(Amendment No. 1)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

| Securities registered pursuant to Section 12(b) of the Act: | |||||

| Title of each class | Trading symbol | Name of each exchange on which registered | |||

| Capital Market | |||||

| Securities registered pursuant to Section 12(g) of the Act: None | |||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| x | Accelerated filer | ¨ | |

| Non-accelerated filer | ¨ | Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨

The aggregate market value of the voting

and non-voting stock held by non-affiliates of the registrant, as of June 28, 2019, the last business day of the registrant’s

most recently completed second fiscal quarter, was approximately $

shares of common stock were issued and outstanding as of April 28, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Tellurian Inc.

Form 10-K

For the Fiscal Year Ended December 31, 2019

TABLE OF CONTENTS

i

Explanatory Note

Tellurian Inc. (the “Company”) will not be filing its definitive proxy materials for its 2020 annual meeting of stockholders with the U.S. Securities and Exchange Commission (the “SEC”) within 120 days after the end of its fiscal year ended December 31, 2019.

Accordingly, pursuant to the instructions to Form 10-K, this Amendment No. 1 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, is being filed to include the Part III information required under the instructions to Form 10-K and the general rules and regulations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which annual report was originally filed with the SEC on February 24, 2020.

This Form 10-K/A amends and restates only Part III, Items 10, 11, 12, 13, and 14, and amends Part IV, Item 15 of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019. No other Items of the previous Form 10-K filing have been amended or revised in this Form 10-K/A, and all such other Items shall be as set forth in such previous Form 10-K filing. In addition, no other information has been updated for any subsequent events occurring after February 24, 2020, the date of filing of the original Form 10-K.

1

Cautionary Information About Forward-Looking Statements

The information in this report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical facts, that address activity, events, or developments with respect to our financial condition, results of operations, or economic performance that we expect, believe or anticipate will or may occur in the future, or that address plans and objectives of management for future operations, are forward-looking statements. The words “anticipate,” “assume,” “believe,” “budget,” “estimate,” “expect,” “forecast,” “initial,” “intend,” “may,” “plan,” “potential,” “project,” “proposed,” “should,” “will,” “would” and similar expressions are intended to identify forward-looking statements. These forward-looking statements relate to, among other things:

| • | our businesses and prospects and our overall strategy; |

| • | planned or estimated capital expenditures; |

| • | availability of liquidity and capital resources; |

| • | our ability to obtain additional financing as needed and the terms of financing transactions, including at Driftwood Holdings LP; |

| • | revenues and expenses; |

| • | progress in developing our projects and the timing of that progress; |

| • | future values of the Company’s projects or other interests, operations or rights; and |

| • | government regulations, including our ability to obtain, and the timing of, necessary governmental permits and approvals. |

Our forward-looking statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors that we believe are appropriate under the circumstances. These statements are subject to a number of known and unknown risks and uncertainties, which may cause our actual results and performance to be materially different from any future results or performance expressed or implied by the forward-looking statements. Factors that could cause actual results and performance to differ materially from any future results or performance expressed or implied by the forward-looking statements include, but are not limited to, the following:

| • | the uncertain nature of demand for and price of natural gas and LNG; |

| • | risks related to shortages of LNG vessels worldwide; |

| • | technological innovation which may render our anticipated competitive advantage obsolete; |

| • | risks related to a terrorist or military incident involving an LNG carrier; |

| • | changes in legislation and regulations relating to the LNG industry, including environmental laws and regulations that impose significant compliance costs and liabilities; |

| • | governmental interventions in the LNG industry, including increases in barriers to international trade; |

| • | uncertainties regarding our ability to maintain sufficient liquidity and attract sufficient capital resources to implement our projects; |

| • | our limited operating history; |

| • | our ability to attract and retain key personnel; |

| • | risks related to doing business in, and having counterparties in, foreign countries; |

| • | our reliance on the skill and expertise of third-party service providers; |

| • | the ability of our vendors to meet their contractual obligations; |

| • | risks and uncertainties inherent in management estimates of future operating results and cash flows; |

| • | our ability to maintain compliance with our senior secured term loans and other agreements; |

| • | the potential discontinuation of LIBOR; |

| • | changes in competitive factors, including the development or expansion of LNG, pipeline and other projects that are competitive with ours; |

| • | development risks, operational hazards and regulatory approvals; |

| • | our ability to enter and consummate planned financing and other transactions; and |

| • | risks and uncertainties associated with litigation matters. |

The forward-looking statements in this report speak as of the date hereof. Although we may from time to time voluntarily update our prior forward-looking statements, we disclaim any commitment to do so except as required by securities laws.

2

DEFINITIONS

All defined terms under Rule 4-10(a) of Regulation S-X shall have their statutorily prescribed meanings when used in this report. As used in this document, the terms listed below have the following meanings:

| ASC | Accounting Standards Codification | |

| ASU | Accounting Standards Update | |

| Bcf | Billion cubic feet of natural gas | |

| Bcf/d | Billion cubic feet per day | |

| Bcfe | Billion cubic feet of natural gas equivalent | |

| Condensate | Hydrocarbons that exist in a gaseous phase at original reservoir temperature and pressure, but when produced, are in the liquid phase at surface pressure and temperature | |

| DD&A | Depreciation, depletion, and amortization | |

| DES | Delivered ex-ship | |

| DOE/FE | U.S. Department of Energy, Office of Fossil Energy | |

| EPC | Engineering, procurement, and construction | |

| FASB | Financial Accounting Standards Board | |

| FEED | Front-End Engineering and Design | |

| FERC | U.S. Federal Energy Regulatory Commission | |

| FID | Final investment decision | |

| FOB | Free on board | |

| FTA countries | Countries with which the U.S. has a free trade agreement providing for national treatment for trade in natural gas | |

| GAAP | Generally accepted accounting principles in the U.S. | |

| JKM | Platts Japan Korea Marker index price for LNG | |

| LIBOR | London Inter-Bank Offered Rate | |

| LNG | Liquefied natural gas | |

| LSTK | Lump Sum Turnkey | |

| Mcf | Thousand cubic feet of natural gas | |

| MMBtu | Million British thermal unit | |

| MMcf | Million cubic feet of natural gas | |

| MMcf/d | MMcf per day | |

| MMcfe | Million cubic feet of natural gas equivalent volumes using a ratio of 6 Mcf to 1 barrel of liquid. | |

| Mtpa | Million tonnes per annum | |

| Nasdaq | Nasdaq Capital Market | |

| NGA | Natural Gas Act of 1938, as amended | |

| Non-FTA countries | Countries with which the U.S. does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted | |

| Oil | Crude oil and condensate | |

| PSD | Prevention of Significant Deterioration | |

| PUD | Proved undeveloped reserves | |

| SEC | U.S. Securities and Exchange Commission | |

| Train | An industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG | |

| U.K. | United Kingdom | |

| U.S. | United States | |

| USACE | U.S. Army Corps of Engineers |

With respect to the information relating to our working interest in wells or acreage, “net” oil and gas wells or acreage is determined by multiplying gross wells or acreage by our working interest therein. Unless otherwise specified, all references to wells and acres are gross.

3

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The Company’s certificate of incorporation provides for three classes of directors who are to be elected for terms of three years each and until their successors shall have been elected and shall have been duly qualified. The following sets forth certain information about each of the Company’s eight directors. There are no family relationships among any of Tellurian’s directors or executive officers.

Directors Holdings Office for a Term Expiring at the 2020 Annual Meeting of Stockholders

| Name | Other Positions Held with the Company | Age and Business Experience |

Diana Derycz-Kessler

| Member of the Audit Committee, Compensation Committee, and Governance and Nominating Committee | Ms. Derycz-Kessler (age 55) has served as a director of Tellurian since the completion in February 2017 of the merger (the “Merger”) between Tellurian Investments Inc. (now known as Tellurian Investments LLC (“Tellurian Investments”)) and a subsidiary of Magellan Petroleum Corporation (“Magellan”) (now known as Tellurian Inc.), and she served as a director of Tellurian Investments from December 2016 to February 2017. Ms. Derycz-Kessler is an investor with a background in law, business and finance. She has been an active principal of her investment advisory firm Bristol Capital Advisors, LLC since 2000. Her investments have included companies in the energy, biotechnology, technology, education, real estate and consumer products sectors. As part of these investments, she has assumed active operational roles, including a 17-year tenure as Chief Executive Officer of the media arts college of The Los Angeles Film School and manager of commercial property partnerships. In February 2019, Ms. Derycz-Kessler became a founding member and director of PiMac Capital Advisors LLC, a mortgage lending advisory company. Since October 2019, Ms. Derycz-Kessler has been a member of the board of managers of Bristol Luxury Group LLC and Sugarfina Holdings LLC, the parent companies to Sugarfina USA LLC, a luxury candy retailer. Ms. Derycz-Kessler’s early career began as a lawyer in the international oil and gas sector, working at the law firm of Curtis, Mallet-Prevost, Colt & Mosle LLP in New York. Subsequently, she joined Occidental Petroleum Corporation, overseeing legal for its Latin American exploration and production operations. From 2016 to 2018, Ms. Derycz-Kessler was a partner in UNESCO’s TeachHer program, a private–public sector partnership bridging the global gender gap in education. Ms. Derycz-Kessler holds a law degree from Harvard Law School and a master’s degree from Stanford University in Latin American Studies. She obtained her undergraduate “double” degree in History and Latin American Studies from University of California, Los Angeles (UCLA). Ms. Derycz-Kessler’s qualifications to serve as a director of Tellurian include her knowledge of and experience in the energy industry and her leadership and management experience. | ||

Dillon J. Ferguson

| Chairman of the Governance and Nominating Committee | Mr. Ferguson (age 72) has served as a director of Tellurian since the completion of the Merger in February 2017, and he served as a director of Tellurian Investments from December 2016 to February 2017. Mr. Ferguson is a partner at Pillsbury Winthrop Shaw Pittman LLP in its energy and litigation practices. Mr. Ferguson focuses his practice on oil and gas law, with an emphasis on both transaction and litigation matters. His clients are comprised of companies and individuals who are engaged in oil and gas activities, including exploration, production, processing, transportation, marketing and consumption. Mr. Ferguson has been a partner at Pillsbury Winthrop Shaw Pittman LLP since May 2016. He was a partner at Andrews Kurth LLP from 2001 to May 2016. Mr. Ferguson earned his B.B.A. from The University of Texas at Austin in 1970 and his J.D. from South Texas College of Law in 1973. Mr. Ferguson’s qualifications to serve as a director of Tellurian include his experience practicing law and counseling energy companies involved in a wide array of transaction and litigation matters. |

4

| Name | Other Positions Held with the Company | Age and Business Experience |

Meg A. Gentle

| President and Chief Executive Officer | Ms. Gentle (age 45) has served as a director and as President and Chief Executive Officer of Tellurian since the completion of the Merger in February 2017 and as President and Chief Executive Officer of Tellurian Investments since August 2016. Previously, at Cheniere Energy, Inc. (“Cheniere”), Ms. Gentle served as Executive Vice President – Marketing (February 2014–August 2016), Senior Vice President – Marketing (June 2013–February 2014), Senior Vice President and Chief Financial Officer (March 2009–June 2013), Senior Vice President – Strategic Planning & Finance (February 2008–March 2009), and other roles in strategic planning (June 2004–February 2008). From 2007 to August 2016, Ms. Gentle was a member of the board of directors of Cheniere Energy Partners GP, LLC, the general partner of Cheniere Energy Partners, L.P. (NYSE American: CQP), an indirect subsidiary of Cheniere. Prior to joining Cheniere, Ms. Gentle spent eight years in energy market development, economic evaluation and long-range planning. She conducted international business development and strategic planning for Anadarko Petroleum Corporation, a publicly traded independent energy company, from January 1998 to May 2004 and energy market analysis for Pace Global Energy Services, an energy management and consulting firm, from August 1996 to December 1998. Ms. Gentle received a B.A. in Economics and International Affairs from James Madison University in May 1996 and an M.B.A. from Rice University in May 2004. Ms. Gentle’s qualifications to serve as a director of Tellurian include her knowledge of and experience in the LNG industry and her experience and expertise in finance, financial reporting and management. |

Directors Holding Office for a Term Expiring at the 2021 Annual Meeting of Stockholders

| Name | Other Positions Held with the Company | Age and Business Experience |

Martin J. Houston

| Vice Chairman of the Board | Mr. Houston (age 62) has served as a director of Tellurian since the completion of the Merger in February 2017, and he served as a director of Tellurian Investments from February 2016 to February 2017. He was also President of Tellurian Investments from February 2016 until August 2016. Immediately prior to Tellurian Investments, Mr. Houston served as Chairman of Parallax Enterprises LLC (“Parallax Enterprises”) starting in December 2014. From February 2014 until December 2014, Mr. Houston was performing preliminary work related to the formation and business of Parallax Enterprises. Having spent more than three decades at BG Group plc, a Financial Times Stock Exchange (FTSE) 10 international integrated oil and gas company, Mr. Houston retired in February 2014 as the BG Group plc’s Chief Operating Officer and an executive director, which positions he held beginning in November 2011 and 2009, respectively. He is a former director of the Society of International Gas Tanker and Terminal Operators (SIGTTO), and from 2008 to 2014 he was the vice president for the Americas of GIIGNL, the International Group of Liquefied Natural Gas Importers. From November 2014 to February 2018, Mr. Houston was the international chairman of the Houston-based investment bank Tudor Pickering Holt. From August 2017 to February 2018, he was a senior advisor to Gresham Advisory Partners Limited, an M&A advisory firm based in Sydney, Australia. From 2014 to 2019, he was a non-executive director of Bupa, an unlisted international healthcare insurer and provider, based in the United Kingdom. Since January 2019, he has been a non-executive of Bupa Arabia, a Saudi-listed healthcare insurer and provider. Since October 2019, Mr. Houston has served as chairman of the board of directors of EnQuest PLC, an independent petroleum production and development company with operations in the U.K. North Sea and Malaysia. Mr. Houston is also a senior advisory partner and chairman of the global energy group of Moelis & Company (a global independent investment bank), sits on the National Petroleum Council of the United States, and is a nonexecutive director of CC Energy Development (a private oil and gas exploration and production company) and a senior advisor to Hakluyt & Company Limited (a strategic information consultancy). Mr. Houston was the first recipient of the CWC LNG Executive of the Year award in 2011 and is a Fellow of the Geological Society of London. In addition, he is on the advisory board of the Center on Global Energy Policy at Columbia University’s School of International Public Affairs (SIPA) in New York and of Radia Inc. Mr. Houston received a bachelor’s degree in Geology from Newcastle University in England in 1979 and a master’s degree in Petroleum Geology from Imperial College in London in 1983. Mr. Houston’s qualifications to serve as a director of Tellurian include his knowledge of and experience in the LNG industry. In addition to his industry experience, his qualifications include his leadership skills and long-standing senior management experience in the energy industry. |

5

| Name | Other Positions Held with the Company | Age and Business Experience |

Eric P. Festa

| Mr. Festa (age 50) has served as a director of Tellurian since December 2018. Since October 2017, he has served as Vice President of Asset Management for the Gas division of TOTAL S.A. From August 2015 to September 2017, Mr. Festa served as Managing Director of an exploration and production affiliate of TOTAL S.A. in the Middle East. In addition, he served as Vice President of Upstream M&A of TOTAL S.A. from June 2014 to July 2015 and as Vice President of Upstream Corporate Strategy of TOTAL S.A. from September 2012 to June 2014. Mr. Festa previously served in other roles and capacities with TOTAL S.A. and its affiliated entities, including in business development, project management, gas plant management, and planning and development, and as an economist. Since October 2018, he has served on the board of managers of Cameron LNG Holdings, LLC. Mr. Festa received a MEng degree in energy from French engineering school CentraleSupélec and a master’s degree from the French Petroleum Institute (IFP School) in Paris, and was a visiting scientist in the Energy Lab at the Massachusetts Institute of Technology. Mr. Festa’s qualifications to serve as a director of Tellurian include his knowledge of and experience in the energy industry. |

6

Directors Holding Office for a Term Expiring at the 2022 Annual Meeting of Stockholders

| Name | Other Positions Held with the Company | Age and Business Experience |

Brooke A. Peterson

| Chairman of the Compensation Committee and Member of the Audit Committee and Governance and Nominating Committee | Mr. Peterson (age 70) has served as a director of Tellurian since the completion of the Merger in February 2017, and he served as a director of Tellurian Investments from July 2016 to February 2017. He has been involved in construction, resort development and real estate for more than 40 years and has been extensively involved in non-profit work since moving to Aspen, Colorado, in 1975. Mr. Peterson is a member of the Colorado Bar and has been licensed to practice law for over 40 years, has served as an arbitrator and mediator since 1985, and has served as a Municipal Court Judge in Aspen since 1981. Mr. Peterson has served as Manager of Ajax Holdings LLC and its affiliated companies since December 2012 and as the Chief Executive Officer of Coldwell Banker Mason Morse since January 2013. Mr. Peterson earned his B.A. degree from Brown University in 1972 and his J.D. degree from the University of Denver College of Law in 1975. Mr. Peterson’s qualifications to serve as a director of Tellurian include his knowledge of and experience in project development and the construction industry. |

Charif Souki

| Chairman of the Board | Mr. Souki (age 67) has served as a director of Tellurian since the completion of the Merger in February 2017, and he served as a director and Chairman of the board of directors of Tellurian Investments from February 2016 to February 2017. Mr. Souki founded Cheniere in 1996 and served as Chairman of the board of directors (2000–2015), Chief Executive Officer (2003–2015), and President (2003–2004 and 2008–2015) until December 2015. Prior to Cheniere, Mr. Souki was an investment banker. Mr. Souki serves on the board of trustees of the American University of Beirut, as a member of the Advisory Board of the Center on Global Energy Policy at Columbia University, and on the International Advisory Board for the Neurological Research Institute (NRI) at Texas Children’s Hospital. Mr. Souki received a B.A. from Colgate University and an M.B.A. from Columbia University. Mr. Souki is qualified to serve as a director of Tellurian due to his knowledge of and experience in the LNG industry, including his leading the conception, development and construction of the first large-scale LNG export facility in the United States. In addition to his industry experience, his qualifications include his leadership skills, long-standing senior management experience and public company board experience in the LNG industry. |

Don A. Turkleson

| Chairman of the Audit Committee and Member of the Compensation Committee | Mr. Turkleson (age 65) has served as a director of Tellurian since March 2017, and he served as Vice President and Chief Financial Officer of Gulf Coast Energy Resources, LLC, a privately held energy exploration and production company, from April 2012 until his retirement in April 2015. He served as Senior Vice President and Chief Financial Officer of Cheniere Energy Partners GP, LLC, the general partner of Cheniere Energy Partners, L.P. (NYSE American: CQP), an indirect subsidiary of Cheniere, from November 2006 to March 2009 and was a member of the board of directors of Cheniere Energy Partners GP, LLC from November 2006 until September 2012. From December 2013 until February 2017, Mr. Turkleson served on the board of directors and audit committee of Cheniere Energy Partners LP Holdings, LLC. Since February 2018, Mr. Turkleson has served on the board of directors and as chairman of the finance and audit committees of ACCEL Energy Canada Limited, a privately held company constructing and operating facilities for the delivery of energy, ultra-clean fuels and specialty products. From November 2013 until July 2015, he served on the board of directors of the general partner of QEP Midstream Partners, L.P., a midstream publicly traded master limited partnership. In addition, he served on the board of directors and as the chairman of the audit committee of Miller Energy Resources, Inc., a publicly traded energy exploration, production and drilling company, from January 2011 to April 2014. Mr. Turkleson is a Certified Public Accountant and received a B.S. in Accounting from Louisiana State University. He is also a Board Governance Fellow with the National Association of Corporate Directors. Mr. Turkleson’s qualifications to serve as a director of Tellurian include his background and experience in the energy industry and his background as a Certified Public Accountant. |

7

Voting Agreements

Total Delaware, Inc. (“Total”), a Delaware corporation and subsidiary of TOTAL S.A., has the right to designate for election one member of Tellurian’s Board. Mr. Festa is the current Total designee. Total will retain this right for so long as its percentage ownership of Tellurian’s voting stock is at least 10%. In January 2017, Tellurian, Tellurian Investments, Total, Charif Souki, the Souki Family 2016 Trust and Martin Houston entered into a voting agreement pursuant to which Mr. Souki, the Souki Family 2016 Trust and Mr. Houston agreed to vote all shares of Tellurian stock that they own in favor of the director nominee designated by Total for so long as Total owns not less than 10% of the outstanding shares of Tellurian common stock (the “2017 Total Voting Agreement”).

In July 2019, in connection with the execution of the Equity Capital Contribution Agreement, dated as of July 10, 2019, between Driftwood Holdings LP, a subsidiary of the Company (“Driftwood Holdings”), and Total, the Company entered into Amendment No. 1 (the “2019 Total Voting Agreement Amendment”) to the 2017 Total Voting Agreement. Pursuant to the 2019 Total Voting Agreement Amendment, (i) each of Brooke Peterson (who, pursuant to an irrevocable special power of attorney executed by the beneficiaries of the Souki Family 2016 Trust, has the exclusive right to vote the shares of Tellurian common stock held by the Souki Family 2016 Trust) and Messrs. Souki and Houston provided a letter to Total confirming his intent, subject to certain conditions and exceptions including their fiduciary duties as directors of the Company, to vote, as a member of the Board in favor of a policy to declare and pay a dividend to the holders of Tellurian common stock of a minimum of 50% of the Company’s available cash and (ii) in the event any of those directors leave the Tellurian board of directors, each of Messrs. Souki and Houston and the Souki Family 2016 Trust would agree to vote their shares of stock of the Company, and the Company would make commercially reasonable efforts, to elect a successor director who is willing to provide a similar letter to Total.

In connection with the execution of the Securities Purchase Agreement, dated as of April 28, 2020, by and between the Company and High Trail Investments SA LLC (the “High Trail SPA”), Tellurian and each of Mr. Souki, Mr. Houston, Meg Gentle and R. Keith Teague, in their capacity as Tellurian stockholders, expect to enter into a voting agreement (each, a “Share Issuance Voting Agreement”) pursuant to which each of Mr. Souki, Mr. Houston, Ms. Gentle and Mr. Teague will agree to vote, at an annual or special meeting of stockholders of the Company, all shares of Tellurian common stock that they hold in favor of proposals to approve (i) the potential issuance of shares of Tellurian common stock upon conversion of a senior unsecured note to be issued pursuant to the High Trail SPA and (ii) an increase in the number of authorized shares of Tellurian common stock.

Executive Officers

As of April 28, 2020, our executive officers were as follows:

| Name | Title | Age | |||

| Meg A. Gentle | President and Chief Executive Officer | 45 | |||

| R. Keith Teague | Executive Vice President and Chief Operating Officer | 55 | |||

| L. Kian Granmayeh | Executive Vice President and Chief Financial Officer | 41 | |||

| Daniel A. Belhumeur | Executive Vice President, General Counsel and Chief Compliance Officer | 41 | |||

| Khaled A. Sharafeldin | Chief Accounting Officer | 57 |

See “Item 10, Directors, Executive Officers and Corporate Governance—Directors Holding Office for a Term Expiring at the 2020 Annual Meeting of Stockholders” for biographical information concerning Ms. Gentle.

8

R. Keith Teague has served as the Executive Vice President and Chief Operating Officer of Tellurian since the completion of the Merger in February 2017, and he served as Executive Vice President and Chief Operating Officer of Tellurian Investments from October 2016 until the completion of the Merger. Previously, at Cheniere, Mr. Teague served as Executive Vice President, Asset Group (February 2014–September 2016), Senior Vice President –Asset Group (April 2008–February 2014), Vice President –Pipeline Operations (May 2006–April 2008), and Director of Facility Planning (February 2004–May 2006). Mr. Teague also served as President of CQH Holdings Company, LLC (formerly known as Cheniere Pipeline Company), a wholly owned subsidiary of Cheniere, from January 2005 until September 2016. From December 2001 until September 2003, Mr. Teague served as the Director of Strategic Planning for the CMS Panhandle Companies. He began his career with Texas Eastern Transmission Corporation, where he managed pipeline operations and facility expansion projects. Mr. Teague received a B.S. in Civil Engineering from Louisiana Tech University and an M.B.A. from Louisiana State University.

L. Kian Granmayeh has served as the Executive Vice President and Chief Financial Officer of Tellurian since March 6, 2020. Mr. Granmayeh began at Tellurian as a consultant to the Chief Financial Officer in January 2019 and was appointed as its Director of Special Projects in July 2019 and as the Company’s Director of Investor Relations in August 2019. Prior to joining Tellurian, he worked at Apache Corporation from May 2014 until February 2018, including as Manager of Investor Relations (July 2016 to February 2018), Manager of Strategic Planning (January 2015 to June 2016) and Manager of Project Execution (May 2014 to December 2014). Prior to that, he was an Associate, and then a Vice President, at Lazard Frères & Co. from 2009 to 2014. He holds a B.A. from Columbia University and an M.B.A. from Rice University.

Daniel A. Belhumeur has served as an Executive Vice President of Tellurian since March 6, 2020, as the Senior Vice President and General Counsel of Tellurian since the completion of the Merger in February 2017 and as Chief Compliance Officer of Tellurian since March 2017, and he served as General Counsel of Tellurian Investments from October 2016 until the Merger. Previously, at Cheniere, Mr. Belhumeur served as Vice President, Tax and General Tax Counsel (January 2011–October 2016), Tax Director (January 2010–December 2010), and Domestic Tax Counsel (2007–2010). Mr. Belhumeur began his career in public accounting after he received his bachelor’s degree and master’s degree in Accounting from Texas A&M University. He then went on to obtain his law degree from the University of Kansas School of Law and his LL.M. from the Georgetown University Law Center.

Khaled A. Sharafeldin has served as the Chief Accounting Officer of Tellurian since the completion of the Merger in February 2017, and he served as Chief Accounting Officer of Tellurian Investments from January 2017 until that time. From April 2012 to January 2017, Mr. Sharafeldin served as Vice President – Internal Audit at Cheniere. Previously, at Pride International, he served as Director – Quality Management (2010–2011) and Director of Internal Audit (2005–2010). In addition, he served as Director of Internal Audit at BJ Services Company (2003–2005), served in several financial management roles at Schlumberger Limited (1996–2003), and was employed by the public accounting firm Price Waterhouse LLP in Houston, Texas (1991–1996). Mr. Sharafeldin received his Bachelor of Commerce from Cairo University in Egypt. He is also a Certified Public Accountant in the State of California.

Corporate Governance

Code of Conduct and Business Ethics

The Company has adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) that summarizes Tellurian’s compliance and ethical standards and the expectations it has for its officers, directors, and employees. Under the Code of Conduct, all directors, officers, and employees must follow ethical business practices in all business relationships, both within and outside of the Company.

The Code of Conduct is available on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Governance documents.” Tellurian intends to provide disclosure regarding waivers of or amendments to the Code of Conduct by posting such waivers or amendments to the website in the manner provided by applicable law.

Standing Board Committees

Audit Committee

The Audit Committee is comprised of Ms. Derycz-Kessler, Mr. Peterson, and Mr. Turkleson (Chairman). The functions of the Audit Committee are set forth in its written charter, as amended on December 4, 2019 (the “Audit Committee Charter”). The Audit Committee Charter is posted on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Board committees.” The Board has determined that each member of the committee is independent under applicable Nasdaq and Securities and Exchange Commission (“SEC”) rules and that each of Ms. Derycz-Kessler and Mr. Turkleson qualifies as an “audit committee financial expert” as defined in SEC rules.

9

Under the Audit Committee Charter, the Audit Committee is responsible for assisting the Board in fulfilling its oversight responsibilities with respect to (i) the Company’s accounting and financial reporting processes and the integrity of the Company’s financial statements; (ii) the effectiveness of the Company’s internal accounting and financial controls, disclosure controls and procedures, and internal control over financial reporting, as well as the performance of the Company’s internal audit function; (iii) the audits of the Company’s financial statements and the appointment, engagement, compensation, termination (if necessary), qualifications, independence, and performance of the Company’s independent registered public accounting firm; and (iv) the Company’s compliance with legal and regulatory requirements and ethics programs. The Audit Committee has the sole authority to select, engage (including approval of the fees and terms of engagement), oversee, and terminate, as appropriate, the Company’s independent registered public accounting firm.

Compensation Committee

The Compensation Committee is comprised of Ms. Derycz-Kessler, Mr. Peterson (Chairman) and Mr. Turkleson. The functions of the Compensation Committee are set forth in its written charter, as amended on December 5, 2018 (the “Compensation Committee Charter”). The Compensation Committee Charter is posted on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Board committees.”

The Board has determined that each member of the Compensation Committee qualifies as (i) an independent director under applicable Nasdaq rules, (ii) a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act and (iii) to the extent required for awards intended to constitute “qualified performance-based compensation” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “IRS Code”), an “outside director” for purposes of Section 162(m) of the IRS Code.

Under the Compensation Committee Charter, the primary duties and responsibilities of the Compensation Committee are to assist the Board in fulfilling its responsibilities with respect to the Company’s compensation plans, policies, programs, and practices, including (i) determining, and/or recommending to the Board for its determination, the compensation of the Company’s chief executive officer and all other executive officers of the Company; and (ii) reviewing and approving, and/or recommending to the Board for its approval, equity and other incentive compensation plans, policies, and programs for the Company’s directors, officers, employees, or consultants, and overseeing and administering such plans, policies, and programs in accordance with their terms. From time to time, the Compensation Committee consults with the Chairman of the Board regarding executive and director compensation matters and with the Chief Executive Officer and/or Chief Human Resources Officer of the Company regarding executive compensation matters. In addition, the Vice Chairman of the Board regularly serves as a non-voting advisory participant in meetings of the Compensation Committee.

Governance and Nominating Committee

The Governance and Nominating Committee is comprised of Ms. Derycz-Kessler, Mr. Ferguson (Chairman) and Mr. Peterson. The functions of the Governance and Nominating Committee are set forth in its written charter, as amended on December 5, 2018 (the “Governance and Nominating Committee Charter”). The Governance and Nominating Committee Charter is posted on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Board committees.” The Board has determined that each member of the committee is independent under applicable Nasdaq rules.

Under the Governance and Nominating Committee Charter, the Governance and Nominating Committee is responsible for assisting the Board in fulfilling its oversight responsibilities with respect to (i) identifying individuals qualified to serve as directors; (ii) recommending to the Board candidates for nomination for election to the Board at the annual meeting of stockholders or to fill Board vacancies; and (iii) developing and recommending to the Board a set of corporate governance guidelines and reviewing on a regular basis the overall corporate governance of the Company.

10

ITEM 11. EXECUTIVE COMPENSATION

Compensation discussion and analysis

The following Compensation Discussion and Analysis summarizes our compensation program for our named executive officers for the 2019 fiscal year.

Named Executive Officers

Our named executive officers (“NEOs”) based on position and compensation for the fiscal year ended December 31, 2019 are the following individuals:

| Name | Position | |

| Meg A. Gentle | President and Chief Executive Officer (“CEO”) | |

| R. Keith Teague | Executive Vice President and Chief Operating Officer | |

| Antoine J. Lafargue | Senior Vice President of LNG Marketing and former Chief Financial Officer (“former CFO”) (1) | |

| Daniel A. Belhumeur | Executive Vice President, General Counsel and Chief Compliance Officer | |

| Khaled A. Sharafeldin | Chief Accounting Officer | |

| (1) | On March 6, 2020, L. Kian Granmayeh was appointed as the Executive Vice President and Chief Financial Officer of the Company, and Mr. Lafargue joined the Company’s marketing group as Senior Vice President of LNG Marketing. |

2019 Performance Highlights

Under the leadership of our NEOs, we continued our efforts to create value for stockholders by building a low-cost, global natural gas business, profitably delivering natural gas to customers worldwide through a portfolio of natural gas production, LNG marketing, and infrastructure assets.

Since our inception as Tellurian Investments in 2016, our efforts have been driven by the goal of constructing an LNG terminal facility (the “Driftwood terminal”) and related pipelines—the Driftwood pipeline, the Haynesville Global Access Pipeline and the Permian Global Access Pipeline (collectively, the “Pipeline Network”)—and owning upstream gas assets (together with the Driftwood terminal and the Pipeline Network, the “Driftwood Project”) to provide optionality to our business model. Our success depends to a significant extent upon our ability to obtain the funding necessary to construct the Driftwood Project on a commercially viable basis, to finance the costs of our operations, development activities and general working capital needs until our facilities are fully operational and to implement our LNG marketing strategies. In 2019, we entered into an equity capital contribution agreement and an LNG sale and purchase agreement with Total and one of its affiliates, respectively (see “Total Transactions” below), and obtained the most significant permits required for construction and operation of the Driftwood terminal and Driftwood pipeline. See “Components of Pay and 2019 Compensation Decisions—Components of Tellurian’s Compensation Program—Discretionary Annual Bonus” for further information with respect to 2019 performance highlights.

Executive Summary of our Compensation Program

Program Focus

| · | Our executive compensation program links our executives’ pay to the achievement of the Company’s current and long-term strategic projects, particularly the successful financing and construction of the Driftwood terminal and related pipelines. |

11

Pay Elements

| · | Our executive compensation program is currently comprised of three primary pay elements: (i) annual base salary; (ii) a discretionary annual bonus; and (iii) outstanding long-term incentives granted in previous years, consisting of (a) performance-based restricted stock that vests only if we are able to secure FID by our Board to proceed with the construction of the Driftwood terminal, (b) time-vested stock options, and (c) a long-term cash incentive program (the “Driftwood Incentive Program”). Awards under the Driftwood Incentive Program are earned in four stages based on the delivery of a notice to proceed with designated construction phases of the Driftwood terminal, with the amount earned for a particular phase paying out in equal installments over the first four anniversaries of the delivery of notice to proceed for such phase, generally contingent upon the executive’s continued employment. We also provide standard employee benefits. |

| · | The majority of our NEOs’ compensation is variable and made up of annual bonus awards and outstanding long-term incentives. |

Setting Compensation

| · | Executive compensation decisions generally are made by our Board based on recommendations from our independent Compensation Committee. |

| · | When making compensation recommendations, the Compensation Committee reviews data from its independent compensation consultant (currently Pearl Meyer & Partners, LLC (“Pearl Meyer”)) and receives input from our CEO and other members of our senior management team as well as from the Chairman of the Board. In addition, the Vice Chairman of the Board regularly serves as a non-voting advisory participant in meetings of the Compensation Committee. |

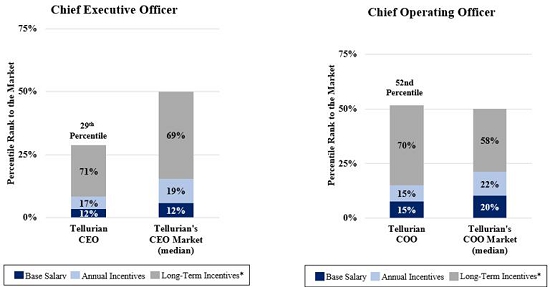

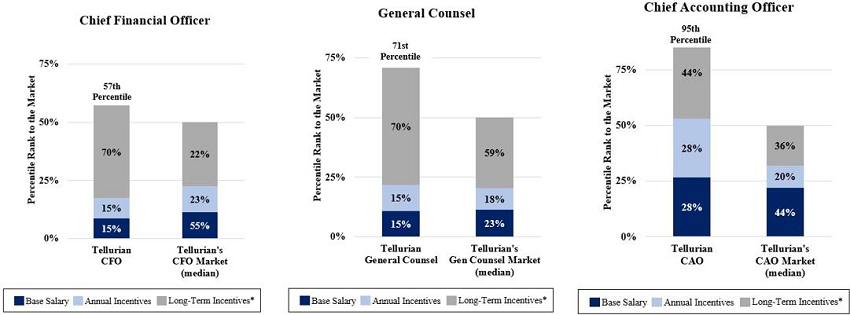

| · | The Compensation Committee also reviews relevant market compensation data, which includes the compensation paid by a peer group of companies in our industry sectors that we compete against for executive talent. We strive to set base salaries at the 50th percentile of market, annual compensation opportunities (i.e., base salary and annual incentives) at the 75th percentile of market, and total compensation opportunities (i.e., base salary, annual incentives and long-term incentives issued or amortized in the relevant year) at up to the 90th percentile of market. |

| · | We view compensation cumulatively over the course of multiple years. Accordingly, we may take into account outstanding compensation opportunities provided in previous years in making decisions for the current year. |

Key 2019 Compensation Actions

| · | We did not make any material changes to the components or structure of our executive compensation program in 2019. |

| · | We adjusted 2019 base salaries for our NEOs for cost of living increases and, in the case of Mr. Lafargue, to better align his base compensation with that of our peer group. |

| · | We increased our CEO’s target and stretch bonus percentages from 100% and 150%, respectively, of her base salary to 150% and 225%, respectively, of her base salary in order to provide her with an annual bonus opportunity that is more competitive with market. We also lowered our former CFO’s target and stretch bonus percentages from 150% and 200%, respectively, of his base salary to 100% and 150%, respectively, of his base salary in order to better align his annual bonus incentive award with that of the remainder of the senior leadership team. |

| · | We did not award discretionary annual bonuses to our NEOs other than Mr. Lafargue for 2019, as we did not achieve FID in 2019. In recognition of Mr. Lafargue’s strong individual efforts throughout 2019 and in order to align his compensation structure with his current non-NEO position as Senior Vice President of LNG Marketing, we awarded Mr. Lafargue a 2019 discretionary bonus that was paid in the form of restricted stock units. The restricted stock units vest in twelve substantially equal monthly installments beginning on June 1, 2020. |

| · | Consistent with our multi-year approach to setting compensation, we did not grant any long-term incentive awards to our NEOs in 2019 as we believe that the long-term incentive awards made to our NEOs in prior years already properly motivate and reward our NEOs’ performance and incentivize the completion of our long-term strategic projects. |

Compensation Best Practices

| · | We seek to incorporate and adhere to compensation best practices in our executive compensation program. Please see the chart under the heading “Our Executive Compensation Philosophy and Practices—Our Executive Compensation Practices” for details. |

12

Our Executive Compensation Philosophy and Practices

Objectives and Philosophy

The objectives of our executive compensation program are to attract the top executive talent in our competitive, growing industry and to motivate such individuals to execute on the Company’s business strategy and to remain with the Company long-term.

With those objectives in mind, our executive compensation philosophy is as follows:

| · | Our executives’ pay should be linked to the achievement of current and long-term Company strategic projects. Our business strategy is dependent on the successful financing and construction of the Driftwood terminal and Pipeline Network and the acquisition of complementary upstream assets. Accordingly, our NEOs’ compensation is generally tied to the completion of those projects. For example, the outstanding restricted stock awards held by our NEOs generally vest solely upon reaching FID (or anniversaries thereof). The awards under our Driftwood Incentive Program are earned in tranches based on the delivery of a notice to proceed with designated construction phases of the Driftwood terminal. Furthermore, the metrics in our discretionary annual bonus program are weighted toward short-term goals that significantly advance our ability to reach FID, construct the Driftwood terminal, progress the Pipeline Network and acquire upstream assets. |

| · | Compensation should be market competitive. We compete with our peers and other companies in our industry sectors for executive-level talent. We, therefore, benchmark our executive compensation program against a group of publicly traded peers and other companies in our industry sectors using compensation surveys and relevant industry data. Base salaries of our NEOs are targeted at the median, or the 50th percentile, of the relevant benchmarked data (“market”). Annual compensation opportunities (base salary and annual bonus) are targeted at the 75th percentile of market. Total compensation opportunities (base salary, annual bonus and long-term incentives) are targeted at the 90th percentile of market when warranted for exceptional Company performance and individual achievement. In addition, as described below, we have implemented a number of executive compensation best practices. |

| · | Compensation should support the stability of our executive team for the long-term. Our business strategy requires a long-term focus, with the completion of the various phases of the Driftwood terminal and Pipeline Network scheduled to stretch into the early to mid-2020s, and with the full deployment of our capabilities thereafter expected to take several years. We want executives who are similarly focused on the long-term. With the complexity of our business and the extended timelines for completion of our critical projects, the departure of top executive talent and the related loss of institutional knowledge would be harmful to our business. We, therefore, implemented the Driftwood Incentive Program to provide for incentives after FID and designed that program to provide for delayed payouts that are generally contingent upon each executive remaining employed with us for several years following commencement of the various phases of the Driftwood terminal. We also have three-year vesting schedules on our stock option grants. |

| · | Compensation should align the interests of our executives with those of our stockholders. Although we expect that achievement of our business strategy will drive stock price performance, we believe that our executive team should think like and be motivated as owners so that their interests are aligned with those of our stockholders. We have, therefore, structured their long-term incentives so that a portion consists of restricted shares of Tellurian stock (which vest generally upon FID or other milestones), and another portion consists of stock options that have value to the executive only if our stock price increases. We have also included stock performance targets in our CEO’s annual bonus metrics. |

13

Compensation Mix

Our compensation philosophy is reflected in the proportion of our NEOs’ compensation that is variable as compared to the overall compensation package awarded to our NEOs. The charts below show the targeted fixed and variable components applicable to our NEOs for 2019 as a percentage of their target total direct compensation, as well as the fixed and variable components to the named executive officers of our peers and other companies in our industry sectors as a percentage of their total direct compensation for 2019, based on data provided by Pearl Meyer. These charts are not a substitute for the “Summary Compensation Table,” which includes amounts in addition to target total direct compensation. For 2019, Ms. Gentle’s target compensation was 88% variable and linked to Company performance, consistent with that of chief executive officers of our peers and other companies in our industry sectors, and still below the market median of target total compensation for chief executive officers. For Messrs. Teague, Lafargue and Belhumeur, approximately 85% of their target compensation was variable and linked to Company performance, as compared to approximately 80%, 45%, and 77% of target total compensation being variable and linked to company performance for chief operating officers, chief financial officers and general counsels, respectively, among our peers and other companies in our industry sectors. In addition, for Mr. Sharafeldin, approximately 72% of his target compensation was variable and linked to Company performance, as compared to approximately 56% of target total compensation being variable and linked to company performance for chief accounting officers among our peers and other companies in our industry sectors.

| * | We did not make any new long-term incentive awards in 2019. However, for purposes of determining total compensation opportunities, we amortize awards under the Driftwood Incentive Program over eight years from the date of grant. The portion of such awards amortized in 2019 is, therefore, included in the charts above as our NEOs’ 2019 long-term incentive. |

Our Executive Compensation Practices

Our executive compensation program reflects a number of best pay practices, including the following:

What Tellurian does |

What Tellurian does not do | |

| · Pay-for-performance compensation structure (a significant portion of NEO pay is variable and tied to individual performance and the achievement of major corporate milestones). | · No gross-ups for penalty taxes or interest that may be imposed under the IRS Code. | |

| · Annual review of market compensation in setting executive compensation. | · No guaranteed bonuses. | |

| · Prohibit hedging transactions involving company stock. | · No automatic base salary increases. | |

| · At-will employment (including our former CFO, whose three-year employment agreement expired on February 10, 2020). | · No fixed-term employment agreements (including our former CFO, whose three-year employment agreement expired on February 10, 2020). | |

| · Retain services of an independent compensation consultant. | · No defined benefit retirement plan or supplemental executive retirement plan. | |

| · No perquisites. | · No contractual severance arrangements with NEOs and no executive severance plans or policies. | |

| · Maintain discretion to pay all or a portion of annual incentives in the form of shares. | · No repricing, cancellation or exchange of option awards. |

14

Administration of Executive Compensation Programs and Methodology

The Role of the Compensation Committee

Our Compensation Committee sets our compensation philosophy and objectives and designs our executive compensation programs to support our strategic business objectives. The Compensation Committee is comprised entirely of independent directors who are appointed by the Board and meets at least annually with the CEO and any other corporate officers that the Compensation Committee deems appropriate. From time to time, the Compensation Committee also consults with the Chairman and Vice Chairman of the Board regarding executive and director compensation matters. The Compensation Committee meets in executive session on an as-needed basis.

The Compensation Committee is responsible for the following:

| · | Reviewing and making recommendations to the Board regarding the compensation of the CEO and all other executive officers of Tellurian. |

| · | Reviewing and making recommendations to the Board, on an annual basis, regarding the corporate goals and objectives relevant to the compensation of the CEO and other executive officers, including annual and long-term performance goals and objectives. |

| · | Considering information and reports with respect to whether our compensation programs encourage unnecessary or excessive risk, and reporting concerns to the Board. |

| · | Designing the equity and other incentive compensation plans, policies and programs for the benefit of Tellurian’s directors, executive officers, officers, employees and consultants and recommending that the Board adopt the same. |

| · | Overseeing and administering equity and other incentive compensation plans, policies and programs in accordance with their terms. |

| · | Reviewing the form and amount of non-employee director compensation at least annually and making recommendations with respect thereto to the Board for its approval. |

| · | Assessing the performance criteria and compensation levels of key executives. |

| · | Reviewing, on a quarterly basis, progress towards the achievement of corporate performance goals and other considerations relevant to the determination of our NEOs’ annual discretionary bonuses and making a final recommendation for the Board’s approval. |

The Role of Management

The Compensation Committee, along with each of the independent directors, is authorized by the Board to obtain information from and work directly with any employee in fulfilling its responsibilities. The Compensation Committee receives from the CEO compensation recommendations and evaluations of the executive group (including with respect to the annual bonus award pool size and individual bonus awards). The CEO meets with the Compensation Committee at least annually as part of the Compensation Committee’s annual discussion and review of the performance criteria and compensation levels of the other key executives. However, the CEO is not, and may not be, present during any voting or deliberations on her compensation.

Management also plays a role in Tellurian’s annual bonus program. Management will review the achievement of corporate goals to date and make a recommendation to the Compensation Committee regarding the annual bonus pool to award employees outside of the executive group and individual bonus awards to employees outside of senior management. The Compensation Committee takes management’s recommendation into account but ultimately has the sole discretion to determine or recommend to the Board for its determination the amount and form (i.e., cash, equity or a mix thereof) of annual bonus awards to the CEO and other executive officers and other employees and service providers outside of senior management.

15

Our Senior Vice President and Chief Human Resources Officer prepares materials for the CEO and the Compensation Committee for the exercise of their distinct, but interrelated, compensation responsibilities.

The Role of the Independent Compensation Consultant

The Compensation Committee has retained Pearl Meyer as its independent compensation consultant. In 2019, Pearl Meyer provided the Compensation Committee with advice and information regarding current executive compensation practices, including market trends and reviews, and benchmarking of our executive compensation against the market. The Compensation Committee utilizes the benchmarking data provided by Pearl Meyer in making its compensation recommendations to the Board. Representatives of Pearl Meyer are invited to select Compensation Committee meetings to present their benchmarking data and to assist the Compensation Committee with its executive compensation decisions. Pearl Meyer also conducts an annual assessment of issues that may or could be associated with or indicative of excessive compensation-related risk-taking and summarizes its findings for the Compensation Committee’s review. In its compensation-related risk assessments in each of 2017, 2018, and 2019, Pearl Meyer identified no programs or practices that indicated the presence of a material compensation-related risk.

Review of Executive Officer Compensation

Generally

Our review of executive officer compensation encompasses both the structure of our executive compensation program and the targeted amount of compensation. The Compensation Committee considers multiple sources of internal and external data to reach final determinations in order to recommend actions to the Board, including the recommendations of the CEO. Comparative compensation information is one of several analytical tools that we use in setting executive compensation, and the Compensation Committee utilizes its judgment in determining the nature and extent of its use of comparative companies. With the assistance of Pearl Meyer, the Compensation Committee reviews the executive compensation programs in effect at our peer group companies and other companies in our industry sectors. Market and peer group compensation data is one factor among many that the Compensation Committee considers in reviewing executive compensation and is critical in ensuring that Tellurian remains competitive among the companies against which it is competing for talent.

In its analysis and in making decisions, the Compensation Committee may consider factors such as the nature of the officer’s duties and responsibilities as compared to the corresponding position used in the benchmarking data, the experience and value the executive brings to the role, the executive’s performance results, the success demonstrated in meeting strategic and other business objectives, the relationship of compensation earned compared to Company performance, previous compensation awarded to the executive that remains outstanding, and the impact on the internal equity of our pay structure within the Company.

Each year, the Compensation Committee reviews individualized, position-specific compensation benchmarking studies provided by Pearl Meyer, which help the Compensation Committee make recommendations to the Board for the upcoming fiscal year. In the first quarter of each year, the Compensation Committee makes recommendations to the Board regarding base salaries for the upcoming fiscal year and discretionary annual incentive bonus awards for the most recent fiscal year.

The Compensation Committee recommends to the Board, and ultimately the Board sets, goals applicable to the discretionary annual incentive bonuses for the year. The Compensation Committee, together with the CEO, reviews the year-to-date progress on the corporate goal achievement each quarter. Following completion of the year, the Compensation Committee will review the discretionary annual incentive bonus payouts for the NEOs recommended by the CEO and will present them to the Board for approval in the first quarter of that year.

Compensation Peer Group

As noted above, we use peer group companies, along with other companies in our industry sectors, to benchmark our compensation. Our peer group consists of publicly traded companies in (i) the oil and gas storage and transportation sector, (ii) the oil and gas exploration and production sector and (iii) the utilities sector. We have selected companies in each of these sectors as part of our peer group because our business model makes it such that we perform functions performed by or related to companies in each of those sectors. In constructing the peer group, we also considered peers of peers and other peers identified by management as competitors for business or talent, and took into account workforce and business operations footprint in determining whether or not to include companies in the peer group.

16

With the assistance of Pearl Meyer, our Compensation Committee reviews the composition of the peer group annually so that the included companies remain relevant for comparative purposes. The Compensation Committee, with the assistance of Pearl Meyer, reviewed the peer group in September 2019 and made certain changes to the composition of the peer group to reduce the number of limited partnerships in the peer group, remove companies with the lowest stock price correlation and add two additional LNG companies. The revised peer group will be used for purposes of determining compensation for 2020.

Tellurian’s peer groups for purposes of determining compensation for 2019 and 2020 are listed below:

Sector |

Peer |

2019 |

2020 | |||

Oil and Gas Storage and Transportation Companies |

Buckeye Partners, L.P. | ü | ||||

| Cheniere Energy, Inc. | ü | ü | ||||

| Enable Midstream Partners, LP | ü | |||||

| Enterprise Products Partners L.P. | ü | ü | ||||

| Gibson Energy Inc. | ü | ü | ||||

| Kinder Morgan, Inc. | ü | |||||

| Magellan Midstream Partners, L.P. | ü | |||||

| NextDecade Corporation | ü | |||||

| NuStar Energy L.P. | ü | ü | ||||

| ONEOK, Inc. | ü | ü | ||||

| Summit Midstream Partners, LP | ü | |||||

| The Williams Companies, Inc. | ü | ü | ||||

Oil and Gas Exploration and Production Companies |

Anadarko Petroleum Corporation | ü | ü | |||

| EQT Corporation | ü | ü | ||||

| Noble Energy, Inc. | ü | ü | ||||

| Range Resources Corporation | ü | ü | ||||

| Southwestern Energy Company | ü | ü | ||||

| WPX Energy, Inc. | ü | ü | ||||

Utilities

|

The AES Corporation | ü | ü | |||

| CMS Energy Corporation | ü | |||||

| Dominion Energy, Inc. | ü | ü | ||||

| NiSource Inc. | ü | |||||

| PPL Corporation | ü | ü | ||||

| Sempra Energy | ü | ü | ||||

| Total | 22 | 18 | ||||

Risk Oversight

Consistent with the compensation-related risk assessment made by Pearl Meyer, we have determined that any risks arising from our compensation programs and policies are not reasonably likely to have a material adverse effect on the Company. Our compensation programs and policies mitigate risk by combining performance-based, long-term compensation elements with payouts that are highly correlated to the achievement of our strategic business objectives. The combination of performance measures for the annual bonus awards and long-term incentive compensation program encourages executives to maintain both a short and a long-term view with respect to Company performance. We maintain an insider trading policy that prohibits directors, officers and employees of the Company from hedging or engaging in derivative transactions involving shares of Tellurian stock.

Components of Pay and 2019 Compensation Decisions

Components of Tellurian’s Compensation Program

Our executive compensation program consists of the following pay elements:

17

Compensation Element |

Compensation Type |

Form of Compensation |

Purpose |

| Base salary | Fixed | · Cash | · Provide competitive cash compensation based on position and experience |

| Annual discretionary bonus awards | Variable | · Annual discretionary bonus paid in cash, common stock, restricted stock units, or a combination thereof | · Motivate and reward the achievement of annual corporate goals and strategic milestones over the short term · Payment in stock preserves cash and aligns the long-term interests of employees and stockholders by promoting stock ownership |

| Long-term incentive awards | Variable | · Performance-based restricted shares and/or restricted stock units · Stock options · Performance-based cash awards under the Driftwood Incentive Program |

· Motivate and reward accomplishment of company milestones and creation of long-term stockholder value · Align the long-term interests of employees and stockholders |

| Employee benefits | Fixed | · Health and welfare plans · Retirement plan |

· Provide industry-standard employee benefits necessary to attract and retain talent · Allow executives and other employees to defer compensation on a tax-advantaged basis through our 401(k) plan with Company match |

Base Salary

Consistent with our executive compensation philosophy, base salaries for the NEOs are targeted at the 50th percentile of market. The Compensation Committee reviews our NEOs’ base salaries annually.

In 2019, we provided each of our NEOs (other than Mr. Lafargue) with a 3% cost of living increase to his or her base salary, which is intended to maintain compensation levels at approximately the median of market (with the exception of Ms. Gentle, who remains positioned at around the 29th percentile of market, and Mr. Sharafeldin, who remains positioned above the 90th percentile of market). Mr. Lafargue’s base salary was increased by 17.7% in order to bring his base salary up to the median of market. The adjustment to Mr. Lafargue’s base salary was also accompanied by a reduction to his target and stretch bonus levels, which are now in line with those of similarly situated members of our senior management team.

Effective as of February 17, 2019, our NEOs’ base salaries were as follows:

| Name | Prior

Base Salary (through 2/16/19) | 2019 Base Salary (eff. 2/17/19) | Percentage Increase | |||||||||

| Meg A. Gentle | $ | 700,000 | $ | 721,000 | 3.0 | % | ||||||

| R. Keith Teague | $ | 500,000 | $ | 515,000 | 3.0 | % | ||||||

| Antoine J. Lafargue | $ | 350,000 | $ | 412,000 | 17.7 | % | ||||||

| Daniel A. Belhumeur | $ | 400,000 | $ | 412,000 | 3.0 | % | ||||||

| Khaled A. Sharafeldin | $ | 350,000 | $ | 360,500 | 3.0 | % | ||||||

Discretionary Annual Bonus

Our executive officers are eligible to earn a discretionary annual incentive bonus for each fiscal year. Annual bonus awards, if any, are determined in relation to pre-established target and stretch amounts established for each NEO and are based on a holistic review of corporate and individual performance for the year. Although the Compensation Committee and the Board establish corporate goals for each year, there is no bonus formula or weighting of those goals, and actual bonus determinations may take into account a number of other factors, including Company and individual achievements during the year that are not covered by the pre-established goals. The Compensation Committee reviews corporate performance throughout the year (generally on a quarterly basis) and receives input from our CEO and management team before making a final assessment and bonus recommendation to the Board in the first quarter of the year following the year to which such annual bonus relates. Annual bonuses may be paid in cash and/or stock or other equity awards as the Board may determine in its discretion. In the first quarter of each of 2018 and 2019, annual discretionary bonuses for performance with respect to each of 2017 and 2018, respectively, were awarded to our NEOs entirely in the form of shares of Tellurian common stock.

18

2019 Annual Bonus Targets

For the 2019 annual bonus awards, target and stretch bonus amounts were set by the Compensation Committee as a percentage of each NEO’s base salary. For 2019, we increased Ms. Gentle’s target and stretch bonus percentages from 100% and 150%, respectively, of her base salary to 150% and 225%, respectively, of her base salary in order to provide her with an annual bonus opportunity that is more competitive with market. In addition, we lowered Mr. Lafargue’s target and stretch bonus percentages from 150% and 200%, respectively, of his base salary to 100% and 150%, respectively, of his base salary in order to better align his annual bonus incentive award with that of the remainder of the senior leadership team.

The target annual bonus opportunities for the NEOs for 2019 were as follows:

| NEO | Target

Bonus (As a Percentage of Base Salary) | Stretch

Bonus (As a Percentage of Base Salary) | ||||||

| Meg A. Gentle | 150 | % | 225 | % | ||||

| R. Keith Teague | 100 | % | 150 | % | ||||

| Antoine J. Lafargue | 100 | % | 150 | % | ||||

| Daniel A. Belhumeur | 100 | % | 150 | % | ||||

| Khaled A. Sharafeldin | 100 | % | 150 | % | ||||

2019 Company Performance Goals

The Company performance goals established by the Compensation Committee and the Board for fiscal year 2019 reflect our overall business strategy of developing a global natural gas business through the development of the Driftwood Project, as well as the achievement of other important milestones. The development of the Driftwood Project and implementation of our long-term strategy requires the successful coordination and completion of multiple objectives in a variety of areas, including finance, marketing, natural gas resource acquisitions, pipeline development, and facility planning and permitting. Accordingly, our fiscal year 2019 Company performance goals were generally project-focused as opposed to financial-metric focused, and incentivized the short-term financial, asset, marketing, and gas supply projects that were necessary to implement our business strategy. As discussed below, the Compensation Committee considers reaching FID to be a significant milestone for Tellurian. It was considered a key performance goal for fiscal year 2019 and weighted accordingly.

For 2019, the Compensation Committee and the Board created corporate goals to be used generally for the NEOs, as well as a set of CEO-specific performance goals used solely to measure the performance of Ms. Gentle.

The following chart reflects the Company performance goals used generally for all NEOs for 2019.

| Annual Corporate Performance Goals | ||

Description | Why we use it | |

| Reach FID on Phase 1 of the Driftwood terminal. | FID is a significant milestone that represents our securing of sufficient financing and completion of the other actions necessary to proceed with the construction of the Driftwood terminal. | |

| Control spending to +/- 10% of budget. | Fiscal discipline is essential to our ability to implement our business strategy as we have limited cash resources that need to be deployed to further the Driftwood Project. | |

| Establish financing for operating business. | Our ability to conduct our operations and meet our general working capital needs is dependent on our ability to obtain adequate levels of financing. | |

| Operate owned producing assets (including the sale of gas) safely, efficiently, and profitably. | Producing natural gas is important to our ability to implement our business strategy, and it is fundamental to our business that we be able to do so on a safe, efficient, and profitable basis. | |

| Purchase a targeted amount of natural gas resources. | Achievement of our business objectives requires that we acquire substantial natural gas producing properties at attractive prices. | |

| Execute Memorandum of Understanding sufficient to FID of Phase 1 of the Driftwood terminal. | Our ability to reach FID is dependent on our ability to have arrangements in place to sell sufficient volumes of LNG from the Driftwood terminal. | |

| Execute commercial agreements sufficient to support the financing of Phase 2 of the Driftwood terminal. | Our ability to finance Phase 2 of the Driftwood terminal is dependent on our ability to have agreements in place to sell sufficient volumes of LNG from the Driftwood terminal. | |

| Close financing for Phase 2 of the Driftwood terminal. | Obtaining adequate levels of financing is essential for our ability to complete Phase 2 of the Driftwood terminal. | |

| Secure binding shipper agreements on the Permian Global Access Pipeline and the Haynesville Global Access Pipeline and begin Federal Energy Regulation Commission (FERC) process on each. | Securing customers and obtaining regulatory approval of our pipelines is essential to the successful commercialization of those projects. | |

| Build LNG trading business to a targeted amount of gross profit for fiscal 2018. | Our long-term business plan includes participation in a variety of natural gas-related lines of business, including LNG trading. | |

| Execute transition plan for the Driftwood Project on schedule. | As we structure Driftwood Holdings as a partnership, management is focusing on organizational structure and joint venture capabilities. | |

19

The following chart reflects the Company performance goals used solely in respect of Ms. Gentle:

| CEO Performance Goals | ||

| Description | Why we use it | |

| Reach FID on Phase 1 of the Driftwood terminal. | FID is a significant milestone that represents our securing of sufficient financing and completion of the other actions necessary to proceed with the construction of the Driftwood terminal. | |

| Achieve targeted level of share price appreciation on a one-year basis. | We believe that our CEO should be compensated in part based on the returns delivered to our stockholders. | |

| Achieve targeted level of share price appreciation on a three-year basis. | We believe that our CEO should be compensated in part based on the returns delivered to our stockholders. | |

Assessment of 2019 Performance